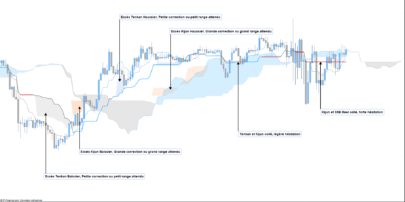

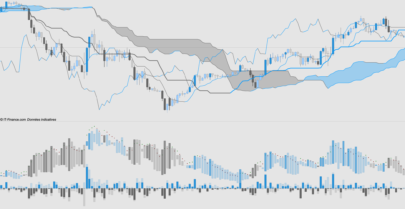

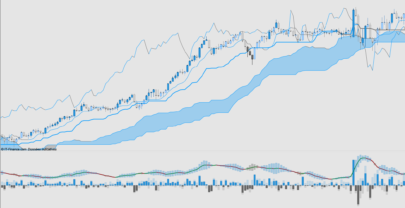

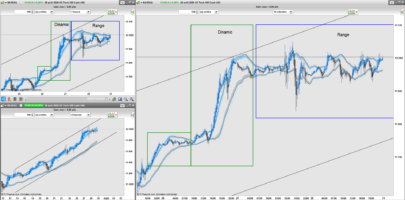

The overriding overriding overriding overriding overriding… overriding trend since the beginning of the indices is long.

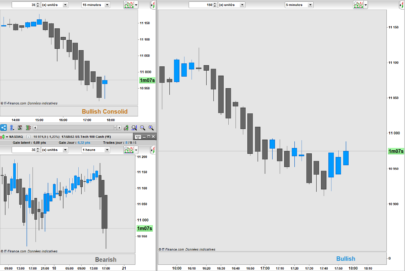

With short we always trade only corrections.

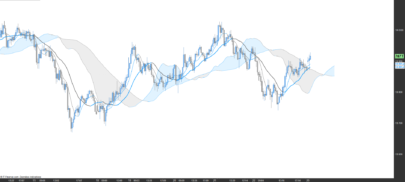

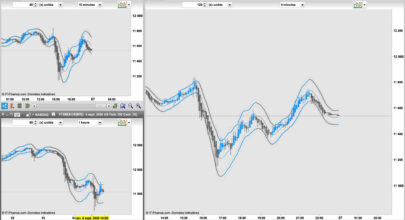

We look for entries into the trend?

So we buy when the price has fallen and starts to rise, not at a new high!

Easygoing.

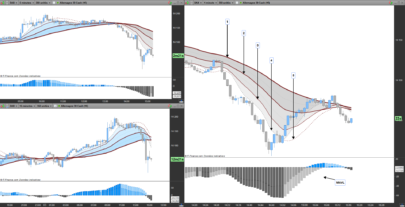

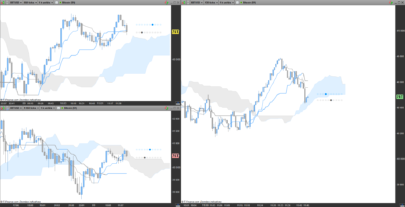

Below is a small code that defines possible entries.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 |

//------------------------------------------------------------------------- // maincode : everytime long kavg5 co2 M9 //------------------------------------------------------------------------- // created and coded by johnscher // s&p500 longonly strategy // timezone europe, berlin // timeframe daily defparam cumulateorders = false once positionsize = 1 c1 = exponentialaverage [1] (close) crosses over exponentialaverage [2] (close) c2 = close < average [5] if c1 and c2 then buy positionsize contracts at market endif set stop %loss 9 set target %profit 9 |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

thanks, really interesting!

thanks,

why do U prefer average than lowest ? to close under average does’nt mean another lowest is less possible than reversal move….

Chris