Hi guys,

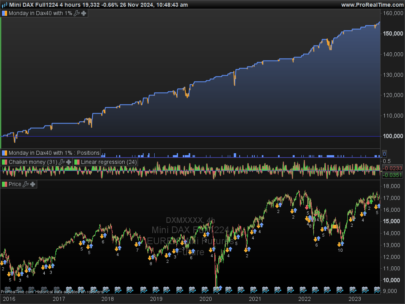

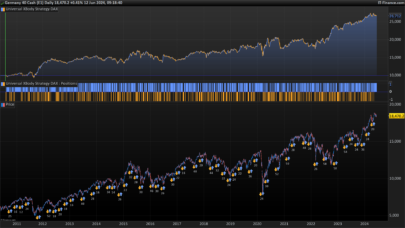

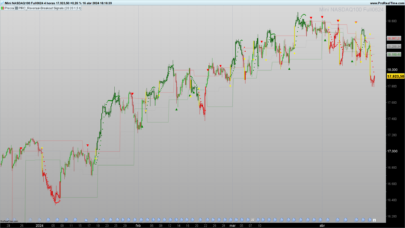

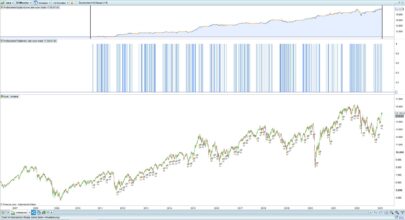

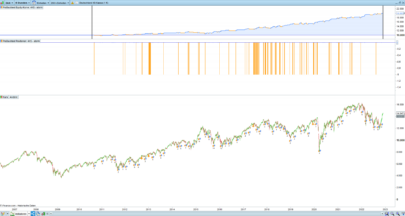

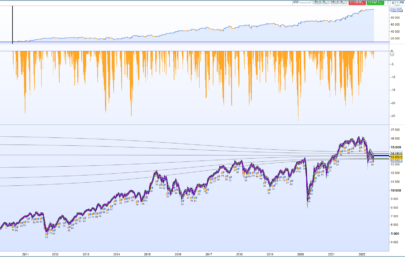

I want to share one of my DAX trading ideas based on simple daily, weekly and monthly high/low crossings. I observed that simple cross over and cross under of daily/weekly/monthly high/lows in combination with a multiple smoothed average and some simple filters could be a profitable approach. On the long side the cumulation of orders could be a performance booster for this system.

Comments and suggestions for improvement are welcome.

Have fun

Reiner

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 |

// Pathfinder DAX 4H, 9-22, 2 points spread // DAX breakout system triggered by previous daily, weekly and monthly high/low crossings // Version 3 // ProOrder code parameter DEFPARAM CUMULATEORDERS = true // cumulate orders if not turned off DEFPARAM PRELOADBARS = 10000 // trading window 8-22 ONCE startTime = 80000 ONCE endTime = 220000 // smoothed average parameter (signalline) ONCE periodFirstMA = 5 ONCE periodSecondMA = 10 ONCE periodThirdMA = 3 // filter parameter ONCE periodLongMA = 250 ONCE periodShortMA = 50 // trading paramter ONCE PositionSize = 1 // money and position management parameter ONCE stoppLoss = 5 // in % ONCE takeProfitLong = 2 // in % ONCE takeProfitShort = 1.75 // in % ONCE maxCandlesLongWithProfit = 18 // take long profit latest after 18 candles ONCE maxCandlesShortWithProfit = 13 // take short profit latest after 13 candles ONCE maxCandlesLongWithoutProfit = 30 // limit long loss latest after 30 candles ONCE maxCandlesShortWithoutProfit = 25 // limit short loss latest after 25 candles ONCE startShortPattern = 4 // April ONCE endShortPattern = 9 // September ONCE longPositionMultiplier = 2 // multiplier for long position size in case of higher saisonal probability ONCE shortPositionMultiplier = 2 // multiplier for short position size in case of higher saisonal probability // calculate daily high/low dailyHigh = DHigh(1) dailyLow = DLow(1) // calculate weekly high/low If DayOfWeek < DayOfWeek[1] then weeklyHigh = Highest[BarIndex - lastWeekBarIndex](dailyHigh) lastWeekBarIndex = BarIndex ENDIF // calculate monthly high/low If Month <> Month[1] then monthlyHigh = Highest[BarIndex - lastMonthBarIndex](dailyHigh) monthlyLow = Lowest[BarIndex - lastMonthBarIndex](dailyLow) lastMonthBarIndex = BarIndex ENDIF // calculate signalline with multiple smoothed averages firstMA = WilderAverage[periodFirstMA](close) secondMA = TimeSeriesAverage[periodSecondMA](firstMA) signalline = TimeSeriesAverage[periodThirdMA](secondMA) // trade only in trading window 8-22 IF Time >= startTime AND Time <= endTime THEN // filter criteria because not every breakout is profitable c1 = close > Average[periodLongMA](close) c2 = close < Average[periodLongMA](close) c3 = close > Average[periodShortMA](close) c4 = close < Average[periodShortMA](close) // saisonal pattern saisonalShortPattern = CurrentMonth >= startShortPattern AND CurrentMonth <= endShortPattern // long position conditions l1 = signalline CROSSES OVER monthlyHigh l2 = signalline CROSSES OVER weeklyHigh l3 = signalline CROSSES OVER dailyHigh l4 = signalline CROSSES OVER monthlyLow // short position conditions s1 = signalline CROSSES UNDER monthlyHigh s2 = signalline CROSSES UNDER monthlyLow s3 = signalline CROSSES UNDER dailyLow // long entry IF ( l1 OR l4 OR l2 OR (l3 AND c2) ) THEN // cumulate orders for long trades IF not saisonalShortPattern THEN BUY PositionSize * longPositionMultiplier CONTRACT AT MARKET ELSE BUY PositionSize CONTRACT AT MARKET ENDIF takeProfit = takeProfitLong ENDIF // short entry IF NOT SHORTONMARKET AND ( (s1 AND c3) OR (s2 AND c4) OR (s3 AND c1) ) THEN // no cumulation for short trades IF saisonalShortPattern THEN SELLSHORT positionSize * shortPositionMultiplier CONTRACT AT MARKET ELSE SELLSHORT positionSize CONTRACT AT MARKET ENDIF takeProfit = takeProfitShort ENDIF // stop and profit management posProfit = (((close - positionprice) * pointvalue) * countofposition) / pipsize m1 = posProfit > 0 AND (BarIndex - TradeIndex) >= maxCandlesLongWithProfit m2 = posProfit > 0 AND (BarIndex - TradeIndex) >= maxCandlesShortWithProfit m3 = posProfit < 0 AND (BarIndex - TradeIndex) >= maxCandlesLongWithoutProfit m4 = posProfit < 0 AND (BarIndex - TradeIndex) >= maxCandlesShortWithoutProfit IF LONGONMARKET AND (m1 OR m3) THEN SELL AT MARKET ENDIF IF SHORTONMARKET AND (m2 OR m4) THEN EXITSHORT AT MARKET ENDIF SET STOP %LOSS stoppLoss SET TARGET %PROFIT takeProfit ENDIF |

Many other instruments and continuously updated versions are available in the dedicated forum topic of this automated trading strategy, everyone can read and participate here: Pathfinder trading strategy forum topic

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thank you REINER for your help.

I’m working a system TRADING with the DAX 3 minutes based on the bollinger bands,but for the moment it’s very difficult.

I use your systems with sometimes some errors between the reality and the backtest.And particulary the TREND SURFER DAX 5mn.But overall it’s ok.

bye bye

Hello,

This strategy seems to work very well on the DAX, H4 timeframe. Thanks for sharing.

But do you know why it is loosing money before 2009, and earning very well since 2009 ?

Is it a problem of trading hours ?? (maybe the trading hours were different before 2009 ?)

Best regards,

I see that on ProRealTime CFD, the DAX had no quote / price before august 2010.

Hi Doctrading,

Thanks for your comment.

as an IG customer it’s a pitty that backtesting is only possible since 2013. It’s good to know that it was profitable before 2013.

2007 – 2008 were hard years for trading due the financial crises and I suppose that for this scenario the short conditions are insufficient.

Even an idea is to set the PositionSize for the short trades depending on saisonal pattern. Perhaps you find something that is better than this suggestion.

regards

Reiner

// saisonal pattern

saisonalShortPattern = CurrentMonth > 3 AND CurrentMonth < 10 // April - September

// short entry

IF NOT SHORTONMARKET AND ( (s1 AND c3) OR (s2 AND c4) OR (s3 AND c1) ) THEN // no cumulation for short trades

IF saisonalShortPattern THEN

SELLSHORT PositionSize * 2 CONTRACT AT MARKET // double position size by higher saisonal probability

ELSE

SELLSHORT PositionSize CONTRACT AT MARKET

ENDIF

ENDIF

Doctrading

You found the reason. Sorry, I only saw your first comment.

Reiner

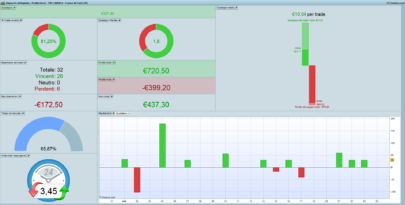

Thanks for sharing. Backtesting almost too good to be true, however there was almost 20% loss of equity in one trade.

when i do the proback test i only get 9 trades for the last 16 years, that cant be correct? anyone know what i might be doing wrong?

Hey Reiner,

nice code, as always! Thanks a lot.

In the code you have definded the trading window from 08:00 to 22:00. But some positions are open for several days and even during the weekend. Is this supposed to happen?

Cheers

Flo

Hi Flo,

Yes, that’s the expectation. Pathfinder is not an intraday strategy and positions could hold for several days until stop or exit conditions closed the trade. I’m still work on improvements, e.g. the position management for the short side depending on saisonal pattern is promising. I’m not happy with the exit rules and have tested many complex things but at the end of the day the simple %stop is the best solution so far.

regards

Reiner

Hi Reiner,

Thanks for sharing, Some nice parts to play with.

thanks,

james

in order to understand the system better it’s helpful to see the relevant things, here is Pathfinder as indicator with the relevant lines and levels

// Pathfinder

// daily high/low

dailyHigh = DHigh(1)

dailyLow = DLow(1)

// weekly high/low

Once lastWeekBarIndex = 0

Once weeklyHigh = undefined

Once weeklyLow = undefined

If DayOfWeek < DayOfWeek[1] then

weeklyHigh = Highest[BarIndex - lastWeekBarIndex](DHigh(1))

weeklyLow = Lowest[BarIndex - lastWeekBarIndex](DLow(1))

lastWeekBarIndex = BarIndex

ENDIF

// monthly high/low

Once lastMonthBarIndex = 0

Once monthlyHigh = undefined

Once monthlyLow = undefined

If Month<>Month[1] then

monthlyHigh = Highest[BarIndex - lastMonthBarIndex](DHigh(1))

monthlyLow = Lowest[BarIndex - lastMonthBarIndex](DLow(1))

lastMonthBarIndex = BarIndex

ENDIF

// signalline

firstMA = WilderAverage[5](close)

secondMA = TimeSeriesAverage[10](firstMA)

signalline = TimeSeriesAverage[5](secondMA)

// filter

ma50 = Average[50]

ma200 = Average[200]

return signalline AS \"signal line\", dailyHigh AS \"daily High\", dailyLow AS \"daily Low\", weeklyHigh AS \"weekly High\", weeklyLow AS \"weekly Low\", monthlyHigh AS \"monthly High\", monthlyLow AS \"monthly Low\", ma50 AS \"average[50]\", ma200 AS \"average[200]\"

Massive gains on this strategy since Friday….”If only it was real money”

Hi Reiner. I decided to try and live test your code, but seems like it has insufficient data to begin with- so it never starts

Here is the screenshoot of the error it generates. http://prntscr.com/brssm3 Anyway great code, that backtest really well.

Hi Elsborgtrading,

Welcome and thanks for your comment.

the message is clear, PRT is not happy with the pre loaded bars in order to calculate all used indicators. Default are 1000 bars and that shoud be enough for the used indicators. In my IG PRT environment it works without any problem in backtesting and real trading mode. In which environment do you get this message?

I suggest to raise the bar size with the mentioned command, add the following line after the first Defparam command and play around with the size: DEFPARAM PRELOADBARS = 2000

regards

Reiner

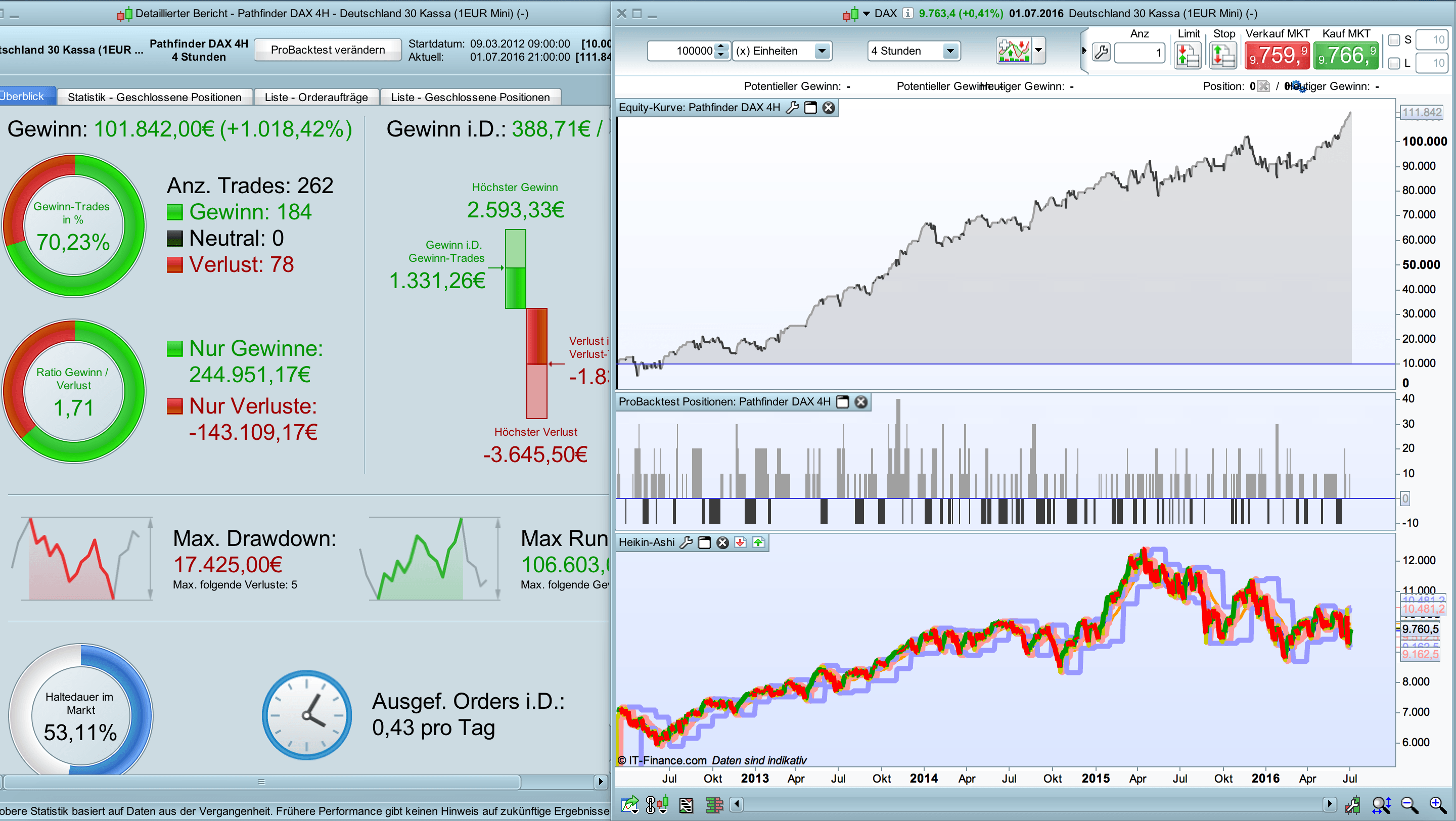

the following link shows some pictures of Pathfinder detail information

https://www.evernote.com/shard/s80/sh/3c8432cd-63f5-4301-a3cb-9a9dd5c8713b/743defcc06fa10ab3a514b9e34fbf76a

Thx for share Reiner very good TS

Pathfinder version 2 released.

The new version include some position management extensions like e.g. saisonal pattern as booster for short trades and maximal days hold feature to save profits and limit losses.

The following link shows some additional infos.

https://www.evernote.com/shard/s80/sh/3c8432cd-63f5-4301-a3cb-9a9dd5c8713b/743defcc06fa10ab3a514b9e34fbf76a

// Pathfinder DAX 4H, 8-22, 2 points spread

// DAX breakout system triggered by previous daily, weekly and monthly high/low crossings

// Version 2

// code parameter

DEFPARAM CUMULATEORDERS = true // cumulate orders if not switch off

DEFPARAM PRELOADBARS = 1000

// trading window 8-22

ONCE startTime = 80000

ONCE endTime = 220000

// smoothed average parameter (signalline)

periodFirstMA = 5

periodSecondMA = 10

periodThirdMA = 5

// filter parameter

periodLongMA = 200

periodShortMA = 50

// trading paramter

ONCE positionSize = 10

// money and position management parameter

ONCE stoppLoss = 3 // in %

ONCE takeProfit = 1.5 // in %

ONCE maxDaysWithProfit = 3 // take profit after 3 days

ONCE maxDaysWithoutProfit = 5 // limit loss after 5 days

ONCE startShortPattern = 4 // April

ONCE endShortPattern = 9 // September

ONCE shortPositionMultiplier = 2 // double short position size in case of higher saisonal probability

// calculate weekly high/low

If DayOfWeek < DayOfWeek[1] then

weeklyHigh = Highest[BarIndex - lastWeekBarIndex](DHigh(1))

lastWeekBarIndex = BarIndex

ENDIF

// calculate monthly high/low

If Month <> Month[1] then

monthlyHigh = Highest[BarIndex - lastMonthBarIndex](DHigh(1))

monthlyLow = Lowest[BarIndex - lastMonthBarIndex](DLow(1))

lastMonthBarIndex = BarIndex

ENDIF

// calculate signalline with multiple smoothed averages

firstMA = WilderAverage[periodFirstMA](close)

secondMA = TimeSeriesAverage[periodSecondMA](firstMA)

signalline = TimeSeriesAverage[periodThirdMA](secondMA)

// trade only in trading window 8-22

IF Time >= startTime AND Time <= endTime THEN

// filter criteria because not every breakout is profitable

c1 = close > Average[periodLongMA](close)

c2 = close < Average[periodLongMA](close)

c3 = close > Average[periodShortMA](close)

c4 = close < Average[periodShortMA](close)

// saisonal pattern

saisonalShortPattern = CurrentMonth >= startShortPattern AND CurrentMonth <= endShortPattern

// long position conditions

l1 = signalline CROSSES OVER monthlyHigh

l2 = signalline CROSSES OVER weeklyHigh

l3 = signalline CROSSES OVER DHigh(1)

l4 = signalline CROSSES OVER monthlyLow

// short position conditions

s1 = signalline CROSSES UNDER monthlyHigh

s2 = signalline CROSSES UNDER monthlyLow

s3 = signalline CROSSES UNDER Dlow(1)

// long entry

IF ( l1 OR l4 OR l2 OR (l3 AND c2) ) THEN // cumulate orders for long trades

BUY PositionSize CONTRACT AT MARKET

ENDIF

// short entry

IF NOT SHORTONMARKET AND ( (s1 AND c3) OR (s2 AND c4) OR (s3 AND c1) ) THEN // no cumulation for short trades

IF saisonalShortPattern THEN

SELLSHORT positionSize * shortPositionMultiplier CONTRACT AT MARKET

ELSE

SELLSHORT positionSize CONTRACT AT MARKET

ENDIF

ENDIF

// stop and profit management

posProfit = (((close - positionprice) * pointvalue) * countofposition) / pipsize

m1 = posProfit > 0 AND (BarIndex - TradeIndex) >= maxDaysWithProfit * 5 // 5*4H candles are one day

m2 = posProfit < 0 AND (BarIndex - TradeIndex) >= maxDaysWithoutProfit * 5

IF ONMARKET AND m1 OR m2 THEN

IF SHORTONMARKET THEN

EXITSHORT positionSize SHARES AT MARKET

ENDIF

IF LONGONMARKET THEN

SELL positionSize SHARES AT MARKET

ENDIF

ENDIF

SET STOP %LOSS stoppLoss

SET TARGET %PROFIT takeProfit

ENDIF

Hello, the system in backtest seems work but go on live, seems that have a problem.

Like: Partial close of position Le seguenti modifiche sono state applicate prima dell’invio del codice a ProOrder: – I sistemi di trading con ordini che chiudono parzialmente una posizione non possono essere inviati a ProOrder (ad es. SELL 3 SHARES AT MARKET).Assicurati che non sia specificata nessuna quantità nelle istruzioni che chiudono le posizioni (in questo caso, l’istruzione chiude l’intera posizione). Ad es.SELL AT MARKETEXITSHORT AT 1.5 LIMIT

Hi AleX,

Thanks for your comment. I see what you mean. For real mode trading you have to replace the following lines:

Sorry for the confusion.

Reiner

IF ONMARKET AND m1 OR m2 THEN

IF SHORTONMARKET THEN

EXITSHORT AT MARKET

ENDIF

IF LONGONMARKET THEN

SELL AT MARKET

ENDIF

ENDIF

Pathfinder version 2 update. Bug fixing for real mode trading.

// Pathfinder DAX 4H, 8-22, 2 points spread

// DAX breakout system triggered by previous daily, weekly and monthly high/low crossings

// Version 2

// code parameter

DEFPARAM CUMULATEORDERS = true // cumulate orders if not switch off

DEFPARAM PRELOADBARS = 1000

// trading window 8-22

ONCE startTime = 80000

ONCE endTime = 220000

// smoothed average parameter (signalline)

periodFirstMA = 5

periodSecondMA = 10

periodThirdMA = 5

// filter parameter

periodLongMA = 200

periodShortMA = 50

// trading paramter

ONCE positionSize = 1

// money and position management parameter

ONCE stoppLoss = 3 // in %

ONCE takeProfit = 1.5 // in %

ONCE maxDaysWithProfit = 3 // take profit after 3 days

ONCE maxDaysWithoutProfit = 5 // limit loss after 5 days

ONCE startShortPattern = 4 // April

ONCE endShortPattern = 9 // September

ONCE shortPositionMultiplier = 2 // double short position size in case of higher saisonal probability

// calculate weekly high/low

If DayOfWeek < DayOfWeek[1] then

weeklyHigh = Highest[BarIndex - lastWeekBarIndex](DHigh(1))

lastWeekBarIndex = BarIndex

ENDIF

// calculate monthly high/low

If Month <> Month[1] then

monthlyHigh = Highest[BarIndex - lastMonthBarIndex](DHigh(1))

monthlyLow = Lowest[BarIndex - lastMonthBarIndex](DLow(1))

lastMonthBarIndex = BarIndex

ENDIF

// calculate signalline with multiple smoothed averages

firstMA = WilderAverage[periodFirstMA](close)

secondMA = TimeSeriesAverage[periodSecondMA](firstMA)

signalline = TimeSeriesAverage[periodThirdMA](secondMA)

// trade only in trading window 8-22

IF Time >= startTime AND Time <= endTime THEN

// filter criteria because not every breakout is profitable

c1 = close > Average[periodLongMA](close)

c2 = close < Average[periodLongMA](close)

c3 = close > Average[periodShortMA](close)

c4 = close < Average[periodShortMA](close)

// saisonal pattern

saisonalShortPattern = CurrentMonth >= startShortPattern AND CurrentMonth <= endShortPattern

// long position conditions

l1 = signalline CROSSES OVER monthlyHigh

l2 = signalline CROSSES OVER weeklyHigh

l3 = signalline CROSSES OVER DHigh(1)

l4 = signalline CROSSES OVER monthlyLow

// short position conditions

s1 = signalline CROSSES UNDER monthlyHigh

s2 = signalline CROSSES UNDER monthlyLow

s3 = signalline CROSSES UNDER Dlow(1)

// long entry

IF ( l1 OR l4 OR l2 OR (l3 AND c2) ) THEN // cumulate orders for long trades

BUY PositionSize CONTRACT AT MARKET

ENDIF

// short entry

IF NOT SHORTONMARKET AND ( (s1 AND c3) OR (s2 AND c4) OR (s3 AND c1) ) THEN // no cumulation for short trades

IF saisonalShortPattern THEN

SELLSHORT positionSize * shortPositionMultiplier CONTRACT AT MARKET

ELSE

SELLSHORT positionSize CONTRACT AT MARKET

ENDIF

ENDIF

// stop and profit management

posProfit = (((close - positionprice) * pointvalue) * countofposition) / pipsize

m1 = posProfit > 0 AND (BarIndex - TradeIndex) >= maxDaysWithProfit * 5 // 5*4H candles are one day

m2 = posProfit < 0 AND (BarIndex - TradeIndex) >= maxDaysWithoutProfit * 5

IF ONMARKET AND m1 OR m2 THEN

IF SHORTONMARKET THEN

EXITSHORT AT MARKET

ENDIF

IF LONGONMARKET THEN

SELL AT MARKET

ENDIF

ENDIF

SET STOP %LOSS stoppLoss

SET TARGET %PROFIT takeProfit

ENDIF

Hi Reiner and many thanks again for contributing to the Library. Do you want me to change the code and file of the post?

Hi Nicolas and thanks for your offer. Yes please make an update. With version 2 everything is finished what I had planed so far. Let’s make money with it. Reiner

The post code and file has been updated to your last version (version 2)

Hi Reiner,

Thanks for sharing your strategy and code. It seems to work very well on demo, Congratulations.

Hi Jesús,

Welcome and thanks for your comment. Yes backtest looks realy promising. Yesterday I have started the robot for real trading let’s see how it works in real life.

regards

Reiner

Yes, its really look good. I will try to run this live, for the beginning with a smaller Positionsize.

The problem in the automatic systems are, that we check in few minutes a Timeframe of 4 years and see, that we can earn money. But in Real, 4 Years are a lot of time. Each Day you will check your system, maybe you will loss money on that day but you have the belive in your System an have to still wait. And i think, that is the most difficult thing at the automatic trading.

Vielen Dank Reiner für die ganzen tollen Codes. Tradest du die selber auch live ?

Gruß

Thanks.

Hallo Bolu14,

Danke für deinen Kommentar und Willkommen. Ich trade verschiedene Strategien automatisch oder manuell aber nicht alle die ich hier veröffentlich habe. Pathfinder ist eine Sammlung von Techniken die ich bisher manuell gehandelt habe, den Breakout von Tages- oder Monats Hoch/Tief haben viele Trader auf dem Plan. Bisher ist das System noch in der Entwicklung und ich bin ehrlich selbst überrascht wie gut der Backtest ist. Das Grundgerüst scheint mir robust zu sein, 100% zufrieden bin ich aber noch nicht, da das System doch spät einsteigt und den Trend nicht lange genug mitnimmt durch die harten Stop und Target Limits. Aber vlt. finden wir gemeinsam ja eine noch bessere Lösung.

Gruß

Reiner

Hi Reiner,

I am testing in demo account and for now only made a one positive trade. For me it is too early to put the strategy in real mode, but I hope your comments as you go running in real. Again, thank you very much for your excellent work Rainer.

Hallo Bolu14,

Danke für deinen Kommentar und Willkommen. Ich trade verschiedene Strategien automatisch oder manuell aber nicht alle die ich hier veröffentlich habe. Pathfinder ist eine Sammlung von Techniken die ich bisher manuell gehandelt habe, den Breakout von Tages- oder Monats Hoch/Tief haben viele Trader auf dem Plan. Bisher ist das System noch in der Entwicklung und ich bin ehrlich selbst überrascht wie gut der Backtest ist. Das Grundgerüst scheint mir robust zu sein, 100% zufrieden bin ich aber noch nicht, da das System doch spät einsteigt und den Trend nicht lange genug mitnimmt durch die harten Stop und Target Limits. Aber vlt. finden wir gemeinsam ja eine noch bessere Lösung.

Gruß

Reiner

I also have one positive trade on demo. The only thing which concerns me long-term is that stoploss is 3% vs target profit of 1.5%. To my knowledge it means a negative expectancy in the long run because you need consistent 60%+ win/lose ratio to accommodate system requirements.

Hi absent1980,

Thanks for your comment and welcome. You ‘re right. I’m not happy with the hard % limits and 300 points loss is a big number. Maybe we find together a better solution. regards Reiner

Capital = 10000

Risk = 0.01

StopCoefficient = 75 //it can be any number, 75 gives you initial positionsize of 1.

REM Calculate contracts

equity = Capital + StrategyProfit

maxrisk = round(equity*Risk)

PositionSize = abs(round((maxrisk/StopCoefficient)/PointValue))

// money and position management parameter

ONCE stoppLoss = 1 // in % (reduced from 3 to 1)

ONCE takeProfit = 2.5 // in % (increased from 1.5 to 2.5)

This amendment will reduce your system performance on backtesting but you shouldn’t lose more than 1%(or 2% for cumulative positions) of your equity on a trade. R/R ratio is still high enough to be profitable long term due to compounding position sizing. Also may i ask you how much automated optimization have you done? Your system looks very good but over optimizing will make it curve fitted, thus very vulnerable to market changes.

I understand what you mean and thanks for your contribution. Give me a moment to play around with your idea. Key feature of Pathfinder is the smoothed average as signalline. The used period lenghts are optimized. Stop and take profit limits and max days holding period values as well. The backtest result is certainly an optimized view but I’m confident that it could work because Pathfinder is a backward engineering of some of my manual but profitable trading techniques. We will see.

Also you can try to optimize your system to volatility and trade only if volatility is within certain range. I did some backtesting and noticed better performance.

Il timing è il mio mestiere .

Dopo aver testato in demo … ieri primo trade in reale … No comment (solo parolacce)

Comunque in base alla mia esperienza , un trade negativo , anche se il primo , non condiziona il mio giudizio sul codice che ritengo tra i più validi in circolazione.

peccato sarebbe stato più bello partire con un gain .

Grazie comunque per il tuo contributo Reiner .

miguel

Hi miguell33,

Thanks for your comment and welcome. Yesterday evening Pathfinder shorted the DAX at 9968 because signalline crossed under previous daily low. Unfortunately good company news from SAP and VW pushed the DAX higher and the trade is under water so far. Please find below some additional infos. regards Reiner

https://www.evernote.com/shard/s80/sh/3c8432cd-63f5-4301-a3cb-9a9dd5c8713b/743defcc06fa10ab3a514b9e34fbf76a

Hi Reiner.

First of all, thanks for sharing this exceptional system code with all of us.

I also agree with absent1980 as I also understand that a system with a stop loss of 3% against a take profit of 1,5% should be a long term loser. This is not the case with the backtests I did.

With the backtest between 4th of January and 18/07, I got a profit of 21.282€. However, changing this fix nr. by a variable number and substituting the take profit of 1.5% by a 2.3%, the backtest increases the profit up to 27.641€. Do you recommend to increase this take profit in general, or this could be a too high risk to work normally with? And do you also think that reducing the stop loss could be a solution to minimize the losses? Although you have an excellent ratio benefits/losses…

Und danke für deine Hilfe für die Anfänger wie ich.

Grüsse

Petrus

Hi Petrus,

Thanks for your comment and welcome. The stop loss in Pathfinder works in a sense of a disaster stopp. You can omit it or set it to a higher value like e.g 5% without lose significant performance. The take profit limit depends to your willingness to take risk. Higher profit limits lead to higher performance and lower profitable trade rates. Personally I prefer trading systems with 70% rate of profitable trades. A good take profit limit is 2%.

regards

Reiner

Dear Reiner

Thanks for sharing all your codes,

rather than using fix profit limit and stop loss, have you tried to use weekly/daily pivot point for exit?

Regards

Yannick

Bonjour Yannick,

Thanks for your comment and welcome. I didn’t test pivots as exit trigger but this idea would be worth to test.

regards

Reiner

Yannick, I have made a “quick and dirty” test of your idea. Results were partially better but drawdowns were higher and the rate of profitable trades were under 50%. Weekly pivots delivered the best results. Here is the code to play around – just uncomment the related pivot calculations. regards Reiner

// Pathfinder DAX 4H, 8-22, 2 points spread

// DAX breakout system triggered by previous daily, weekly and monthly high/low crossings

// Version test pivots as exit trigger

// code parameter

DEFPARAM CUMULATEORDERS = true // cumulate orders if not turned off

DEFPARAM PRELOADBARS = 1000

// trading window 8-22

ONCE startTime = 80000

ONCE endTime = 220000

// smoothed average parameter (signalline)

periodFirstMA = 5

periodSecondMA = 10

periodThirdMA = 5

// filter parameter

periodLongMA = 200

periodShortMA = 50

// trading paramter

positionSize = 1

// money and position management parameter

ONCE startShortPattern = 4 // April

ONCE endShortPattern = 9 // September

ONCE shortPositionMultiplier = 2 // double short position size in case of higher saisonal probability

// daily pivots

//dailyPivot = (DHigh(1) + DLow(1) + Close[1]) / 3

//dailyR1 = 2*dailyPivot - DLow(1)

//dailyS1 = 2*dailyPivot - DHigh(1)

//dailyR2 = dailyPivot + (DHigh(1) - DLow(1))

//dailyS2 = dailyPivot - (DHigh(1) - DLow(1))

//dailyR3 = dailyR1 + (DHigh(1) - DLow(1))

//dailyS3 = dailyS1 - (DHigh(1) - DLow(1))

// calculate weekly high/low and pivots

If DayOfWeek < DayOfWeek[1] then

weeklyHigh = Highest[BarIndex - lastWeekBarIndex](DHigh(1))

weeklyLow = Lowest[BarIndex - lastWeekBarIndex](DLow(1))

lastWeekBarIndex = BarIndex

weeklyPivot = (weeklyHigh + weeklyLow + DClose(1)) / 3

weeklyR1 = 2*weeklyPivot - weeklyLow

weeklyS1 = 2*weeklyPivot - weeklyHigh

//weeklyR2 = weeklyPivot + (weeklyHigh - weeklyLow)

//weeklyS2 = weeklyPivot - (weeklyHigh - weeklyLow)

weeklyR3 = weeklyR1 + (weeklyHigh - weeklyLow)

weeklyS3 = weeklyS1 - (weeklyHigh - weeklyLow)

ENDIF

// calculate monthly high/low and pivots

If Month <> Month[1] then

monthlyHigh = Highest[BarIndex - lastMonthBarIndex](DHigh(1))

monthlyLow = Lowest[BarIndex - lastMonthBarIndex](DLow(1))

lastMonthBarIndex = BarIndex

//monthlyPivot = (monthlyHigh + monthlyLow + DClose(1)) / 3

//monthlyR1 = 2*monthlyPivot - monthlyLow

//monthlyS1 = 2*monthlyPivot - monthlyHigh

//monthlyR2 = monthlyPivot + (monthlyHigh - monthlyLow)

//monthlyS2 = monthlyPivot - (monthlyHigh - monthlyLow)

//monthlyR3 = monthlyR1 + (monthlyHigh - monthlyLow)

//monthlyS3 = monthlyS1 - (monthlyHigh - monthlyLow)

ENDIF

// calculate signalline with multiple smoothed averages

firstMA = WilderAverage[periodFirstMA](close)

secondMA = TimeSeriesAverage[periodSecondMA](firstMA)

signalline = TimeSeriesAverage[periodThirdMA](secondMA)

// trade only in trading window 8-22

IF Time >= startTime AND Time <= endTime THEN

// filter criteria because not every breakout is profitable

c1 = close > Average[periodLongMA](close)

c2 = close < Average[periodLongMA](close)

c3 = close > Average[periodShortMA](close)

c4 = close < Average[periodShortMA](close)

// saisonal pattern

saisonalShortPattern = CurrentMonth >= startShortPattern AND CurrentMonth <= endShortPattern

// long position conditions

l1 = signalline CROSSES OVER monthlyHigh

l2 = signalline CROSSES OVER weeklyHigh

l3 = signalline CROSSES OVER DHigh(1)

l4 = signalline CROSSES OVER monthlyLow

// short position conditions

s1 = signalline CROSSES UNDER monthlyHigh

s2 = signalline CROSSES UNDER monthlyLow

s3 = signalline CROSSES UNDER Dlow(1)

// long entry

IF ( l1 OR l4 OR l2 OR (l3 AND c2) ) THEN // cumulate orders for long trades

BUY PositionSize CONTRACT AT MARKET

ENDIF

// short entry

IF NOT SHORTONMARKET AND ( (s1 AND c3) OR (s2 AND c4) OR (s3 AND c1) ) THEN // no cumulation for short trades

IF saisonalShortPattern THEN

SELLSHORT positionSize * shortPositionMultiplier CONTRACT AT MARKET

ELSE

SELLSHORT positionSize CONTRACT AT MARKET

ENDIF

ENDIF

// stop and profit management triggered by pivots

// long

IF LONGONMARKET AND close CROSSES OVER weeklyR3 THEN // take profit

SELL AT MARKET

ENDIF

IF LONGONMARKET AND close CROSSES UNDER weeklyS3 THEN // stop

SELL AT MARKET

ENDIF

// short

IF SHORTONMARKET AND close CROSSES UNDER weeklyS3 THEN // take profit

EXITSHORT AT MARKET

ENDIF

IF SHORTONMARKET AND close CROSSES OVER weeklyR3 THEN // stop

EXITSHORT AT MARKET

ENDIF

ENDIF

Hi Reiner ,

oggi il codice ha generato un ordine long mentre in backtest e’ sempre short dal 19 luglio.

come mai questa diseguaglianza ?

Grazie .

miguel

Hi Miguel,

Pathfinder closed at 9:00 the short postion and opened in the same transaction a long position at 10190. Trigger was that signalline crossed over the weekly high. Backtest mode needs one additional candle to display the syncronized events. regards Reiner

Si ho visto adesso .

Grazie per la tua cortesia.

miguel

Hi Reiner,

Great system and thank you for sharing it with the community here.

I’m having trouble with setting this part of the code working for my timezone (GMT+8 Australia AWST):

// trading window 8-22

ONCE startTime = 80000

ONCE endTime = 220000

For me, DAX opens @ 1500 and closes @ 2330 for 1pt spread. 2pt spread ends at 0500.

The problem I’m having is that I’m not sure how I can modify the code to take into account my timezone since the below code doesn’t work:

// trading window 8-22

ONCE startTime = 150000

ONCE endTime = 050000

I haven’t yet found a way for it to work, and is a common issue I face quite often with systems that work through till the end of 2pt spread session.

Are you able to shed some light on this and help if possible?

Thanks again Reiner, love your work by the way especially with the DAX up/down and DAX Bluemoon!

Siaoman

Hi Siaoman,

Thanks for your comment and welcome. I asume the problem is that the used indicator calculation doesn’t work correctly in different timezones. Please check workstation-options and timezone settings or check the forum for relevant topics. I have found a related discussion here: http://www.prorealcode.com/topic/proorder-and-customized-time-zones/

regards

Reiner

Hi Reiner. I start pathfinder in real on 23/07 but at today it’s doesn’t start. what you think about this? It’s normal or my proorder get some trouble?

thank you for sharing your strategy

Hi Luigi,

Thanks for your comment and welcome. I’m still analyzing the backtest trades and that’s why I’m currently not trading in real mode but I observed that proorder needs more than max 1 position size because Pathfinder works with variable order sizes. When you started at 23/07 I would expect the last trade on 26/07 9:00 Buy 1 at 10190 and close on 27/07 9:00 at 10343. Please find more details in Pathfinder Inside.

https://www.evernote.com/shard/s80/sh/3c8432cd-63f5-4301-a3cb-9a9dd5c8713b/743defcc06fa10ab3a514b9e34fbf76a

regards

Reiner

Hi Reiner.

In order to solve the IG problem on mondays (DHigh[1] is then the High from Sunday), perhaps you could try this solution I programmed:

a1=DayOfWeek

b1=DHigh(1)

b2=DHigh(2)

c1=DLow(1)

c2=DLow(2)

d1=DClose(1)

d2=DClose(2)

IF a1=1 THEN

b1=b2

c1=c2

d1=d2

ELSE

b1=b1

c1=c1

d1=d1

ENDIF

H1 = b1//High

L1 = c1//Low

C = d1//Close

Pivot = (H1 + L1 + C) / 3

RETURN b1 AS \"DHigh[1]\", c1 AS \"DLow[1]\", Pivot AS \"Pivot Point[1]\"

It is not 100% perfect, but it works.

Regards

Petrus

Petrus, I have made a quick test of your idea. Results with weekly pivots were not better. Replace Pathfinders DHigh/DLow calculation of weekly and monthly high/low leads not to better results as well. It seems that for Pathfinder the “IG problem” is a feature and not a bug.

See below the code I have used.

regards Reiner

IF dayOfWeek = 1 THEN

dayHigh = DHigh(2)

dayLow = DLow(2)

dayClose = DClose(2)

ENDIF

IF dayOfWeek >=2 and dayOfWeek < 6 THEN

dayHigh = DHigh(1)

dayLow = DLow(1)

dayClose = DClose(1)

ENDIF

dailyPivot = (dayHigh + dayLow + dayClose) / 3

// calculate weekly high/low and pivots

If DayOfWeek < DayOfWeek[1] then

weeklyHigh = Highest[BarIndex - lastWeekBarIndex](dayHigh)

weeklyLow = Lowest[BarIndex - lastWeekBarIndex](dayLow)

lastWeekBarIndex = BarIndex

weeklyPivot = (weeklyHigh + weeklyLow + dayClose) / 3

weeklyR1 = 2*weeklyPivot - weeklyLow

weeklyS1 = 2*weeklyPivot - weeklyHigh

//weeklyR2 = weeklyPivot + (weeklyHigh - weeklyLow)

//weeklyS2 = weeklyPivot - (weeklyHigh - weeklyLow)

weeklyR3 = weeklyR1 + (weeklyHigh - weeklyLow)

weeklyS3 = weeklyS1 - (weeklyHigh - weeklyLow)

ENDIF

hi reiner, proorder tell my error message for preloadbars, I change 1000 in 2000,it’s ok?

thanks for your answer and for your system

Luigi, you can set this parameter to every value as long as proorder is happy with it. I never had this problem in backtest or real mode. In which environment you are getting this message?

Hi reiner, thanks for your reply in advance….I’m trying to launch pathfinder in real with 1 contract with Dax and the same for CAC and FTSE100. It’s strange because this night Pathfinder try to start CAC and FTSE100 and proorder stop them with the message of the preloadbars, so on DAX never start and I’m waiting to see what pathfinder do in real. I write from Italy and my platform is IG.

Have you something to suggest me? ( I think thet your system is very good and then I would spend time to see what the system do in real instead of waiting)

thank you very much

Luigi, Pathfinder works with cumulative and variable order sizes maybe that’s your problem. When you start Pathfinder and proorder is asking after the max position size set a higher value then 1 also if you have set positionSize to 1 in Pathfinder’s code. Take care with CAC and FTSE100 – Pathfinder was not tested with these instruments.

Hi reainer and Thanks again for your reply, I saw that also in my backtest pathfinder don’t start from 27 july, it’s correct?

Luigi, Pathfinder shorted the DAX at 10130 today.

Hi reiner, today afternoon pathfinder start in real 2 contracts on Dax and 2 in Cac, I see that don’t start in backtest….why?

I don’t change nothing of your version 2 ready for real trading

PRT will synchronize the trading events in backtest mode after an additional candle.

Perfekt !!

Ho reiner, Yes in Dax 2 position open at 10130,5 and 2 position at 10128,5… I don’t know why

on cac open 2 position at 4319,9

Reiner

Mi puoi spiegare perché inserendo lo stesso codice in prt 10.2 e prt 10.3 ho dei risultati diversi ?

Ieri per esempio nella versione 10.3 mi fa uscire in profit (entrato prima in short) mentre nella versione 10.2 m

fa entrare short .

cosa non capisco ?

grazie per la tua collaborazione e cortesia .

miguel

Miguel,

as IG customer currently only 10.2 is available for me. I haven’t used 10.3 so far and unfortunately I have no answer to your question. – regards Reiner

Good move on DAX today.

Hallo Reiner,

Really impressed by this strategy, vielen dank for sharing it. I’ve been reading a couple of times to completely understand the workflow and I just wondered why maxDaysWith and WithoutProfit are * 5 as maybe stupidely, I always thought that there where 6 candles of 4 hours in a day. To be sure I changed maxDays by MaxCandles to test. The optimal result shows 16 candles with profit and a different number withoutProfit, depending on if it is a long or a short trade. As it works great “like it is”, and just to be sure, is there in your opinion any special reason to keep the MaxDays and with *5 without breaking the global coherency?

Thank you again,

My best regards

Bonjour mofiman,

Thanks for your comment and welcome. You are wright using candles is better to understand. I will change this in the next version.

regards

Reiner

@mofiman

yes, 5 * 4H-Candles per Day is not correct but it gives the best result.

OK OldGerman, thanks for your reply. So there is nothing against using candles instead of 5 candle packs. Everything is clear now. Thank you again

best regards

Pathfinder version 3 released. I have reorganized the code a little bit to make things clearer. Based on comments and results of the last trades I tried to improve the trading algorithm as well. The main changes are:

the separation of the limits for long and short trades

introduction of seasonal position management for long and short trades

the conversion of maximum holding period from days to candles

optimizing of some parameters like periodThirdMA, periodLongMA

Please find more details in Pathfinder Inside.

https://www.evernote.com/shard/s80/sh/3c8432cd-63f5-4301-a3cb-9a9dd5c8713b/743defcc06fa10ab3a514b9e34fbf76a

// Pathfinder DAX 4H, 9-22, 2 points spread

// DAX breakout system triggered by previous daily, weekly and monthly high/low crossings

// Version 3

// ProOrder code parameter

DEFPARAM CUMULATEORDERS = true // cumulate orders if not turned off

DEFPARAM PRELOADBARS = 10000

// trading window 8-22

ONCE startTime = 80000

ONCE endTime = 220000

// smoothed average parameter (signalline)

ONCE periodFirstMA = 5

ONCE periodSecondMA = 10

ONCE periodThirdMA = 3

// filter parameter

ONCE periodLongMA = 250

ONCE periodShortMA = 50

// trading paramter

ONCE PositionSize = 1

// money and position management parameter

ONCE stoppLoss = 5 // in %

ONCE takeProfitLong = 2 // in %

ONCE takeProfitShort = 1.75 // in %

ONCE maxCandlesLongWithProfit = 18 // take long profit latest after 18 candles

ONCE maxCandlesShortWithProfit = 13 // take short profit latest after 13 candles

ONCE maxCandlesLongWithoutProfit = 30 // limit long loss latest after 30 candles

ONCE maxCandlesShortWithoutProfit = 25 // limit short loss latest after 25 candles

ONCE startShortPattern = 4 // April

ONCE endShortPattern = 9 // September

ONCE longPositionMultiplier = 2 // multiplier for long position size in case of higher saisonal probability

ONCE shortPositionMultiplier = 2 // multiplier for short position size in case of higher saisonal probability

// calculate daily high/low

dailyHigh = DHigh(1)

dailyLow = DLow(1)

// calculate weekly high/low

If DayOfWeek < DayOfWeek[1] then

weeklyHigh = Highest[BarIndex - lastWeekBarIndex](dailyHigh)

lastWeekBarIndex = BarIndex

ENDIF

// calculate monthly high/low

If Month <> Month[1] then

monthlyHigh = Highest[BarIndex - lastMonthBarIndex](dailyHigh)

monthlyLow = Lowest[BarIndex - lastMonthBarIndex](dailyLow)

lastMonthBarIndex = BarIndex

ENDIF

// calculate signalline with multiple smoothed averages

firstMA = WilderAverage[periodFirstMA](close)

secondMA = TimeSeriesAverage[periodSecondMA](firstMA)

signalline = TimeSeriesAverage[periodThirdMA](secondMA)

// trade only in trading window 8-22

IF Time >= startTime AND Time <= endTime THEN

// filter criteria because not every breakout is profitable

c1 = close > Average[periodLongMA](close)

c2 = close < Average[periodLongMA](close)

c3 = close > Average[periodShortMA](close)

c4 = close < Average[periodShortMA](close)

// saisonal pattern

saisonalShortPattern = CurrentMonth >= startShortPattern AND CurrentMonth <= endShortPattern

// long position conditions

l1 = signalline CROSSES OVER monthlyHigh

l2 = signalline CROSSES OVER weeklyHigh

l3 = signalline CROSSES OVER dailyHigh

l4 = signalline CROSSES OVER monthlyLow

// short position conditions

s1 = signalline CROSSES UNDER monthlyHigh

s2 = signalline CROSSES UNDER monthlyLow

s3 = signalline CROSSES UNDER dailyLow

// long entry

IF ( l1 OR l4 OR l2 OR (l3 AND c2) ) THEN // cumulate orders for long trades

IF not saisonalShortPattern THEN

BUY PositionSize * longPositionMultiplier CONTRACT AT MARKET

ELSE

BUY PositionSize CONTRACT AT MARKET

ENDIF

takeProfit = takeProfitLong

ENDIF

// short entry

IF NOT SHORTONMARKET AND ( (s1 AND c3) OR (s2 AND c4) OR (s3 AND c1) ) THEN // no cumulation for short trades

IF saisonalShortPattern THEN

SELLSHORT positionSize * shortPositionMultiplier CONTRACT AT MARKET

ELSE

SELLSHORT positionSize CONTRACT AT MARKET

ENDIF

takeProfit = takeProfitShort

ENDIF

// stop and profit management

posProfit = (((close - positionprice) * pointvalue) * countofposition) / pipsize

m1 = posProfit > 0 AND (BarIndex - TradeIndex) >= maxCandlesLongWithProfit

m2 = posProfit > 0 AND (BarIndex - TradeIndex) >= maxCandlesShortWithProfit

m3 = posProfit < 0 AND (BarIndex - TradeIndex) >= maxCandlesLongWithoutProfit

m4 = posProfit < 0 AND (BarIndex - TradeIndex) >= maxCandlesShortWithoutProfit

IF LONGONMARKET AND (m1 OR m3) THEN

SELL AT MARKET

ENDIF

IF SHORTONMARKET AND (m2 OR m4) THEN

EXITSHORT AT MARKET

ENDIF

SET STOP %LOSS stoppLoss

SET TARGET %PROFIT takeProfit

ENDIF

Do you want me to update the main post ITF file Reiner?

Hi Reiner, and good job 🙂 I really like that you works very hard and persistent to optimize and tweak your own code. When I backtest Ver.3 on DAX I see very early you put up 10 positionsize the 22 nov. 2012 and risk around 20% of your account?

I added this small code

graph ((tradeprice*stopploss)/100)*positionsize*pointvalue*pipsize/(equity+capital)*100 COLOURED(0,0,0) AS \"MAXRISK\"//Aqua

forgot this code as well

Capital=1000

equity = Capital + StrategyProfit

Nicolas, please make an update. Thanks

Your post has been updated with the V3 code and ITF file too.

Hi Reiner,Your v3 Path Finder Performance is excellent! However, i do not have large capital to manage any of the losing trade. so I resized the output by changing the SL% and TP%. Unfortunately, the result is not good as compared to default parameters. Could you please advice what are parameters i need to change in order to maintain the performance? br,CKW

Hi CKW,

a reduction of risk with the same performance is impossible. You can reduce risk and drawdown when you omit order cumulation and the seasonal pattern booster and increase the take profit limit. Change the following parameters:

DEFPARAM CUMULATEORDERS = falseONCE takeProfitLong = 3.25

ONCE longPositionMultiplier = 1

ONCE shortPositionMultiplier = 1

With these changes Pathfinder is trading only with fixed position size of 1 contract and the drawdown is reduced under 10%. Unfortunately the performance is reduced as well.

regards

Reiner

Hi Reiner,

Crazy performance on this one – great work! Have you tested it with that variable position sizing code you’re using in some of your other algos? If you have the time please consider including it – would be interessting to see the result.

Hi dane,

Yes, I have tested it and it delivers exceptional but results. Pathfinder V3 has some features for variable position sizing and for me it’s enough thrill. But if you have the “balls” for bigger drawdowns here is the code to play around and in Pathfinder Inside you can see an example of smart position sizing.

https://www.evernote.com/shard/s80/sh/3c8432cd-63f5-4301-a3cb-9a9dd5c8713b/743defcc06fa10ab3a514b9e34fbf76a

regards

Reiner

// Pathfinder DAX 4H, 9-22, 2 points spread

// DAX breakout system triggered by previous daily, weekly and monthly high/low crossings

// Version 3 with smart position sizing

// ProOrder code parameter

DEFPARAM CUMULATEORDERS = true // cumulate orders if not turned off

DEFPARAM PRELOADBARS = 10000

// trading window 8-22

ONCE startTime = 80000

ONCE endTime = 220000

// smoothed average parameter (signalline)

ONCE periodFirstMA = 5

ONCE periodSecondMA = 10

ONCE periodThirdMA = 3

// filter parameter

ONCE periodLongMA = 250

ONCE periodShortMA = 50

// trading paramter

// smart position sizing

Capital = 10000

Risk = 0.01

StopCoefficient = 75

equity = Capital + StrategyProfit

maxrisk = round(equity * Risk)

PositionSize = abs(round((maxrisk / StopCoefficient) / PointValue))

//ONCE PositionSize = 1

// money and position management parameter

ONCE stoppLoss = 5 // in %

ONCE takeProfitLong = 3.25 // in %

ONCE takeProfitShort = 1.75 // in %

ONCE maxCandlesLongWithProfit = 18 // take long profit latest after 18 candles

ONCE maxCandlesShortWithProfit = 13 // take short profit latest after 13 candles

ONCE maxCandlesLongWithoutProfit = 30 // limit long loss latest after 30 candles

ONCE maxCandlesShortWithoutProfit = 25 // limit short loss latest after 25 candles

ONCE startShortPattern = 4 // April

ONCE endShortPattern = 9 // September

ONCE longPositionMultiplier = 2 // multiplier for long position size in case of higher saisonal probability

ONCE shortPositionMultiplier = 2 // multiplier for short position size in case of higher saisonal probability

// calculate daily high/low

dailyHigh = DHigh(1)

dailyLow = DLow(1)

// calculate weekly high/low

If DayOfWeek < DayOfWeek[1] then

weeklyHigh = Highest[BarIndex - lastWeekBarIndex](dailyHigh)

lastWeekBarIndex = BarIndex

ENDIF

// calculate monthly high/low

If Month <> Month[1] then

monthlyHigh = Highest[BarIndex - lastMonthBarIndex](dailyHigh)

monthlyLow = Lowest[BarIndex - lastMonthBarIndex](dailyLow)

lastMonthBarIndex = BarIndex

ENDIF

// calculate signalline with multiple smoothed averages

firstMA = WilderAverage[periodFirstMA](close)

secondMA = TimeSeriesAverage[periodSecondMA](firstMA)

signalline = TimeSeriesAverage[periodThirdMA](secondMA)

// trade only in trading window 8-22

IF Time >= startTime AND Time <= endTime THEN

// filter criteria because not every breakout is profitable

c1 = close > Average[periodLongMA](close)

c2 = close < Average[periodLongMA](close)

c3 = close > Average[periodShortMA](close)

c4 = close < Average[periodShortMA](close)

// saisonal pattern

saisonalShortPattern = CurrentMonth >= startShortPattern AND CurrentMonth <= endShortPattern

// long position conditions

l1 = signalline CROSSES OVER monthlyHigh

l2 = signalline CROSSES OVER weeklyHigh

l3 = signalline CROSSES OVER dailyHigh

l4 = signalline CROSSES OVER monthlyLow

// short position conditions

s1 = signalline CROSSES UNDER monthlyHigh

s2 = signalline CROSSES UNDER monthlyLow

s3 = signalline CROSSES UNDER dailyLow

// long entry

IF ( l1 OR l4 OR l2 OR (l3 AND c2) ) THEN // cumulate orders for long trades

IF not saisonalShortPattern THEN

BUY PositionSize * longPositionMultiplier CONTRACT AT MARKET

ELSE

BUY PositionSize CONTRACT AT MARKET

ENDIF

takeProfit = takeProfitLong

ENDIF

// short entry

IF NOT SHORTONMARKET AND ( (s1 AND c3) OR (s2 AND c4) OR (s3 AND c1) ) THEN // no cumulation for short trades

IF saisonalShortPattern THEN

SELLSHORT positionSize * shortPositionMultiplier CONTRACT AT MARKET

ELSE

SELLSHORT positionSize CONTRACT AT MARKET

ENDIF

takeProfit = takeProfitShort

ENDIF

// stop and profit management

posProfit = (((close - positionprice) * pointvalue) * countofposition) / pipsize

m1 = posProfit > 0 AND (BarIndex - TradeIndex) >= maxCandlesLongWithProfit

m2 = posProfit > 0 AND (BarIndex - TradeIndex) >= maxCandlesShortWithProfit

m3 = posProfit < 0 AND (BarIndex - TradeIndex) >= maxCandlesLongWithoutProfit

m4 = posProfit < 0 AND (BarIndex - TradeIndex) >= maxCandlesShortWithoutProfit

IF LONGONMARKET AND (m1 OR m3) THEN

SELL AT MARKET

ENDIF

IF SHORTONMARKET AND (m2 OR m4) THEN

EXITSHORT AT MARKET

ENDIF

SET STOP %LOSS stoppLoss

SET TARGET %PROFIT takeProfit

ENDIF

Great, thanks! Yes, the drawdowns indeed increase but they seem to be in relation to the higher gains. As long as you are way past your initial capital it is kind of justified – although easy to say when you’re not dealing with real money 🙂

Saw that if you enter a smaller amount than roughly 5000 the PositionSize variable will sometimes round down to zero and thus practically end the backtest. For those who wish to test with lower initial capital I added this to the smart position sizing:

// smart position sizing

Capital = 2000

Risk = 0.01

StopCoefficient = 75

equity = Capital + StrategyProfit

maxrisk = round(equity * Risk)

PositionSize = abs(round((maxrisk / StopCoefficient) / PointValue))

// prevent PositionSize to be zero

IF PositionSize < 1 THEN

PositionSize = 1

ENDIF

Hi Reiner,

Thanks for your advice.I made a small analysis based on the trade (2012 May – 2016 Aug) executed to improve the confident to go on Live. Your “path Finder v3” backtest result is very stable! I just launched this strategy on Live Demo account:)

Few Points:#Month of Dec is Perfect!#2016 having the best performance so far!#Weak Gain on Month on Feb, May but still Good (Which Below <75%)

Sorry, I don’t have the permission the share the screenshot so i share on this link:

https://1drv.ms/i/s!Aq8pIkk5CfoblQznPSXXZ7u54wJ-

br,CKW

Hi Reiner,

Good job, congratulations !!!

Hey guys, is anybody actually trading this for real?

Mark

Hi Mark,

I trade the system real with minor changes since 01.08.2016 . It’s a nice addition to my intraday systems .

Antonius

Hi antonius,

what changes have you made? And how are you results?

Hello mbaker,

//————————————————-// PositionSize longONCE LongSize = 1 //1 // Optimum = >= 2ONCE MaxLongShares = 3 //3 // Optimum = 3 * LongSize//————————————————-// PositionSize shortONCE ShortSizeSmall = 0 // Optimum = 0 Size in WinterONCE ShortSizeBig = 3 // Optimum = MaxLongShares in Summer//————————————————-// money and position management parameterONCE stoppLosslongProz = 3 // in %ONCE stoppLossshortProz = 1.75 // in %ONCE takeProfitlongProz = 4 // in %ONCE takeProfitshortProz = 1.95 // in %

Backtest-Results in four Years are now with long and short nearly the same.

Antonius

Hall Reiner , was passiert wenn ich auf prelaodbars verzichte ?

Beste Grüße

Hallo Michael,

Danke für deine Frage und Willkommen.

ProOrder benötigt für die Berechnung der Indikatoren eine Werte Historie abhängig von den gewählten Parametern. Mit Preloadbars kannst du diese Anzahl einstellen. Pathfinder V3 hat z.B. einen Filter basierend auf einem einfachen gleitenden Durchschnitt mit der Periode 250. Das System benötigt also 250 Kerzen Historie um den korrekten Wert zu berechnen. Lässt du Preloadbars weg und das System benötigt über den Defaultwert hinaus historische Daten liefert ProOrder eine Fehlermeldung. Du kannst den aktuellen Wert von 10.000 reduzieren, aber weglassen würde ich ihn nicht.

Gruß

Reiner

Hey Reiner,

ich hab versucht den MaxDrawdown zu verringern indem ich für die einzelnen Short und Long conditions (monthly, weekly, daily) verschiedene Take Profit und StopLoss Level definiert habe. Hat leider nicht ganz so gut funktioniert, aber dadurch ist es möglich das Ergebnis marginal zu verbessern und den StopLoss manchmal geringer zu setzen.

Ich finde es krass wie du die Performance über die verschiedenen Versionen hinweg verbessern konntest. Danke und weiter so!

Gruß

Flo

// Pathfinder DAX 4H, 9-22, 2 points spread

// DAX breakout system triggered by previous daily, weekly and monthly high/low crossings

// Version 3 with smart position sizing

// ProOrder code parameter

DEFPARAM CUMULATEORDERS = true // cumulate orders if not turned off

DEFPARAM PRELOADBARS = 10000

// trading window 8-22

ONCE startTime = 80000

ONCE endTime = 220000

// smoothed average parameter (signalline)

ONCE periodFirstMA = 5

ONCE periodSecondMA = 10

ONCE periodThirdMA = 3

// filter parameter

ONCE periodLongMA = 250

ONCE periodShortMA = 50

// trading paramter

// smart position sizing

ONCE PositionSize = 1

// money and position management parameter

ONCE stoppLossL1 = 3.25 // in %

ONCE stoppLossL2 = 4.75 // in %

ONCE stoppLossL3 = 5.5 // in %

ONCE stoppLossL4 = 4 // in %

ONCE stoppLossS1 = 2 // in %

ONCE stoppLossS2 = 3 // in %

ONCE stoppLossS3 = 3 // in %

ONCE takeProfitL1 = 3.5 // in %

ONCE takeProfitL2 = 3 // in %

ONCE takeProfitL3 = 4 // in %

ONCE takeProfitL4 = 4 // in %

ONCE takeProfitS1 = 2 // in %

ONCE takeProfitS2 = 2 // in %

ONCE takeProfitS3 = 3 // in %

ONCE maxCandlesLongWithProfit = 18 // take long profit latest after 18 candles

ONCE maxCandlesShortWithProfit = 13 // take short profit latest after 13 candles

ONCE maxCandlesLongWithoutProfit = 30 // limit long loss latest after 30 candles

ONCE maxCandlesShortWithoutProfit = 25 // limit short loss latest after 25 candles

ONCE startShortPattern = 4 // April

ONCE endShortPattern = 9 // September

ONCE longPositionMultiplier = 1 // multiplier for long position size in case of higher saisonal probability

ONCE shortPositionMultiplier = 1 // multiplier for short position size in case of higher saisonal probability

// calculate daily high/low

dailyHigh = DHigh(1)

dailyLow = DLow(1)

// calculate weekly high/low

If DayOfWeek < DayOfWeek[1] then

weeklyHigh = Highest[BarIndex - lastWeekBarIndex](dailyHigh)

lastWeekBarIndex = BarIndex

ENDIF

// calculate monthly high/low

If Month <> Month[1] then

monthlyHigh = Highest[BarIndex - lastMonthBarIndex](dailyHigh)

monthlyLow = Lowest[BarIndex - lastMonthBarIndex](dailyLow)

lastMonthBarIndex = BarIndex

ENDIF

// calculate signalline with multiple smoothed averages

firstMA = WilderAverage[periodFirstMA](close)

secondMA = TimeSeriesAverage[periodSecondMA](firstMA)

signalline = TimeSeriesAverage[periodThirdMA](secondMA)

// trade only in trading window 8-22

IF Time >= startTime AND Time <= endTime THEN

// filter criteria because not every breakout is profitable

c1 = close > Average[periodLongMA](close)

c2 = close < Average[periodLongMA](close)

c3 = close > Average[periodShortMA](close)

c4 = close < Average[periodShortMA](close)

// saisonal pattern

saisonalShortPattern = CurrentMonth >= startShortPattern AND CurrentMonth <= endShortPattern

// long position conditions

l1 = signalline CROSSES OVER monthlyHigh

l2 = signalline CROSSES OVER weeklyHigh

l3 = signalline CROSSES OVER dailyHigh

l4 = signalline CROSSES OVER monthlyLow

// short position conditions

s1 = signalline CROSSES UNDER monthlyHigh

s2 = signalline CROSSES UNDER monthlyLow

s3 = signalline CROSSES UNDER dailyLow

// long entry monthly (L1)

IF l1 THEN // cumulate orders for long trades

IF not saisonalShortPattern THEN

BUY PositionSize * longPositionMultiplier CONTRACT AT MARKET

SET STOP %LOSS stoppLossL1

SET TARGET %PROFIT takeProfitL1

ELSE

BUY PositionSize CONTRACT AT MARKET

SET STOP %LOSS stoppLossL1

SET TARGET %PROFIT takeProfitL1

ENDIF

ENDIF

// long entry weekly (L2)

IF l2 THEN // cumulate orders for long trades

IF not saisonalShortPattern THEN

BUY PositionSize * longPositionMultiplier CONTRACT AT MARKET

SET STOP %LOSS stoppLossL2

SET TARGET %PROFIT takeProfitL2

ELSE

BUY PositionSize CONTRACT AT MARKET

SET STOP %LOSS stoppLossL2

SET TARGET %PROFIT takeProfitL2

ENDIF

ENDIF

// long entry dayly (L3)

IF l3 AND c2 THEN // cumulate orders for long trades

IF not saisonalShortPattern THEN

BUY PositionSize * longPositionMultiplier CONTRACT AT MARKET

SET STOP %LOSS stoppLossL3

SET TARGET %PROFIT takeProfitL3

ELSE

BUY PositionSize CONTRACT AT MARKET

SET STOP %LOSS stoppLossL3

SET TARGET %PROFIT takeProfitL3

ENDIF

ENDIF

// long entry monthly low (L4)

IF l4 THEN // cumulate orders for long trades

IF not saisonalShortPattern THEN

BUY PositionSize * longPositionMultiplier CONTRACT AT MARKET

SET STOP %LOSS stoppLossL4

SET TARGET %PROFIT takeProfitL4

ELSE

BUY PositionSize CONTRACT AT MARKET

SET STOP %LOSS stoppLossL4

SET TARGET %PROFIT takeProfitL4

ENDIF

ENDIF

// short entry (S1)

IF NOT SHORTONMARKET AND s1 AND c3 THEN // no cumulation for short trades

IF saisonalShortPattern THEN

SELLSHORT positionSize * shortPositionMultiplier CONTRACT AT MARKET

SET STOP %LOSS stoppLossS1

SET TARGET %PROFIT takeProfitS1

ELSE

SELLSHORT positionSize CONTRACT AT MARKET

SET STOP %LOSS stoppLossS1

SET TARGET %PROFIT takeProfitS1

ENDIF

ENDIF

// short entry (S2)

IF NOT SHORTONMARKET AND s2 AND c4 THEN // no cumulation for short trades

IF saisonalShortPattern THEN

SELLSHORT positionSize * shortPositionMultiplier CONTRACT AT MARKET

SET STOP %LOSS stoppLossS2

SET TARGET %PROFIT takeProfitS2

ELSE

SELLSHORT positionSize CONTRACT AT MARKET

SET STOP %LOSS stoppLossS2

SET TARGET %PROFIT takeProfitS2

ENDIF

ENDIF

// short entry (S3)

IF NOT SHORTONMARKET AND s3 AND c1 THEN // no cumulation for short trades

IF saisonalShortPattern THEN

SELLSHORT positionSize * shortPositionMultiplier CONTRACT AT MARKET

SET STOP %LOSS stoppLossS3

SET TARGET %PROFIT takeProfitS3

ELSE

SELLSHORT positionSize CONTRACT AT MARKET

SET STOP %LOSS stoppLossS3

SET TARGET %PROFIT takeProfitS3

ENDIF

ENDIF

// stop and profit management

posProfit = (((close - positionprice) * pointvalue) * countofposition) / pipsize

m1 = posProfit > 0 AND (BarIndex - TradeIndex) >= maxCandlesLongWithProfit

m2 = posProfit > 0 AND (BarIndex - TradeIndex) >= maxCandlesShortWithProfit

m3 = posProfit < 0 AND (BarIndex - TradeIndex) >= maxCandlesLongWithoutProfit

m4 = posProfit < 0 AND (BarIndex - TradeIndex) >= maxCandlesShortWithoutProfit

IF LONGONMARKET AND (m1 OR m3) THEN

SELL AT MARKET

ENDIF

IF SHORTONMARKET AND (m2 OR m4) THEN

EXITSHORT AT MARKET

ENDIF

ENDIF

Flo, Danke für deinen Beitrag. Die Idee ist nicht schlecht, ich hatte etwas ähnliches getestet. Die Ergebnisse waren aber nicht so viel besser, dass sich die zusätzliche Komplexität rechtfertig.

sorry, war nicht das aktuellste

// Pathfinder DAX 4H, 9-22, 2 points spread

// DAX breakout system triggered by previous daily, weekly and monthly high/low crossings

// Version 3 with smart position sizing

// ProOrder code parameter

DEFPARAM CUMULATEORDERS = true // cumulate orders if not turned off

DEFPARAM PRELOADBARS = 10000

// trading window 8-22

ONCE startTime = 80000

ONCE endTime = 220000

// smoothed average parameter (signalline)

ONCE periodFirstMA = 5

ONCE periodSecondMA = 10

ONCE periodThirdMA = 3

// filter parameter

ONCE periodLongMA = 250

ONCE periodShortMA = 50

// trading paramter

// smart position sizing

ONCE PositionSize = 1

// money and position management parameter

ONCE stoppLossL1 = 3.25 // in %

ONCE stoppLossL2 = 4.75 // in %

ONCE stoppLossL3 = 5.5 // in %

ONCE stoppLossL4 = 4 // in %

ONCE stoppLossS1 = 2 // in %

ONCE stoppLossS2 = 3 // in %

ONCE stoppLossS3 = 3 // in %

ONCE takeProfitL1 = 3.5 // in %

ONCE takeProfitL2 = 3 // in %

ONCE takeProfitL3 = 4 // in %

ONCE takeProfitL4 = 4 // in %

ONCE takeProfitS1 = 3.5 // in %

ONCE takeProfitS2 = 1.15 // in %

ONCE takeProfitS3 = 1.75 // in %

ONCE maxCandlesLongWithProfit = 20 // take long profit latest after 18 candles

ONCE maxCandlesShortWithProfit = 13 // take short profit latest after 13 candles

ONCE maxCandlesLongWithoutProfit = 30 // limit long loss latest after 30 candles

ONCE maxCandlesShortWithoutProfit = 25 // limit short loss latest after 25 candles

ONCE startShortPattern = 4 // April

ONCE endShortPattern = 9 // September

ONCE longPositionMultiplier = 1 // multiplier for long position size in case of higher saisonal probability

ONCE shortPositionMultiplier = 1 // multiplier for short position size in case of higher saisonal probability

// calculate daily high/low

dailyHigh = DHigh(1)

dailyLow = DLow(1)

// calculate weekly high/low

If DayOfWeek < DayOfWeek[1] then

weeklyHigh = Highest[BarIndex - lastWeekBarIndex](dailyHigh)

lastWeekBarIndex = BarIndex

ENDIF

// calculate monthly high/low

If Month <> Month[1] then

monthlyHigh = Highest[BarIndex - lastMonthBarIndex](dailyHigh)

monthlyLow = Lowest[BarIndex - lastMonthBarIndex](dailyLow)

lastMonthBarIndex = BarIndex

ENDIF

// calculate signalline with multiple smoothed averages

firstMA = WilderAverage[periodFirstMA](close)

secondMA = TimeSeriesAverage[periodSecondMA](firstMA)

signalline = TimeSeriesAverage[periodThirdMA](secondMA)

// trade only in trading window 8-22

IF Time >= startTime AND Time <= endTime THEN

// filter criteria because not every breakout is profitable

c1 = close > Average[periodLongMA](close)

c2 = close < Average[periodLongMA](close)

c3 = close > Average[periodShortMA](close)

c4 = close < Average[periodShortMA](close)

// saisonal pattern

saisonalShortPattern = CurrentMonth >= startShortPattern AND CurrentMonth <= endShortPattern

// long position conditions

l1 = signalline CROSSES OVER monthlyHigh

l2 = signalline CROSSES OVER weeklyHigh

l3 = signalline CROSSES OVER dailyHigh

l4 = signalline CROSSES OVER monthlyLow

// short position conditions

s1 = signalline CROSSES UNDER monthlyHigh

s2 = signalline CROSSES UNDER monthlyLow

s3 = signalline CROSSES UNDER dailyLow

// long entry monthly (L1)

IF l1 THEN // cumulate orders for long trades

IF not saisonalShortPattern THEN

BUY PositionSize * longPositionMultiplier CONTRACT AT MARKET

SET STOP %LOSS stoppLossL1

SET TARGET %PROFIT takeProfitL1

ELSE

BUY PositionSize CONTRACT AT MARKET

SET STOP %LOSS stoppLossL1

SET TARGET %PROFIT takeProfitL1

ENDIF

ENDIF

// long entry weekly (L2)

IF l2 THEN // cumulate orders for long trades

IF not saisonalShortPattern THEN

BUY PositionSize * longPositionMultiplier CONTRACT AT MARKET

SET STOP %LOSS stoppLossL2

SET TARGET %PROFIT takeProfitL2

ELSE

BUY PositionSize CONTRACT AT MARKET

SET STOP %LOSS stoppLossL2

SET TARGET %PROFIT takeProfitL2

ENDIF

ENDIF

// long entry dayly (L3)

IF l3 AND c2 THEN // cumulate orders for long trades

IF not saisonalShortPattern THEN

BUY PositionSize * longPositionMultiplier CONTRACT AT MARKET

SET STOP %LOSS stoppLossL3

SET TARGET %PROFIT takeProfitL3

ELSE

BUY PositionSize CONTRACT AT MARKET

SET STOP %LOSS stoppLossL3

SET TARGET %PROFIT takeProfitL3

ENDIF

ENDIF

// long entry monthly low (L4)

IF l4 THEN // cumulate orders for long trades

IF not saisonalShortPattern THEN

BUY PositionSize * longPositionMultiplier CONTRACT AT MARKET

SET STOP %LOSS stoppLossL4

SET TARGET %PROFIT takeProfitL4

ELSE

BUY PositionSize CONTRACT AT MARKET

SET STOP %LOSS stoppLossL4

SET TARGET %PROFIT takeProfitL4

ENDIF

ENDIF

// short entry (S1)

IF NOT SHORTONMARKET AND s1 AND c3 THEN // no cumulation for short trades

IF saisonalShortPattern THEN

SELLSHORT positionSize * shortPositionMultiplier CONTRACT AT MARKET

SET STOP %LOSS stoppLossS1

SET TARGET %PROFIT takeProfitS1

ELSE

SELLSHORT positionSize CONTRACT AT MARKET

SET STOP %LOSS stoppLossS1

SET TARGET %PROFIT takeProfitS1

ENDIF

ENDIF

// short entry (S2)

IF NOT SHORTONMARKET AND s2 AND c4 THEN // no cumulation for short trades

IF saisonalShortPattern THEN

SELLSHORT positionSize * shortPositionMultiplier CONTRACT AT MARKET

SET STOP %LOSS stoppLossS2

SET TARGET %PROFIT takeProfitS2

ELSE

SELLSHORT positionSize CONTRACT AT MARKET

SET STOP %LOSS stoppLossS2

SET TARGET %PROFIT takeProfitS2

ENDIF

ENDIF

// short entry (S3)

IF NOT SHORTONMARKET AND s3 AND c1 THEN // no cumulation for short trades

IF saisonalShortPattern THEN

SELLSHORT positionSize * shortPositionMultiplier CONTRACT AT MARKET

SET STOP %LOSS stoppLossS3

SET TARGET %PROFIT takeProfitS3

ELSE

SELLSHORT positionSize CONTRACT AT MARKET

SET STOP %LOSS stoppLossS3

SET TARGET %PROFIT takeProfitS3

ENDIF

ENDIF

// stop and profit management

posProfit = (((close - positionprice) * pointvalue) * countofposition) / pipsize

m1 = posProfit > 0 AND (BarIndex - TradeIndex) >= maxCandlesLongWithProfit

m2 = posProfit > 0 AND (BarIndex - TradeIndex) >= maxCandlesShortWithProfit

m3 = posProfit < 0 AND (BarIndex - TradeIndex) >= maxCandlesLongWithoutProfit

m4 = posProfit < 0 AND (BarIndex - TradeIndex) >= maxCandlesShortWithoutProfit

IF LONGONMARKET AND (m1 OR m3) THEN

SELL AT MARKET

ENDIF

IF SHORTONMARKET AND (m2 OR m4) THEN

EXITSHORT AT MARKET

ENDIF

ENDIF

Reiner , das bedeutet 10.000 Kerzen (4h Bar) , dann muss ja eine Ewigkeit warten ehe das System startet ?

das System startet immer ab dem Moment, ab dem du es aktivierst. preloadbars steuert die Anzahl Kerzen die ab dem aktuellen Zeitpunkt historisch!!! geladen werden sollen um deine Algo Parameter zu berechnen – das sind bei dem dem aktuellen Setup mindestens 250 Kerzen. preloadbars hat je nach PRT Instanz einen Standardwert, der liegt für die deutsche Instanz m.E. bei 2000 Kerzen. Pathfinder wird also mit dem Defaultwert funktionieren wenn du preloadbars weglässt. Da es aber immer wieder Probleme mit anderen Länderinstanzen und ProOrder gibt habe ich bewusst einen hohen Wert ghewählt.

hi firstly say thanks to the creator, im just new into prorealtime and I’m really enjoying it, its a great platform.

Im checking your automated system and I realised 2 hour bars is the best for backtest, are you testint it on real account or anyone is doing it, or real time? cuz i cant really imagine that working like this in real, but it’ll be great.

If you check backtest you can se that the first month of the year are the worst of the backtest.

Hi pep17,

Thanks for your comment and welcome. Pathfinder was created original for H4. The shown backtest is of course an optimized view to historic data. The results are promising but Pathfinder must prove that it works in real mode. I’m trading V2 since mid of July and I can confirm that the results are like the backtest. I’m now switched to V3.

reagrds

Reiner

Hello Reiner,

thank you for sharing your strategy, it seems to be awesome, and I would like to test it in real environment. I will do with Mini DAX 1Eur (CFDs), and spread is differente at IG Spain than yours I think, 1 point from 9 to 17:30 and 2 from 8 to 9 and from 17:30 to 22:00. I supose that this is not a problem for the calculations, isn’t it?

And about the automatic trading preferences, is there something to consider? For example, maximun number of orders per day that could be launched? maximun position size? Close for maximun X orders in queue?

Thank you again,

Regards,

Fran

Hi Fran,

Thanks for your comment and welcome. The spreads you mentioned in your post are the same condition like here in Germany. The backtest was calculated with 2 point spread from 8-22. Please consider that Pathfinder works with cumulative and variable order sizes when you start Pathfinder and ProOrder is asking after the max position size set a higher value then 1 also if you have set positionSize to 1 in Pathfinder’s code. When you don’t like this behavior you can omit order cumulation and the seasonal pattern booster when you change the following parameters:

DEFPARAM CUMULATEORDERS = false

ONCE longPositionMultiplier = 1

ONCE shortPositionMultiplier = 1

With these changes Pathfinder is trading only with fixed position size of 1 contract.

Max Orders per day depends on your number of running trading systems. Pathfinder usually trades not very often intraday.

regards

Reiner

The system has just open a long at 10.719 at 13:00h

thank you for your comments Rainer. Is it normal the behavior about this early begining? I have uploaded the strategy at prorealtime at 12:35 h and 25 minutes later it has just beging to open a position.

the system is aktiv immediately after start, Pathfinder in H4 checks every start of 9:00, 13:00, 17:00 and 21:00 candle the trading conditions

Great bit of code this. I can see you have put a lot of thought in to it. Doesn’t seem to work before 2009 for some reason. I used an IN/OUT sample from Jan 2009 until May 2014, optimising the stoploss, takeprofitlong, takeprofit short. I used 0.5 – 5 with 0.25 increments. This still works well going forward to today’s date so seems to stand up 🙂 I’m considering running stopploss 3, takeprofitlong 5, takeprofitshort 3.5. I think the next IN/OUT sample test should be the candle lengths perhaps?

@Nicolas Can’t seem to attach my opp excel spreadsheet?

Hi Cosmic,

Thanks for your comment. Regarding performance before 2009 Doctrading made the remark that on ProRealTime CFD, the DAX had no quote / price before August 2010.

regards

Reiner

Hey Reiner,

there are 4h candles since March 2006. But before August 2010 there are no prices for the time between 22:00 and 08:00. If you need the list of orders for the complete periode, just let me know and I will send you the excel file.

Is it possible to open a trade as soon as I start the system, even though there is no new position? Because I would like to wait for a trade to be negative and then start the system. So if the worst drawdown is e.g. 1.500€, I would wait for a 500€ drawdown and then start the system with a capital of 2.000, to be save.

Thanks

Flo

Flo, thanks for your offer but for me the current backtest results are sufficient. As I understand you right you want to wait for a first virtual looser before you start real trading. I think that is possible to realize but in my opinion not a good approach. With 80% profitable trades you will miss a lot of good possibilities before you start trading. Pathfinders drawdown is around 15-17% and I recommend a trading budget of at least 5.000 Euro.

I have tested Pathfinder with other popular indices. Due every index has it’s own “heartbeat” minor adjustments were necessary. Here are the results for FTSE, EU Stocks 50 and CAC. Please be aware that this is an optimized view to historic data. Please find more details in Pathfinder Inside.

https://www.evernote.com/shard/s80/sh/3c8432cd-63f5-4301-a3cb-9a9dd5c8713b/743defcc06fa10ab3a514b9e34fbf76a

Here is the code for the FTSE:

// Pathfinder FTSE 4H, 9-22, 2 points spread

// FTSE breakout system triggered by previous daily, weekly and monthly high/low crossings

// Version 3

// ProOrder code parameter

DEFPARAM CUMULATEORDERS = true // cumulate orders if not turned off

DEFPARAM PRELOADBARS = 10000

// trading window 9-22

ONCE startTime = 90000

ONCE endTime = 220000

// smoothed average parameter (signalline)

ONCE periodFirstMA = 5

ONCE periodSecondMA = 10

ONCE periodThirdMA = 7

// filter parameter

ONCE periodLongMA = 200

ONCE periodShortMA = 40

// trading paramter

ONCE PositionSize = 1

// money and position management parameter

ONCE stoppLoss = 5 // in %

ONCE takeProfitLong = 3 // in %

ONCE takeProfitShort = 2.25 // in %

ONCE maxCandlesLongWithProfit = 25 // take long profit latest after 25 candles

ONCE maxCandlesShortWithProfit = 13 // take short profit latest after 13 candles

ONCE maxCandlesLongWithoutProfit = 40 // limit long loss latest after 30 candles

ONCE maxCandlesShortWithoutProfit = 25 // limit short loss latest after 25 candles

ONCE startShortPattern = 8 // August

ONCE endShortPattern = 9 // September

ONCE longPositionMultiplier = 2 // multiplier for long position size in case of higher saisonal probability

ONCE shortPositionMultiplier = 2 // multiplier for short position size in case of higher saisonal probability

// calculate daily high/low

dailyHigh = DHigh(1)

dailyLow = DLow(1)

// calculate weekly high/low

If DayOfWeek < DayOfWeek[1] then

weeklyHigh = Highest[BarIndex - lastWeekBarIndex](dailyHigh)

lastWeekBarIndex = BarIndex

ENDIF

// calculate monthly high/low

If Month <> Month[1] then

monthlyHigh = Highest[BarIndex - lastMonthBarIndex](dailyHigh)

monthlyLow = Lowest[BarIndex - lastMonthBarIndex](dailyLow)

lastMonthBarIndex = BarIndex

ENDIF

// calculate signalline with multiple smoothed averages

firstMA = WilderAverage[periodFirstMA](close)

secondMA = TimeSeriesAverage[periodSecondMA](firstMA)

signalline = TimeSeriesAverage[periodThirdMA](secondMA)

// trade only in trading window 9-22

IF Time >= startTime AND Time <= endTime THEN

// filter criteria because not every breakout is profitable

c1 = close > Average[periodLongMA](close)

c2 = close < Average[periodLongMA](close)

c3 = close > Average[periodShortMA](close)

// saisonal pattern

saisonalShortPattern = CurrentMonth >= startShortPattern AND CurrentMonth <= endShortPattern