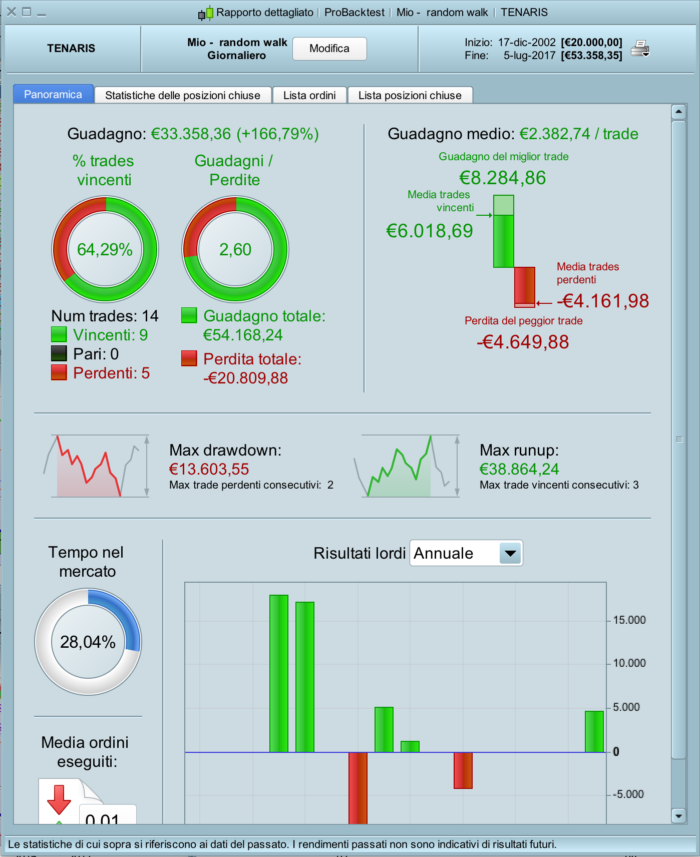

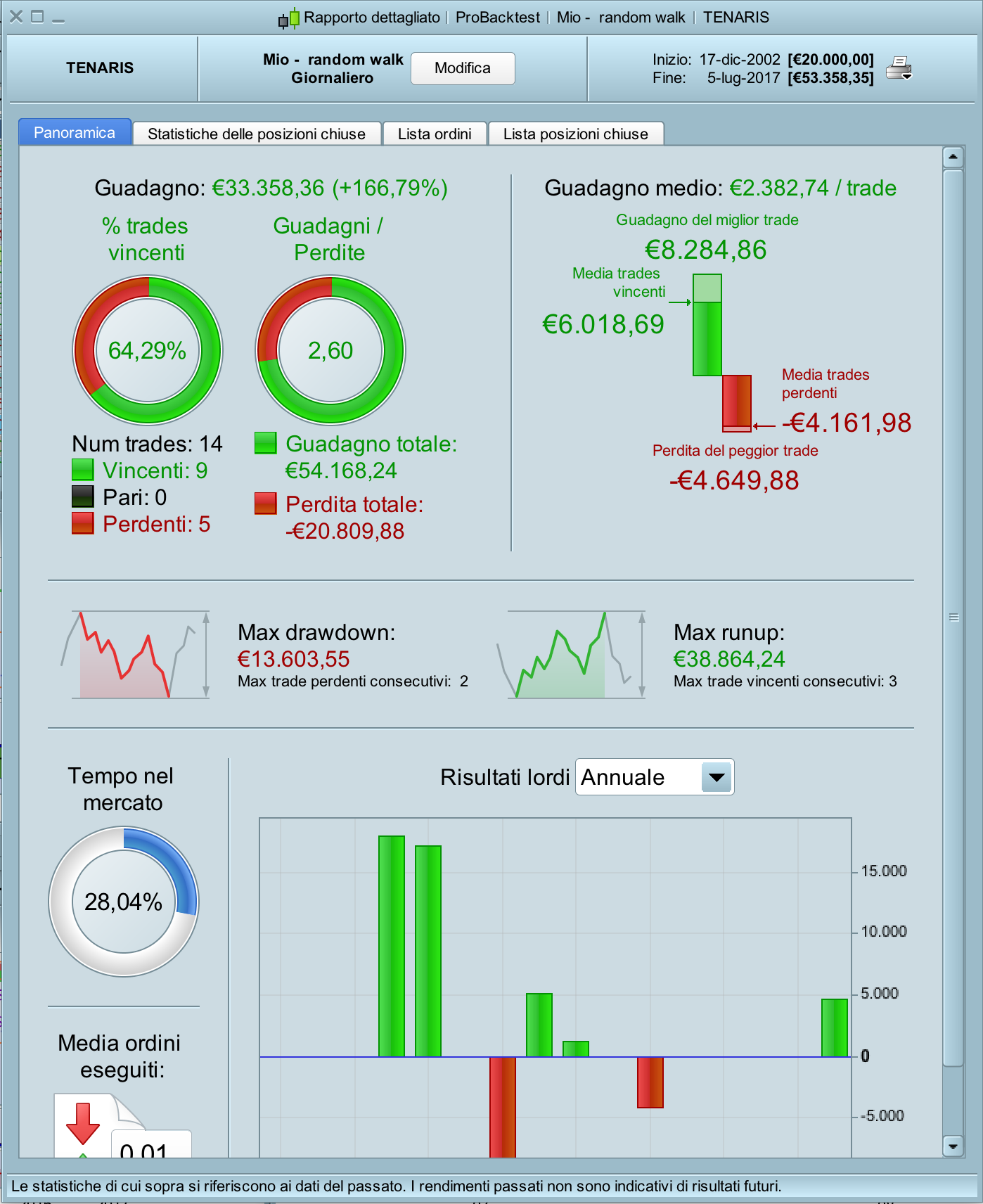

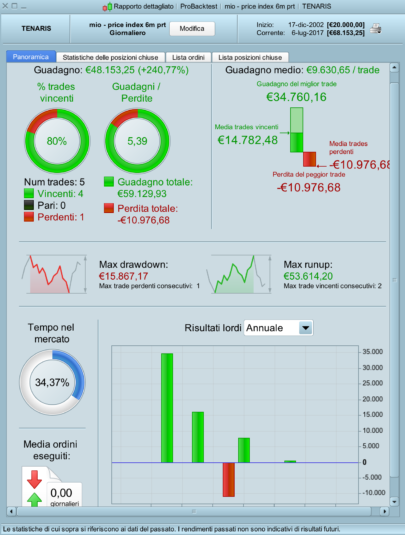

This is a variation of the “Price Index 6 months strategy” and it’s LONG only. The selected stock has to be a good performer in terms of Price Index value. While in the former strategy the exit was made ALWAYS after a hold period of one year, in this strategy we sell in one of the following cases:

1. Gain = 40% (or whatever value chosen)

2. Loss = 20% (or half the target gain)

3. after 6 months holding time without exiting as per points 1 or 2 (you can also use 3 months max hold time)

I’ve been using this strategy real-money with portfolios of stocks from different countries for about 5 years and a half now with a annualized return of the portfolio of about 26% (I uses a portfolio with 30 to 50 stocks).

If you select the top stocks in terms of the relative strength in their sector the annualised return is approximately 35%.

Blue skies!

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 |

// Definizione dei parametri del codice DEFPARAM CumulateOrders = False // Posizioni cumulate disattivate p=130 out=40 // Condizioni per entrare su posizioni longs c1 = (100*(close - close[p])/close[p])>44 IF c1 and not longonmarket THEN BUY 20000 cash AT MARKET ENDIF barontrade=barindex-tradeindex // exit long position IF barontrade=130 THEN SELL AT MARKET ENDIF set target %profit out set stop %loss out/2 |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hello, I downloaded your strategy and I can not get it to have signals.

I work with the free PRT version, so I only have daily data.

Is it possible that I need to change the ranges of the indicators?

Hi, I am not sure the reason you have this problem. I am not familiar with the free version of PRT

ciao gabri scusa una domanda mi ptresti spiegare il codice perfavore??