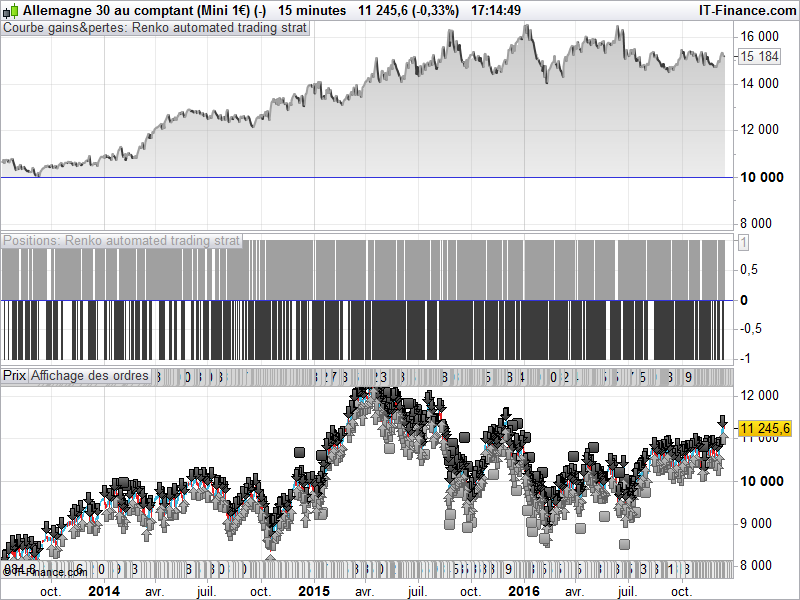

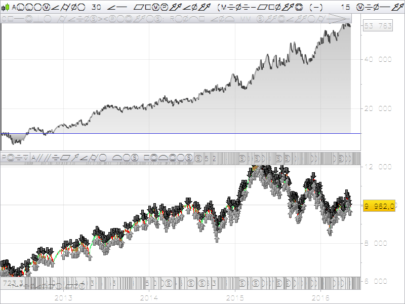

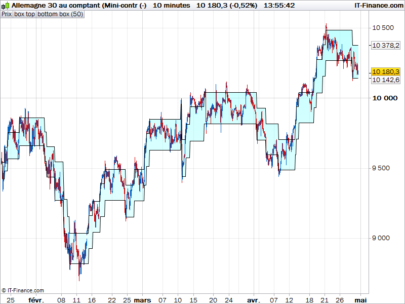

Renko trading system (very general, applicable e.g. for DAX 15 min chart) goes long when at least 2 upbricks appear after a downtrend of 2 bricks or more goes short when 2 downbricks appear after an uptrend of 2 bricks or more.

“bricksize” is the length of a Renko brick in points and be modified (line 3).

“BIfirst” is the first bar in the chart that defines the position of all other Renko bricks. Can be left out, but can makes a big difference.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 |

defparam cumulateorders = false bricksize = 22 BIfirst = 1 n = 1 If barindex >= BIfirst then ONCE upbrick = close ONCE downbrick = close - bricksize buysignal = 0 shortsignal = 0 IF close >= upbrick + bricksize THEN newbricksup = (round(((close - upbrick) / bricksize) - 0.5)) diffup = newbricksup * bricksize downbrick = downbrick + diffup upbrick = upbrick + diffup totalbricksup = totalbricksup + newbricksup totalbricksdown = 0 If (totalbricksup[1] = 0 OR totalbricksup[1] = 1) AND totalbricksup >= 2 then buysignal = 1 endif ELSIF close <= downbrick - bricksize THEN newbricksdown = (round(((downbrick - close) / bricksize) - 0.5)) diffdown = newbricksdown * bricksize upbrick = upbrick - diffdown downbrick = downbrick - diffdown totalbricksdown = totalbricksdown + newbricksdown totalbricksup = 0 If (totalbricksdown[1] = 0 OR totalbricksdown[1] = 1) AND totalbricksdown >= 2 then shortsignal = 1 endif ENDIF endif If buysignal = 1 then buy n contracts at market endif If shortsignal = 1 then sellshort n contracts at market endif set stop ploss 120 |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Looks great.

Have you tested it in demo?

Looks good, but perhaps is not. Try to vary the box size first and look at the variation of the results. Of course, everything will depend on a suitable box size. But is there such a thing ?

(Sorry, I tried to upload an optimization report as .jpg, but it always says : http upload error. Don’t know why.)

Then, take a good box size and vary the first bar of the chart that defines the position of the first Renko box and therefore of all other Renko boxes for the whole chart for all times. You will see that the result depends enormously on the exact position of the first Renko box ! Renko trading alone is therefore a lot of chance, and not reliable, in my opinion. May be it can be combined with other indicators and entry/exit conditions, but I have not tried.

I was just interested whether trading with Renko charts is really as great as the charts superficially look like, and apparently it is not.

Can anyone please tell me, why a cannot upload any attachments ? Most of the time, I get an error message (http error).

I’m sorry, upload of attachments is actually not possible in the comments.

hi Verdi, nice try…I’ve developed a similar strategy but got poor profit factor…what’s yours?

The profit factor depends very much on the brick size AND on the position of the first bar of the chart, in which the position of all following bricks is fixed. Therefore, the profit factor can be very different. In the example shown above (DAX 15 min chart, start on 1/1/2014, 24 h timescale), for a brick size of 18, the profit factor is 1.40 (total 12.517 DAX points), for a brick size of 22 the profit factor is 1.25 (total result 7.706 DAX points). The first brick is located in the first bar of 2014, when you put it elsewhere, you will get different results.

Profit

Profit in %

Number of Positions

Winning Trades in %

Profit / Position

brick size

12.610,2000

+12,61%

916

+40,94%

13,7666

17

12.517,3000

+12,52%

830

+41,98%

15,0811

18

12.114,2000

+12,11%

1072

+39,96%

11,3006

15

12.107,0000

+12,11%

990

+41,01%

12,2293

16

11.419,5000

+11,42%

714

+41,80%

15,9937

21

9.785,1000

+9,79%

1321

+38,03%

7,4073

13

9.614,9000

+9,61%

752

+41,94%

12,7858

20

9.497,1000

+9,50%

812

+41,43%

11,6959

19

8.062,8000

+8,06%

1204

+38,94%

6,6967

14

7.822,2000

+7,82%

574

+41,46%

13,6275

25

7.706,9000

+7,71%

692

+41,47%

11,1371

22

7.277,7000

+7,28%

1479

+37,44%

4,9207

12

7.030,8000

+7,03%

648

+42,44%

10,8500

23

6.948,4000

+6,95%

433

+39,49%

16,0471

31

6.694,8000

+6,69%

1655

+36,86%

4,0452

11

6.596,8000

+6,60%

515

+40,19%

12,8093

28

6.469,1000

+6,47%

632

+42,09%

10,2359

24

6.415,5000

+6,42%

329

+38,30%

19,5000

38

5.870,0000

+5,87%

529

+40,83%

11,0964

27

5.414,0000

+5,41%

567

+41,98%

9,5485

26

5.341,1000

+5,34%

463

+38,44%

11,5359

30

5.255,5000

+5,26%

344

+36,05%

15,2776

37

4.884,6000

+4,88%

1865

+36,86%

2,6191

10

4.624,6000

+4,62%

300

+36,67%

15,4153

42

4.571,7000

+4,57%

491

+40,12%

9,3110

29

4.486,2000

+4,49%

390

+37,95%

11,5031

35

4.318,8000

+4,32%

432

+37,50%

9,9972

32

4.243,9000

+4,24%

331

+36,86%

12,8215

39

4.096,8000

+4,10%

2775

+36,16%

1,4763

7

3.812,0000

+3,81%

2409

+36,14%

1,5824

8

3.727,8000

+3,73%

406

+38,18%

9,1818

34

3.568,2000

+3,57%

374

+36,90%

9,5406

36

3.506,5000

+3,51%

289

+33,91%

12,1332

43

3.473,1000

+3,47%

2101

+37,10%

1,6531

9

3.376,8000

+3,38%

326

+37,12%

10,3583

40

2.798,3000

+2,80%

431

+37,59%

6,4926

33

2.756,0000

+2,76%

287

+34,15%

9,6028

44

2.304,9000

+2,30%

318

+34,91%

7,2481

41

1.095,5000

+1,10%

273

+31,87%

4,0128

46

960,2000

+0,96%

3301

+35,20%

0,2909

6

835,6000

+0,84%

255

+32,68%

3,2769

49

624,2000

+0,62%

3970

+35,05%

0,1572

5

296,5000

+0,30%

255

+31,50%

1,1627

50

15,9000

+0,02%

263

+33,21%

0,0605

48

-36,3000

-0,04%

276

+30,55%

-0,1315

47

-1.807,2000

-1,81%

4810

+35,43%

-0,3757

4

-2.289,9000

-2,29%

297

+31,65%

-7,7101

45

-3.860,4000

-3,86%

7888

+33,62%

-0,4894

2

-5.570,2000

-5,57%

6088

+34,00%

-0,9149

3

-7.223,4000

-7,22%

10776

+32,67%

-0,6703

1

Hi to all, please try to test on 1 febrary to 15 febrary 2016…..

Hi, I tested this strategy on Spot Gold with a brick size of 20 on the weekly timeframe with ProTester and manually. (Reverse 5 lots after a swing of two bricks over 10 years) The problem is I got very different results. Based on the ProTester results I will not trade the strategy, but based on the results of the manually test I can’t wait.

Maybe I don’t understand the strategy because of my poor programming skills. What I am looking for is an automated strategy which reverse a trade of a specific lot size after two reversed bricks of an adjustable fixed size. The intention is to be always in the market with the strategy. Is this the right strategy for this?

Because the renko chart construction begin at the first price of the loaded history. So you obviously get different results if you have an history of just more or less 1 or 2 bars loaded.

I am learning to code. I try to understand these lines newbricksup = (round(((close – upbrick) / bricksize) – 0.5))

diffup = newbricksup * bricksize

downbrick = downbrick + diffup

upbrick = upbrick + diffup

totalbricksup = totalbricksup + newbricksup

totalbricksdown

Could you eventually explain? Could we introduce also a condition to be above ou under a moving average of 20? Thank a lot.