Hi all,

Here is a little strategy of my own. It will not give you millions of dollars, buy it is very simple (no indicators), and effective on much forex pairs and timeframes.

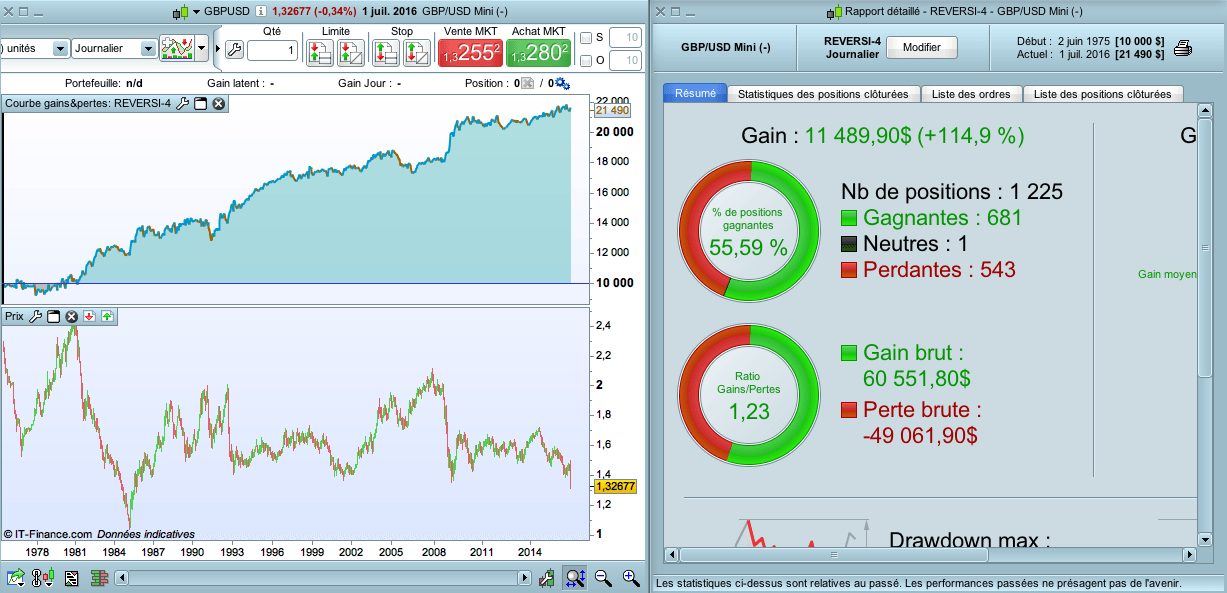

As we can see, performance can be done with simple things.

A picture worths a long description.

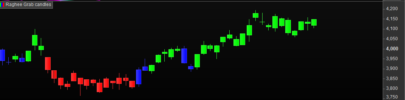

Here is a “Bullish Reversi” : 2 bearish candles, followed by 2 bearish candles

Here is a “Bearish Reversi” : 2 bullish candles, followed by 2 bullish candles

The trade rules are very simple :

“LONG” entry when we have a bullish Reversi

“SHORT” entry when we have a bearish Reversi

Stop loss : at the lowest / highest of the previous candle.

Take profit : equal to the stop loss.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 |

Defparam cumulateorders = false // REVERSI HAUSSIER ca1 = close > open and close[1] > open[1] and close[2] < open[2] and close[3] < open[3] IF ca1 THEN buy at market nextbaropen amplitude = close - low ENDIF // REVERSI BAISSIER cv1 = close < open and close[1] < open[1] and close[2] > open[2] and close[3] > open[3] IF cv1 THEN sellshort at market nextbaropen amplitude = high - close ENDIF // STOP LOSS & OBJECTIF set stop loss amplitude set target profit amplitude |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi @Doc,

If my calculations are correct, your example above, over 40 years, made 1.88% per year (CAGR%), or $280 per year on average.

Is that correct? Also, did you include trade costs/spread? How much?

Regards

Hello,

I didn’t make the calculation, it should be true.Best regards,

Adding spread, it only generates losses. The idea is good, I see use for this algo in combination with a price level reversal strategy. Unfortunately IG does give us volume in PRT to identify those price levels, even if we use l2 data there.

This code is the work of a simple genius! Profitability lies in simplicity and repetition.

Good joke. FYI, you’ll find many identified recurring patterns there: http://paststat.com

Genius inside 😉

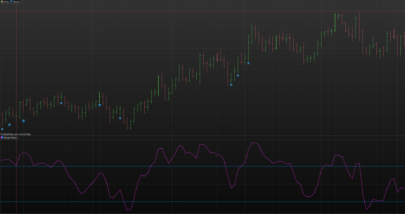

i added a MA as a filter, that improved the equity curve quit nice actually