Hi all,

Here is another strategy from Larry Connors, that I did coded for us.

It was designed for M30 timeframe, on various indices / forex / raw materials. But my tests show that is is most of time unprofitable.

I also find that some values are profitable with it, on higher timeframes.

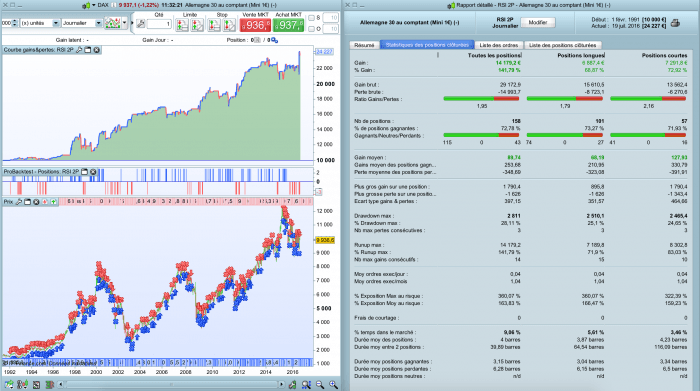

For example as show in the backtest picture (CFD Germany 30, 1€ per point, spread 1 point, daily timeframe).

RULES aver very simple :

BUY if :

- close > SMA200

- RSI2 < 5

CLOSE BUY if :

- close > SMA5

That’s all.

Opposite rules for SELL positions.

Larry Connors didn’t use stop loss ; but you can set one.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 |

// RSI 2P // de Larry Connors // www.doctrading.fr DEFPARAM CUMULATEORDERS = false n = 3 // mettre ce que vous voulez // INDICATEURS MM200 = average[200](close) MM5 = average[5](close) RSI2 = RSI[2](close) // ACHAT ca1 = close > MM200 ca2 = RSI2 < 5 IF ca1 and ca2 then BUY n shares at market ENDIF // SORTIE ACHAT IF close > MM5 THEN sell at market ENDIF // VENTE cv1 = close < MM200 cv2 = RSI2 > 95 IF cv1 and cv2 THEN SELLSHORT n shares at market ENDIF // SORTIE VENTE IF close < MM5 THEN exitshort at market ENDIF |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi,

Thanks for your works

Sadly, as always, without Walk Forward system, sadly it means nothing

As you said, it was generally unprofitable until you “optimize” somes variables

Personnaly, I stopped doing backtestsand even automatic trading with this actual poor system of PRT with all the defaults with speak before

Have a nice day

Zilliq

Hello Zilliq,

You don’t need a system to produce a walk forward test. You can easily create one with help from Excel. Just optimize the “in sample” period and test it on the “out of sample” period and copy the results into Excel were you have created a curve builder. Just as effective in the end as if a system would do for you. It takes some time though.

The reasons why I think it’s time consuming and we loose time to try to do backests and Automatic trading / robots with the actual version of PRT:

http://www.prorealcode.com/topic/liste-au-pere-noel-pour-la-v10-4/

I hope the 10.4 version will be much better than the actual

Bye

It is incredible! Thanks for sharing, Doctrading!