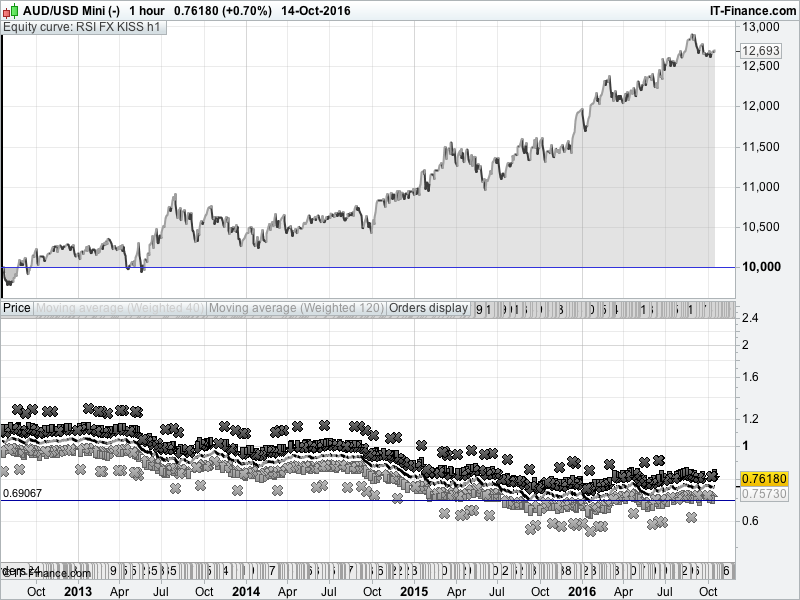

This is a an extremely simple system called: RSI FX KISS h1 (AUDUSD AUDSGD EURUSD)

instrument: FX

time-frame: h1

backtest period: August 2012 to November 2016 (Nicolas might backtest further and report results)

initial capital: 10,000

spread: 2

pairs that I have back-tested on with good results:

AUDUSD: Profit: 25% / 4 = 6.25% PA | Max DD $675 | 67% winning trades

AUDSGD: Profit: 30% / 4 = 7.5% PA| Max DD $677 | 70% winning trades (* > 2 spread will reduce profit and highly correlated with AUDUSD)

EURUSD: Profit: 26% / 4 = 6.5% PA | Max DD $1494 | 66% winning trades

Negatives:

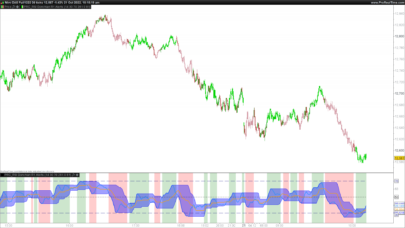

- shorts more profitable the longs (but this could be due to recent downtrends)

- there can be long periods of small losses or limited profit

Positives:

- no optimization

- low drawdown

- low consecutive losses

- reasonable profitable

HOW IT WORKS

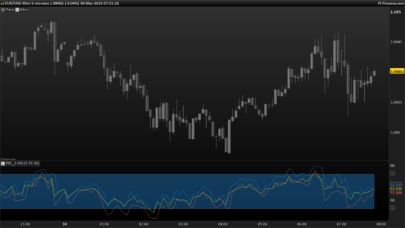

Buy 1 position if RSI[14] < 30 and exit if RSI[14] >= 60

Sell 1 position if RSI[14] > RSI 70 and exit if RSI[14] <= 40

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 |

// timeframe: h1 // instrument: FX // pairs: AUDUSD / AUDSGD / EURUSD / // // SUMMARY // Buy 1 position if RSI[14] < 30 and exit if RSI[14] >= 60 // Sell 1 position if RSI[14] > RSI 70 and exit if RSI[14] <= 40 // // Definition of code parameters DEFPARAM CumulateOrders = FALSE // Cumulating positions deactivated // Conditions to enter long positions theRSI = RSI[14](close) c1 = (theRSI < 30) IF c1 THEN BUY 1 CONTRACT AT MARKET ENDIF // Conditions to exit long positions c2 = (theRSI >= 60) IF c2 THEN SELL AT MARKET ENDIF // Conditions to enter short positions c3 = (theRSI > 70) IF c3 THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF // Conditions to exit short positions c4 = (theRSI <= 40) IF c4 THEN EXITSHORT AT MARKET ENDIF |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi David, thank you for the contribution. I have tested the strategy through 200.000 bars and results are not as good before your own test period I’m sorry. As you mentioned it, specific market behaviour may have cause the good results over the last months. Anyway, I think this simple KISS trading strategy (that worked for years) may have its placed in the Library and can be a good start for any other member willing to modify and adjust it for improvements on current and future data. In my own experience, this kind of strategy may have better result on shares, intraday forex trading is a battlefield and “simple rules” often don’t fit on them because of noises we all know on these instruments ..

Thanks Nicolas. I assumed that this would be the case when back tested further.

Awesome mate.

Hi David and Nicola, I’d like to share idea with you guys which is related to David’s Idea.

I was thinking to build a screener that show me stocks that become oversold/overbought twice in a row. I aim on creating a criteria where the stock has a strong condition of oversold/overbought giving me a more probable change to pick price reversal as bottom and top, rather than open position at the first RSI oversold/overbought signal.

Unfortunately, I don’t know coding this criteria “second time that is overbought or oversold” show this stock on the list. Nicolas, given what you said above about the different market’s behavior between stock market and Forex, I don’t know if this can be applicable to forex.

I hope I was clear and thank you in advance for you time and help.

Please ask for custom coding in forums instead.