Hi all !

We will check the well-known adage traded “Sell in May , Buy in October .”

So I decided to code the strategy and check on various indices.

You will be surprised at the results!

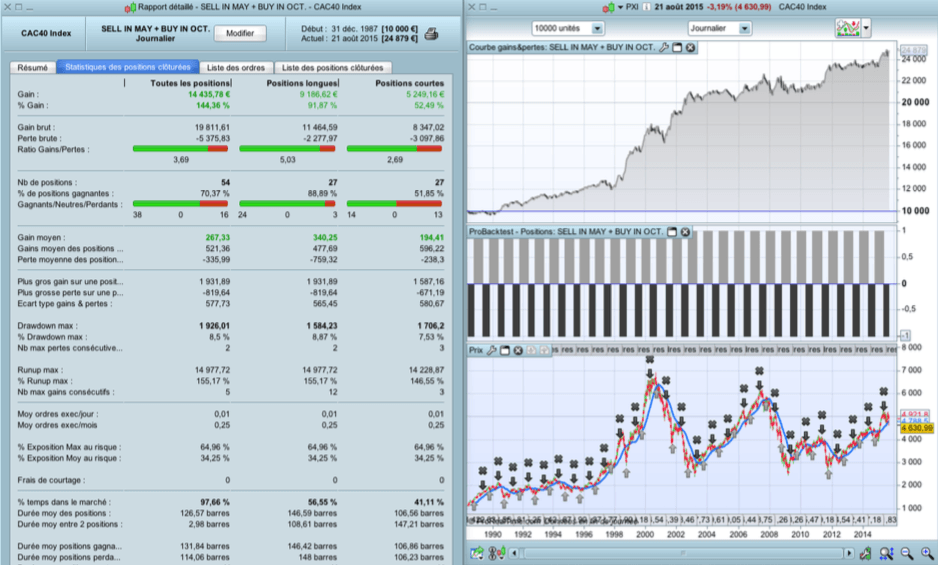

For example, the CAC40 : from 31/12/1987 to 21/08/2015 (my backtest data when I had realized the test) we have 70% winning trades, with higher earnings than average losses and a profit factor of 3.69.

And if you separate long and short positions, positions “long” only give 88.89 % success rate, with a profit factor of 5.03 !

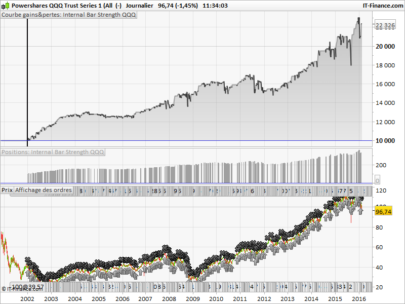

You can check the strategy is clearly winning over as many indexes : DAX30, FTSE, S&P500, NIKKEI, NASDAQ Composite, Dow Jones.

So I give you the code of the backtest (excerpt from one of my e-books), you can test and verify for yourself.

Best Regards,

Marc (from France)

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 |

DEFPARAM CumulateOrders = False IF currentmonth = 10 THEN BUY 1 shares at market ENDIF IF currentmonth = 5 THEN SELL at market ENDIF IF currentmonth = 5 THEN SELLSHORT 1 shares at market ENDIF IF currentmonth = 10 THEN EXITSHORT at market ENDIF |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials