Hello everyone,

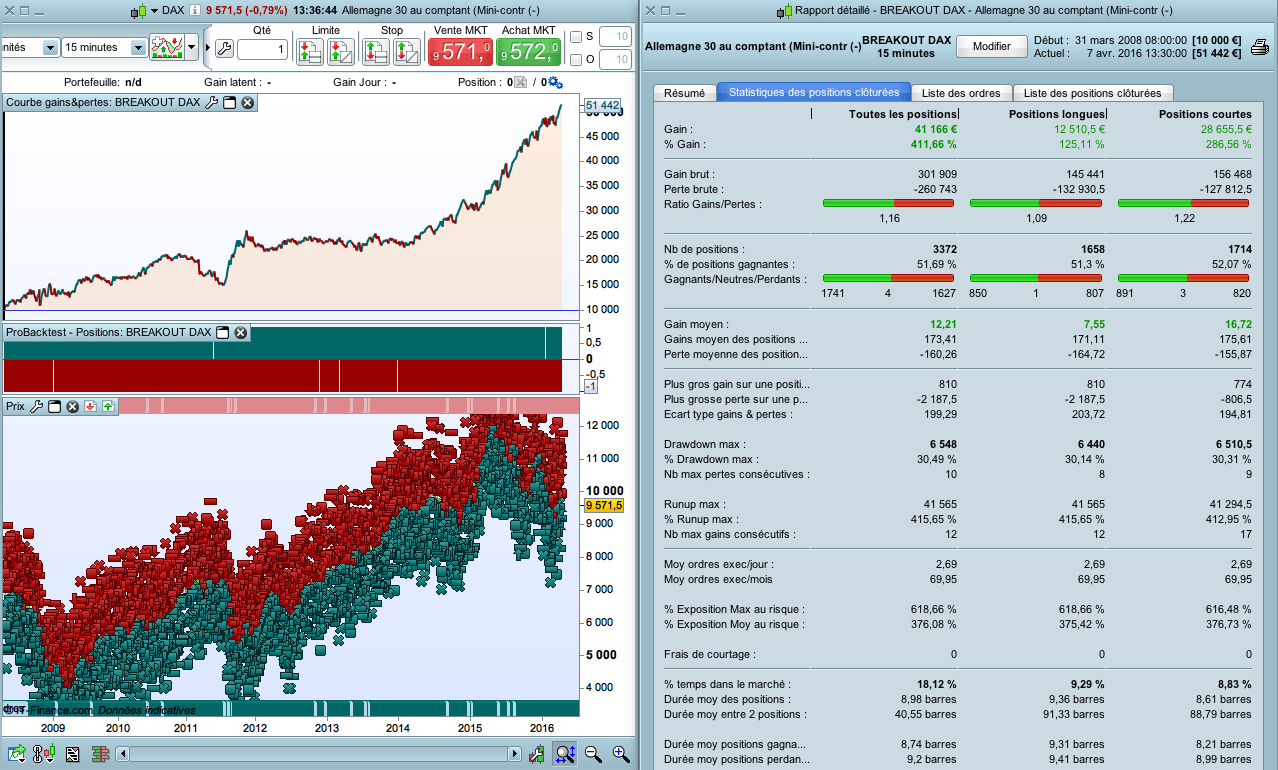

Here is a small breakout strategy.

Here, I tested with the following settings:

– Range (channel) defined between 09H at 9H30

– On the DAX, 15 minute timeframe

– We play the breakout of high / low of the range

– Stop Loss: the other side of the range

– Take Profit: equal to the stop loss

As you can see, the code is simple.

The backtest is positive, even if it is not optimal.

Indeed, the max drawdown of € 6,548 (for an initial bet of € 10,000), for a capital gain of 51.80% per year. is too high.

We can decrease the contract size by 2 (max drawdown of € 3,274 for a capital gain of 25.90% per year), but the capital growth curve is still quite irregular.

However, this strategy seems logical and reliable, so I think there is much way to improve it.

It also works on CAC40 (or may some other indices).

But paradoxically it doesn’t work well on forex (I wanted to write it for forex, in order to use it automatically).

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 |

Defparam cumulateorders = false Defparam flatafter = 180000 n = 1 IF Time = 093000 THEN haut = highest[2](high) bas = lowest[2](low) amplitude = haut - bas achat = 0 vente = 0 ENDIF if Time > 093000 AND Time <= 180000 THEN IF achat = 0 THEN buy n share at haut stop ENDIF IF vente = 0 THEN sellshort n share at bas stop ENDIF ENDIF If longonmarket THEN achat = 1 ENDIF IF shortonmarket THEN vente = 1 ENDIF set stop ploss amplitude set target pprofit amplitude |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi

Have you tried to double the size if the first trade is a loss?

I mean if the first breakout up is false then double the size on the next breakout down

i would try it myself but i cant code it

Hello Eric,

Of course it is possible. But for my backtests I don’t use martingale.

Martingale is an easy solution to make you believe that your strategy works all the time… But the only time you loose, you loose much or all your money !

Backtests without martingale are true results.

Best Regards.

Hello Doc, do you have tested the strategy with transactions costs also? Thanks.

Hi Nicolas,

You are right, as it is in 15min timeframe, transaction costs are important.

I will make the test later 😉

The same code with 1 point spread gives the following :

http://www.doctrading.fr/wp-content/uploads/2016/04/Breakout-DAX-spread-1.png

A little ugly at beginning…

I made no optimization for this code.Later, I will try to create a good breakout code (like “London Open Breakout” for GBP/USD, GOLD, DAX, etc.)

// Definition of code parameters

DEFPARAM CumulateOrders = False // Cumulating positions deactivated

j1=(DHigh(1) - DLow(1)) * .236

j2=(DHigh(1) - DLow(1)) * .50

// Conditions to enter long positions

indicator1 = close //realtime price

c1 = (indicator1 CROSSES OVER DHigh(1))

IF c1 THEN

BUY 2 PERPOINT AT MARKET

ENDIF

// Conditions to enter short positions

indicator3 = close

c3 = (indicator3 CROSSES UNDER DLow(1))

IF c3 THEN

SELLSHORT 2 PERPOINT AT MARKET

ENDIF

// Stops and targets

SET STOP pLOSS j2

// Stops and targets

SET TARGET pPROFIT j1

Hi Doctrading,

I started using proreal time via my IGMarkets website and trying to code a similar breakout strategy system .I am finding difficulty in running the system between only dax trading hours(07:00 to 19:00 UK time).I take previous day high/low and if today’s price breaks yesterday’s high/low , I bought /sell with target as (23.6% of yesterday’s high -low difference) points. The stop loss for both is (50% of of yesterday’s high -low difference) points.I wrote the code as attached.Could you please review the code and include the trading hours restriction.

Thank you in advançe for your valuable time.

Johnny

Hi

Thanks for sharing. I’m new to autotrading.

I thought this was a 30min breakout strategy with one position per day.

Testing this on PRT/IG works ok with index (swedish omxs30) but when testing on stocks I get several positions during 9.30 and 18.00. Mostly one bar positions. What do I do wrong? Do I need to change something when testing on stocks?

Best regards

Martin

Hi Martin, are you testing on a daily timeframe?

Hi, if i want to do this whit 2 contracts then i only have to chanche N=1 to N=2??

greetings Jan

Hi Jan, yes “n” is the contracts size, you are right.

Thanks for the quick answer.

Is it allso an idea to add a trailing stop extra to the system. start at the take profit zone?

It is Doctrading’s strategy, maybe he could answer better than me to this question 🙂 Sometimes trailing stop just kill profit more than let it run, it needs some test here!

This morning the system startet and worked good whit 1 contract. halfe an houre ago i deleted the system and added a new one whit n=2.

After a few minutes it started too sell 2 contracts. it wasn’t in the ranges of 09:00 houres 09:30. ho is this possible?

Hello,

Of course this strategy needs improvement.

It’s only good after 2014 (don’t forget to backtest it with spread ! the screenshot doesn’t show spread).

Trailing stop would also be a nice idea. But first I test on several years with take profit, in order to see if it’s viable.

Personnage, I wouldn’t use this one in real trading, as it is profitable only since 2014.

Hi! Thanks for this code. Im willing to make some adjustments but before that i need the code to be translated to english. Somebody who can help?

Hello Hockeytrader,

I don’t understand you, the code is already in English, isn’t it ?

Hi! Thanks for answer. Haut, bas, achat & vente are the words i’m thinking about.

“Haut” = “high”

“Bas” = “low”

“Achat & Vente” = “Buy & Sell”

Google Translate is your friend 😉

Haha, thanks for the help!

Hi

Thanks for sharing. I have tried to use this code for a strategy I want to test on forex. The idea is to create an overnight range from the previous 8 hours and trade the breakout of this range from 9am onwards. Below is the code just for the long side of the stagey with 15min bars, hence (32) as this is 8h. I want it to go flat at 13:00, have added a trailing stop and a pip target. This are not optimised in any way, just first ideas to test.

Anyhow, it does not seem to work. For some reason it does not take trades on certain days and sometimes take multiple trades on after another. I think one of the problems is the range is constantly being updated from the previous 32 bars, whereas I want it set rigid after 9am (highest/lowest 1am-9am). I thought the part ‘IF time = 090000’ would set this but not 100% sure, I am very new to this.

Thanks in advance!

Defparam cumulateorders = false

Defparam flatafter = 130000

n = 1

IF Time = 090000 THENtop = highest[32](high)long = 0ENDIF

if Time >= 090000 AND Time <= 130000 THEN

IF long = 0 THENbuy n share at top stopENDIF

ENDIF

If longonmarket THENlong = 1ENDIF

SET STOP pTRAILING 15set target pprofit 30

Only exit at other side of the 9.00-9.30 range, Dax moves far more “usually” than that!Perhaps try this with a 50+ target & 20 point stop trail.

I’ve had this thought that if the first trade goes wrong and we end up with a loose. Is it possible to make the second trade double size?

Hello, it is still possible, but I don’t like martingale.

Hi, I’m trying to get my own system together that is very similar to the OP’s.

It’s in essence a range breakout, but my range is the opening 5m bar of the day.

stops and targets are similar theory to the OP’s as well, Stop Loss: the other side of the range, Take Profit: equal to the stop loss

I just can’t for the life of me amend this code to work, or get my own code.

Is there anyone that’s able to help me with this at all?

Thank you in advance.

Hello,

Do you just consider the first 5min bar at 9AM as the range ?

Yes, it is quite easy to backtest, but results will not be good. Because it is a too small timeframe, because of slippage, because of spread.

Regards,

it’s the first 5m bar on the 8am GMT open.

Manually I would go long 2 points above the high of that first bar, with a stop 2 points below the low, and visa versa for the short entry.

I’m just struggling to code it at the moment.

I will try later.If it is profitable, I will share the code.

Do you take 2 trades a day even if the first is winning ? Or only one ?Regards,

if the first hits the target then that’s the only trade.

If doesn’t hit target, then opens the reverse trade when stopped.

No trades at all after 12pm if long or short hasn’t triggered

Been testing the code for four weeks now. One optimisation i’ve been thinking about is to open a position when a bar closes over/under day h/l. who knows how that code would look?

The code should look like this :

Defparam cumulateorders = false

// Timeframe : H1

// HORAIRES DU BREAKOUT : 05H à 09H

IF TIME = 080000 THEN

HAUT = highest[1](high)

BAS = lowest[1](low)

achatjour = 0

ventejour = 0

amplitude = haut-bas

ENDIF

Ctime = time >= 080000 AND time <= 120000

IF Ctime THEN

IF achatjour = 0 THEN

buy at HAUT + 1 stop

ELSIF ventejour = 0 THEN

sellshort at BAS - 1 stop

ENDIF

ENDIF

IF longonmarket THEN

achatjour = 1

ENDIF

IF shortonmarket THEN

ventejour = 1

ENDIF

set stop loss amplitude

set target profit amplitude

But there is some issues :

I did’t set yet that if the first order is winning, there will be no second order

it is winning without spread… but loosing with 1 point spread

Feel free to improve this code.regards,

Just don’t consider the // timeframe and // 05H to 09H breakout.It was from an ancient london open breakout code.

Thanks. Will try it out.

so I’ve tried to amend the OP’s code to look at a smaller range for my breakout, but I can’t get it to take any trades at all

Defparam cumulateorders = false

Defparam flatafter = 180000

n = 1

IF Time = 090501 THEN

phigh = highest[2](high)

plow = lowest[2](low)

amplitude = phigh - psell

pbuy = 0

psell = 0

ENDIF

if Time > 090501 AND Time <= 180000 THEN

IF pbuy = 0 THEN

buy n share at phigh stop

ENDIF

IF psell = 0 THEN

sellshort n share at plow stop

ENDIF

ENDIF

If longonmarket THEN

pbuy = 1

ENDIF

IF shortonmarket THEN

psell = 1

ENDIF

set stop ploss amplitude

set target pprofit amplitude

Hey. Been comparing the strategys performance versus the DAX volatility index. i’ve not done all 100 000 bars yet but so far the strategy is profitable when the $VDAX is somewhere between 15 & 25. Gonna work on this tonight and see if a can give you some kind of report.

Hi, I’m new to coding and have been trying to modify the code a little to backtest an idea I have but am struggling!.my idea is to take the first 8.00 uk m15 candle and create a sell order 25 points above the high and a buy order 25 from the low incorporating a simple 25 sl and 50tp.Any help would be greatly appreciated.

Regards

Dave

Better use the forums for coding assistance please. You’ll get more results there for sure.

Apologies – only just learning the site layout.

Maybe you could delete the post?