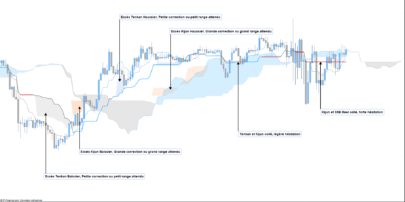

Whatever sophisticated trading systems can do, there are simpler ones, with moderate, but with success.

The only thing is, you need a fat account or microlots.

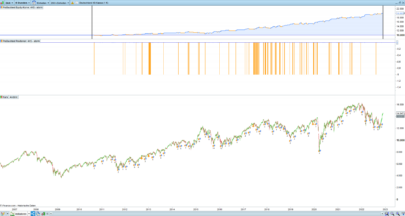

the action instructions is with a small seasonal monthly filter

In timeframe 4H

we sell if price above ema50 and we have little condition

sl tp 2% of price

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 |

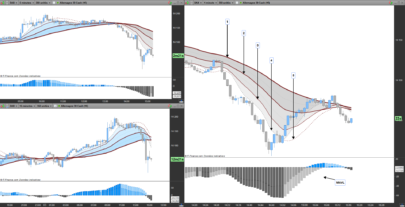

//————————————————————————- // instrument: dax 40 // maincode : 4HS tm tb g50 k1 M2 // timezone : europetime, berlin // timeframe : 4h // created and coded by JohnScher //————————————————————————- defparam cumulateorders = true position = 1 tm = openmonth <>1 and openmonth <> 3 and openmonth <> 10 td = opendayofweek >= 1 and opendayofweek <= 5 tt = time >= 090000 and time <= 210000 c1 = exponentialaverage [1] (close) > exponentialaverage [50] (close) c2 = exponentialaverage [1] (close) < exponentialaverage [2] (close) if tm and td and tt and c1 and c2 then sellshort position contracts at market endif set stop %loss 2 set target %profit 2 // until then |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thanks! Very good work

Hi John, thank you very much for this strategy. Works quite well. Have you also considered using other variations for the SL and the TP?

No, I haven’t.

You could certainly optimize for SL and TP, operate with trailingsstops and re-invest strategies, include momentum, volume, ATR and who knows what else, but that was not my point.

I was more interested in showing that one could have made money with simple means, e.g. short above EMA50 in the 4H in the past years.

Whether this will be the case in the future? No idea. In demo mode, the strategy has been running for 2 years in profit, despite all the current confusion.

je viens de Backtester cette strategie depuis avril 2021 , celle ci fonctionne très bien à partir de 10k capital. si le capital est inferieur (3k pour le backtest) celle ci fonctionne bien avec un SL fixé sur 0.8 et un TP fixé sur 2.3.

Il ne s’agit que d’un backtest…

Postscript:

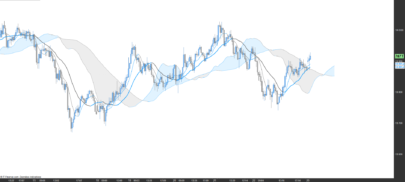

It’s running in the live right now. One position after the other is opened. So it was being programmed.

So let’s look again in 1 year, how it looks….

nice!! how’s it been since your last post on going live? 🙂

Hi,

Is this strategy suitable for daily SPY?

Regards