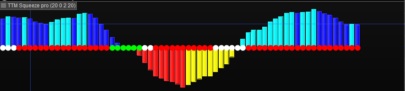

This strategy uses Smoothed Bollinger %b indicator, posted by Nicolas: “This is the modified% bollinger bands oscillator remade by Sylvain Vervoort. It’s using an Heiken Ashi closing price instead of the classic close value with Fears average. This indicator tend to accurate dark be and less choppy for intendifying turning points of the Dow theory by counting reverse oscillation of curved the”.

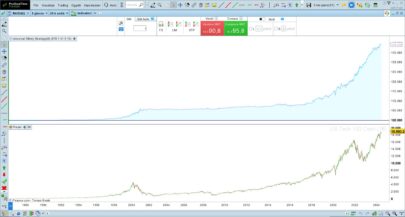

I have thought to post it because I believe that a winning portfolio must be founded on daily strategies, that works with good values for a long time.

I don’t believe in the strategies with time frame inferior to the daily. And I believe that a winning portfolio must be composed from strategies that have little gain but costant, It’s the whole portfolio that will bring to good results.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 |

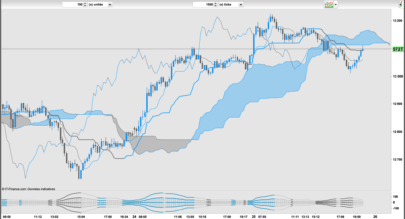

//Nicolas_Smoothed Bollinger %b indicator_11.12.2015 //Ale_Strategy_29.12.2017 //Market:US 100 //Time Frame: Daily //No Tested on Real market yet DEFPARAM CumulateOrders = FALSE ONCE avgEnterEnabled = 1 //Moving Average Entry Filter - 0 OFF, 1 ON ONCE trailingStopType = 1 // Trailing Stop - 0 OFF, 1 ON ONCE takeprofit = 10 // Take Profit % ONCE stoploss = 5 // Stop Loss % ONCE trailingstoplong = 9 // Trailing Stop Atr Relative Distance ONCE trailingstopshort = 4 // Trailing Stop Atr Relative Distance ONCE barlong = 16 // Exit Time Long ONCE barshort = 2 // Exit Time Short ONCE atrtrailingperiod = 200 // Atr parameter Value ONCE minstop = 5 // Minimum Trailing Stop Distance // MOVING AVERAGE - Parameter ONCE avgLongPeriod = 220 // Smoothed Bollinger %b indicator - Parameters ONCE period = 17 ONCE TeAv = 8 ONCE SveEnterLongThreshold = 30 ONCE SveEnterShortThreshold = 90 // TRAILINGSTOP //---------------------------------------------- atrtrail = AverageTrueRange[atrtrailingperiod]((close/10)*pipsize)/1000 trailingstartl = round(atrtrail*trailingstoplong) trailingstartS = round(atrtrail*trailingstopshort) if trailingStopType = 1 THEN TGL =trailingstartl TGS=trailingstarts if not onmarket then MAXPRICE = 0 MINPRICE = close PREZZOUSCITA = 0 ENDIF if longonmarket then MAXPRICE = MAX(MAXPRICE,close) if MAXPRICE-tradeprice(1)>=TGL*pointsize then if MAXPRICE-tradeprice(1)>=MINSTOP then PREZZOUSCITA = MAXPRICE-TGL*pointsize ELSE PREZZOUSCITA = MAXPRICE - MINSTOP*pointsize ENDIF ENDIF ENDIF if shortonmarket then MINPRICE = MIN(MINPRICE,close) if tradeprice(1)-MINPRICE>=TGS*pointsize then if tradeprice(1)-MINPRICE>=MINSTOP then PREZZOUSCITA = MINPRICE+TGS*pointsize ELSE PREZZOUSCITA = MINPRICE + MINSTOP*pointsize ENDIF ENDIF ENDIF if onmarket and PREZZOUSCITA>0 then EXITSHORT AT PREZZOUSCITA STOP SELL AT PREZZOUSCITA STOP ENDIF ENDIF //-------------------------------------------------------------------------------------------------- // FILTER SETTINGS //-------------------------------------------------------------------------------------------------- //MOVING AVERAGE longAvg = Average[avgLongPeriod] (close) avgFilterEnterLong = (close>longAvg OR NOT avgEnterEnabled) avgFilterEnterShort = (close<longAvg OR NOT avgEnterEnabled) //Smoothed Bollinger %b indicator haOpen = ((Open[1]+High[1]+Low[1]+Close[1])/4 + (Open[2]+High[2]+Low[2]+Close[2]))/2 haC = ((Open+High+Low+Close)/4 + haOpen + Max(high,haOpen) + Min(low,haOpen)) /4 TMA1 = tema[TeAv](haC) TMA2 = tema[TeAv](TMA1) Diff = TMA1-TMA2 ZlHA = TMA1+Diff percb = (tema[TeAv](ZLHA)+2*STD[period](tema[TeAv](ZLHA))-weightedaverage[period](tema[TeAv](ZLHA))) / (4*STD[period](tema[TeAv](ZLHA)))*100 SveFilterEnterLong = (percb < SveEnterLongThreshold ) SveFilterEnterShort = (percb > SveEnterShortThreshold ) // STRATEGY //-------------------------------------------------------------------------------------------------- IF NOT LongOnMarket AND avgFilterEnterLong AND SvEFilterEnterLong THEN BUY 1 CONTRACT AT MARKET ENDIF IF NOT ShortOnMarket AND avgFilterEnterShort AND SveFilterEnterShort THEN SELLSHORT 1 CONTRACT AT MARKET ENDIF IF POSITIONPERF<0 THEN IF LongOnMarket AND BARINDEX-TRADEINDEX(1)>= barLong THEN SELL AT MARKET ENDIF ENDIF IF POSITIONPERF<0 THEN IF shortOnMarket AND BARINDEX-TRADEINDEX(1)>= barshort THEN EXITSHORT AT MARKET ENDIF ENDIF SET STOP %LOSS stoploss SET TARGET %PROFIT Takeprofit |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thanks for sharing this ALE. I think it will take a little studying to fully understand how it all works but one part immediately caught my attention – the trailing start calculation using a blend of ATR and price. very interesting and definitely something that may find its way into some other strategies I think.

Yes Vonasi

You can use and improve trailing stop in every strategy, I can suggest to use graph fuction of it’s value to adapt it to other markets

Ciao Ale, ho notato che in molti usate l’ATR per i TS, ma devo avere qualche problema alla mia piattaforma, l’ATR dei CFD di IG ha un andamento totalmente diverso da quello dei mercati ufficiali, è comunque attendibile ed utilizzabile con profitto?

Ciao

Per come l’ho usato qui si.

In demo mode (100,000 periods) I don’t get those ratios… I get a 76.95% winning and 1.75 winners/ losers operations

Please try again

Grazie Ale,

li proverò e modificherò con timeframe più bassi, sui 15 e 30 minuti

Hi Andreag76,

Did you test it in shorter time frames? Any success?

/ Patrick

e un casino mettere apposto tutte le variabili, non tornano i nomi con sui sono stati ottimizzate

Hello, can i help you in the topic?

Hello Ale first of all congratulations for the strategy … I’m asking you something .. if I try to put any of these strategies in real the system tells me:

1) I have to replace the variables with a specific value and I have to replace these variables with a specific numerical value in the code of the trading system

2) that the “Graph” instruction can not be used in automatic mode ..

At this point, since I’m almost new to automatic trading, I’m asking for help on how to solve these two problems … Meanwhile, thanks for the help and for all the work you do!

Hello Max Gomma,

Thanks for your attention, I’ve open a Topic “Smoothed Bollinger% Strategy Daily_Topic”

http://www.prorealcode.com/topic/smoothed-bollinger-strategy-daily_topic/

Thanks Ale..ma for the Graph at the bottom of the code? how should i change it?

Yes, cancel graph function not else

Thanks for the availability …

Hi, will the strategy ever go short? In back-test it was only long trades…

Yes of course

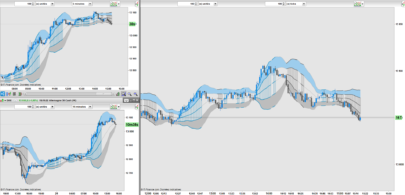

If you remove the Takeprofit and the exit parts, and let work the trailing stop strategy, in the DAX strategy the results are better. I didn’t try it in the other index.

//Nicolas_Smoothed Bollinger %b indicator_11.12.2015

//Ale_Strategy_29.12.2017

//Market: Dax

//Time Frame: Daily

//No Tested on Real market yet

DEFPARAM CumulateOrders = FALSE

ONCE avgEnterEnabled = 1//AVGE //Moving Average Entry Filter – 0 OFF, 1 ON

ONCE trailingStopType = 1//TRT // Trailing Stop – 0 OFF, 1 ON

ONCE stoploss = SL100 // Stop Loss %

ONCE trailingstoplong = TSL // Trailing Stop Atr Relative Distance

ONCE trailingstopshort = TSS // Trailing Stop Atr Relative Distance

ONCE atrtrailingperiod = ATRSP // Atr parameter Value

ONCE minstop = MINSTP // Minimum Trailing Stop Distance

// MOVING AVERAGE – Parameter

ONCE avgLongPeriod = AVG // 100

// Smoothed Bollinger %b indicator – Parameters

ONCE period = PRD

ONCE TeAv = TEV

ONCE SveEnterLongThreshold = SVL

ONCE SveEnterShortThreshold = SVS

// TRAILINGSTOP

//———————————————-

atrtrail = AverageTrueRange[atrtrailingperiod]((close/10)*pipsize)/1000

trailingstartl = round(atrtrail*trailingstoplong)

trailingstartS = round(atrtrail*trailingstopshort)

if trailingStopType = 1 THEN

TGL =trailingstartl

TGS=trailingstarts

if not onmarket then

MAXPRICE = 0

MINPRICE = close

PREZZOUSCITA = 0

ENDIF

if longonmarket then

MAXPRICE = MAX(MAXPRICE,close)

if MAXPRICE-tradeprice(1)>=TGL*pointsize then

if MAXPRICE-tradeprice(1)>=MINSTOP then

PREZZOUSCITA = MAXPRICE-TGL*pointsize

ELSE

PREZZOUSCITA = MAXPRICE – MINSTOP*pointsize

ENDIF

ENDIF

ENDIF

if shortonmarket then

MINPRICE = MIN(MINPRICE,close)

if tradeprice(1)-MINPRICE>=TGS*pointsize then

if tradeprice(1)-MINPRICE>=MINSTOP then

PREZZOUSCITA = MINPRICE+TGS*pointsize

ELSE

PREZZOUSCITA = MINPRICE + MINSTOP*pointsize

ENDIF

ENDIF

ENDIF

if onmarket and PREZZOUSCITA>0 then

EXITSHORT AT PREZZOUSCITA STOP

SELL AT PREZZOUSCITA STOP

ENDIF

ENDIF

//————————————————————————————————–

// FILTER SETTINGS

//————————————————————————————————–

//MOVING AVERAGE

longAvg = Average[avgLongPeriod] (close)

avgFilterEnterLong = (close>longAvg OR NOT avgEnterEnabled)

avgFilterEnterShort = (close<longAvg OR NOT avgEnterEnabled)

//Smoothed Bollinger %b indicator

haOpen = ((Open[1]+High[1]+Low[1]+Close[1])/4 + (Open[2]+High[2]+Low[2]+Close[2]))/2

haC = ((Open+High+Low+Close)/4 + haOpen + Max(high,haOpen) + Min(low,haOpen)) /4

TMA1 = tema[TeAv](haC)

TMA2 = tema[TeAv](TMA1)

Diff = TMA1-TMA2

ZlHA = TMA1+Diff

percb = (tema[TeAv](ZLHA)+2*STD[period](tema[TeAv](ZLHA))-weightedaverage[period](tema[TeAv](ZLHA))) / (4*STD[period](tema[TeAv](ZLHA)))*100

SveFilterEnterLong = (percb SveEnterShortThreshold )

// STRATEGY

//————————————————————————————————–

IF NOT LongOnMarket AND avgFilterEnterLong AND SvEFilterEnterLong THEN

BUY 1 CONTRACT AT MARKET

ENDIF

IF NOT ShortOnMarket AND avgFilterEnterShort AND SveFilterEnterShort THEN

SELLSHORT 1 CONTRACT AT MARKET

ENDIF

SET STOP %LOSS stoploss

//GRAPH TGL

thanks Pere, please uses the topic mentioned above to add further comments, analysis, test and contributions, thanks

Hello everyone .. I try to do backtest of the latest version of Pere gives me this error on line 78. Syntax error .. complete the syntax of this line … SveFilterEnterLong = (percb SveEnterShortThreshold)

How do you correct? thank you

Hello maxgomma please use relative topic

re:AverageTrueRange[atrtrailingperiod]((close/10)*pipsize)/1000, can you explain to how the input of ((close/10)*pipsize) is incorporated into the calculation of averagetruerange?

There is not a particular motive, that formula allows to find a relative value of the price, necessary to make to work the trailing stop in varying way and I don’t fix.

Buon giorno Alessandro e complimenti per la strategia. Sono un neofita di ProRealTime e di ProRealCode. Vorrei fare girare sul demo la tua strategia su EUR/USD per studiare ed imparare. Ho provato ad avviarla, ma senza successo, Mi puoi dare qualche consiglio? Pensavo che il file .ITF potesse già essere attivato su un conto demo. Grazie. Buon lavoro.

Hello gigi, ok no problem I’ll explain it in the topic of This strategy

Hello Gigi

Could you explain your question in the Topic?

I’ve tested it and I can onl say that it is amazing! Many thanks !!

If I can I will try to improve it, but for now it is working in my real account perfectly for EEUU 100 Tech and S&P.

Many thanks for this big strategy!!

Hello, I have back tested you system and found that the ATR variable of 9 works well in low volatility situations but leads to a significant loss in February when the ATR had spiked. Would there be a way to add a variable such as a max trailing distance to allow for high volatility?

Thanks

Very good

Bom dia Ale. Obrigado pela partilha. Você tem alguma das suas estratégias operando em Modo Real?? Quais são as estrategias? é com a IG? Obrigado.

OLÁ NESTE MOMENTO EU NÃO ESTOU USANDO ESTAS ESTRATÉGIAS DESDE QUE EU TENHO O CAPITAL OCUPADO PEQUENO EM OUTROS SISTEMAS.

BROKER IG EU SOU USADO.

Qual é então a sua Estrategia de eleição ALE??

Nasdaq!

HI, which values do I need to change before I can use it?

Hello Wester,

you can change or not every variables that are in the code.

if you need assistence , please write in the forum here:

https://www.prorealcode.com/topic/smoothed-bollinger-strategy-daily_topic/

This catch my attention, tried to load in pro order but not coming through. What variables need to change?

Hello ALE.

Is there any way to help us develop or program an algo-strategy for automatic trading?

Thank you in advance for working with us on this revolutionary strategy called: “kangaroo jump mouse nibbling”.

Ciao, sono nuovo e poco esperto, volevo chiedere perchè il ProBacktest lo esegue correttamente, mentre se lancio la strategia nel ProOrder vengono rilevati errori come: “il code non è valido. Correggilo. Linea 22: Caratteri mancanti. Suggerimenti: fine del codice” e anche “L’istruzione “Graph” non può essere usata in modalità trading automatico”. Qualcuno può spiegare perchè? grazie