Good Day

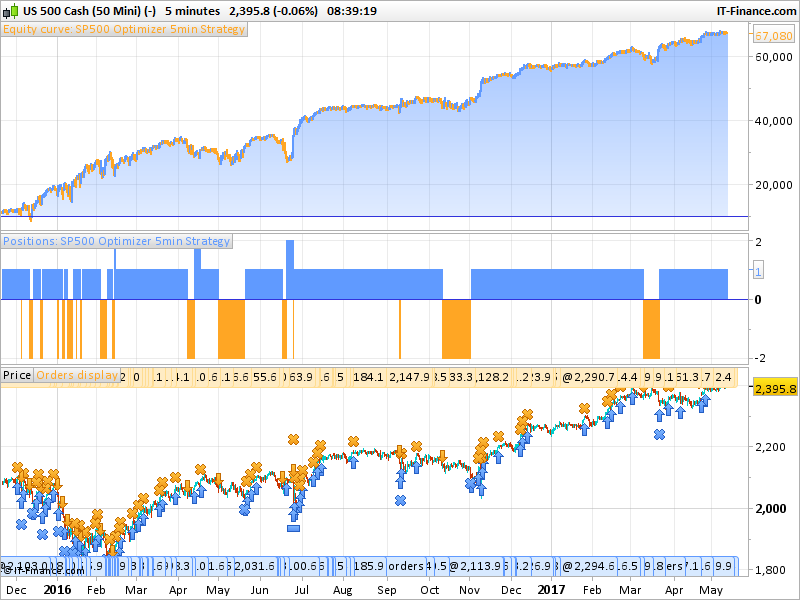

I have been a silent member of this community for quite some time but suppose as time would allow I would try to become more active. I have been developing PRT strategies for almost 2 years now and have quite a few running live and profitable on various indexes and FX Pairs. I still need to get to a point where I can freely share my strategies but still find that slightly difficult (especially knowing some people sell your IP for profit). Anyhow this is just one of the many rabbit hole strategies I have developed in an effort to outperform a given index.

I actually wrote this today when the idea came to me to write a small time frame strategy that attempts to enter the market and take profit as soon as possible with the ability to stop and reverse direction quickly if the position becomes unprofitable. I am sure the general idea can be adapted to other timeframes and markets.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 |

///Spread set to 0.9 points possize = 1 pointsp = 20 //points where profit is to be locked in pointsb = 36 //points where stop is to be taken fast = average[11,4](close) medium = average[13,4](close) If countofposition = 0 then If fast > medium then BUY possize CONTRACT AT open + averagetruerange[3](close)*2 stop EndIf EndIf If longonmarket and close >= positionprice + pointsp then If close < close[1] then SELL AT MARKET EndIf ElsIf longonmarket and close <= positionprice - pointsb then SELLSHORT possize*2 CONTRACT AT MARKET EndIf If shortonmarket and close <= positionprice - pointsp then If close > close[1] then EXITSHORT AT MARKET EndIf ElsIf shortonmarket and close >= positionprice + pointsb then BUY possize*2 CONTRACT AT MARKET EndIf SET TARGET pPROFIT 50 |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

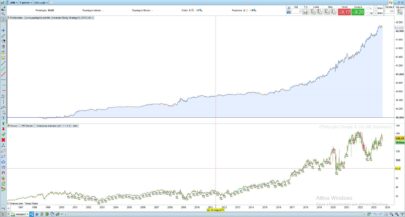

As mentioned, this is a conceptual strategy to beat a buy and hold approach. Practically the costs of staying in the market for such extended periods can potentially outweigh the benefits if the market tends to range longer than what it actually trends. I will in the near future post some of my other strategies that spend much less time in the market and are much more practical to trade.

bonjour je test le robot sp500 Optimizer stategy. Je ne vois pas le SL dans le code??? merci

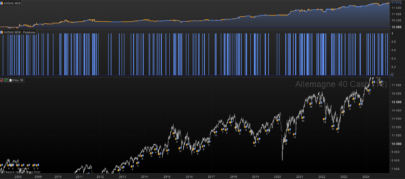

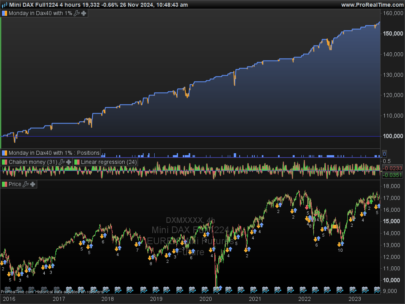

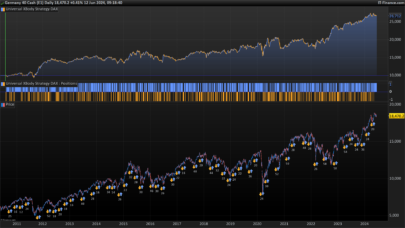

Here is the version adapted for the DAX. Which it also wildly outperforms.

///Spread set to 0.9 points for SP500

///Spread set to 3 points for DAX

possize = 1

pointsp = 90 //20 for SP500 //points where profit is to be locked in

pointsb = 84 //36 for SP500 //points where stop is to be taken

fast = average[12,4](close) //11,4 for SP500

medium = average[14,4](close) //13,4 for SP500

If countofposition = 0 then

If fast > medium then

BUY possize CONTRACT AT open + averagetruerange[3](close)*2 stop

EndIf

EndIf

If longonmarket and close >= positionprice + pointsp then

If close < close[1] then

SELL AT MARKET

EndIf

ElsIf longonmarket and close <= positionprice - pointsb then

SELLSHORT possize*2 CONTRACT AT MARKET

EndIf

If shortonmarket and close <= positionprice - pointsp then

If close > close[1] then

EXITSHORT AT MARKET

EndIf

ElsIf shortonmarket and close >= positionprice + pointsb then

BUY possize*2 CONTRACT AT MARKET

EndIf

SET TARGET pPROFIT 100 //50 for SP500

Looks very interesting! Will try it on both sp500 and dax on one of my demoaccounts 🙂

I just backtested on my German IG account. Looks good almost 70% profit from Jan2016

Unfortunately i was not able to insert a screen shot. Does somebody know how?

ciao Klaus

I tested the strategy on FX today and seems to work very nicely.

Here the example of EUR/USD with spread set to 0.8:

///Spread set to 0.9 points for SP500

///Spread set to 3 points for DAX

///Spread set to 0.8 for EUR/USD

possize = 1

pointsp = 0.0029//90 for DOW //20 for SP500 //points where profit is to be locked in

pointsb = 0.0042//84 for DOW //36 for SP500 //points where stop is to be taken

fast = average[10,4](close) //12,4 for DOW //11,4 for SP500

medium = average[13,4](close) //14,4 for DOW //13,4 for SP500

If countofposition = 0 then

If fast > medium then

BUY possize CONTRACT AT open + averagetruerange[3](close)*2 stop

EndIf

EndIf

If longonmarket and close >= positionprice + pointsp then

If close < close[1] then

SELL AT MARKET

EndIf

ElsIf longonmarket and close <= positionprice - pointsb then

SELLSHORT possize*2 CONTRACT AT MARKET

EndIf

If shortonmarket and close <= positionprice - pointsp then

If close > close[1] then

EXITSHORT AT MARKET

EndIf

ElsIf shortonmarket and close >= positionprice + pointsb then

BUY possize*2 CONTRACT AT MARKET

EndIf

SET TARGET $PROFIT 130//105 for DOW //50 for SP500

Thank you Juanj! It looks very nice, I am running live the one on Dax already and it is already making money 🙂

One question on the EUR/USD.

I have changed the size from 1 to 2 by setting possize = 2 but it change the shape of the equity curve..

What am I missing?

Best

Francesco

Hi Francesco, I am glad you find the strategy useful. However you are rather brave to run the strategy live,usually running a strategy in a demo account for at least a month is strongly advised. However, if you understand the risk involved (as any good trader hopefully does) I wish you all the best.

With regards to changing the possize parameter on the EUR/USD, since this increases the position exposure you would have to make the following modifications to incorporate possize since you are not dealing here with points as with the indexes but pips and dollars;

pointsp = 0.0029*possize

pointsb = 0.0042*possize

SET TARGET $PROFIT 130*possize

Thank you!

Thank you! I think the pointsp and the pointsb are already in pips though so no need to change those.

That is correct, was just about to edit my post to ignore the first part (pointsp and pointsb) as it is already in pips as you mention.

Walk forward, walk forward Guys 😉

Thanks for sharing your ideas.

As with all strategies that uses variables (back tested or forward tested) it is always a good idea to keep your variables optimized to current market conditions. I recommend running variable optimization on a monthly basis and carefully watch the MA on your equity curve for changing conditions requiring optimization. No amount of back or forward testing is sufficient to produce that ‘golden’ set of variables for future market conditions.

Version adapted for FTSE spread set to 3;

///Spread set to 0.9 points for SP500

///Spread set to 3 points for DAX

///Spread set to 0.8 for EUR/USD

///Spread set to 3 points for FTSE

possize = 1

pointsp = 55//0.0029 for EUR/USD //90 for DOW //20 for SP500 //points where profit is to be locked in

pointsb = 45//0.0042 for EUR/USD //84 for DOW //36 for SP500 //points where stop is to be taken

fast = average[11,4](close) //10,4 for EUR/USD //12,4 for DOW //11,4 for SP500

medium = average[13,4](close) //13,4 for EUR/USD //14,4 for DOW //13,4 for SP500

If countofposition = 0 then

If fast > medium then

BUY possize CONTRACT AT open + averagetruerange[3](close)*2 stop

EndIf

EndIf

If longonmarket and close >= positionprice + pointsp then

If close < close[1] then

SELL AT MARKET

EndIf

ElsIf longonmarket and close <= positionprice - pointsb then

SELLSHORT possize*2 CONTRACT AT MARKET

EndIf

If shortonmarket and close <= positionprice - pointsp then

If close > close[1] then

EXITSHORT AT MARKET

EndIf

ElsIf shortonmarket and close >= positionprice + pointsb then

BUY possize*2 CONTRACT AT MARKET

EndIf

SET TARGET pPROFIT 55//130*possize for EUR/USD //105 for DOW //50 for SP500

I realize in the comments of my code I made reference to the parameters of the DOW when in reality I meant DAX.

Very interesting strat juanj

only one remark, I find time on the market a bit high and then risky

Reb

Thanks Reb, I am aware. Interestingly enough though the time in market is much less in more volatile markets such as forex. See the EUR/USD example for instance.

Walk forward Guys, Walk forward as I said ! An optimization means nothing without “confirmation” by WF

An optimization is quite easy, pass a WF is more complicated

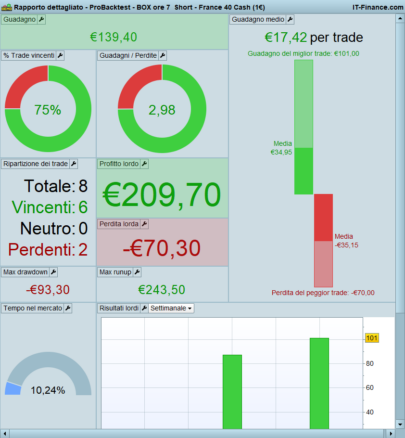

DAX Spread 3 points, 15000 unit

Finish in gain

2/5 >50 % WFE

Ratio 45 %

Not perfect but not bad

Walk forward Guys, Walk forward as I said ! An optimization means nothing without “confirmation” by WF

An optimization is quite easy, pass a WF is more complicated

DAX Spread 3 points, 15000 unit

Finish in gain

2/5 >50 % WFE

Ratio 45 %

Not perfect but not bad

I tried with 3 variables and now 6. Results in some hours …

And of course thanks for your job Juan 😉

WF with 6 variables stopped..Game Over..Be careful Guys …

I will try with 6 variables on US500 …

Game over on sp500 too …

I tried with less variables and on mini 500 (as juan)

Same results sadly…

Hi Zilliq, thank you for taking the time in doing some walk forward testing. You mentioned you used 6 valuables, but there is only 5 that requires optimization. Also what variable ranges did you use? As a side note, it is worth noting that frequent variable optimisation can keep a time optimised strategy surprisingly profitable. Just keep an eye on the equity curve.

Juan, would love to see anything on the South African cash Top4o, if possible please.

Hi juanj

Interesting system but for someone not sure on the coding what does the ,4 represent in the formula:

I tried graphing the average but couldn’t see what it represented?

best regards

dymjohn

fast = average[11,4](close)

The value after the comma refers to the Moving Average type;

0 = Simple,1 = Exponential,2 = Weighted,3 = Wilder’s Smoothed,4 = Triangular,5 = End Point, and6 = Time Series.

Thanks for this, juanj, I didn’t know you could write the average method this way. I would have written it as TriangularAverage[11](close).

Should you worry about “walk Forward” how is this calculated unless you test it for months before using?

Regards

dymjohn

best r

@Ketefster I actually have quite a couple of SA Top40 strategies that I am personally running live. Send me an email on jd3gjacobs@gmail.co.za for more information.

@Dymjohn The above strategy is largely conceptual and hence not optimized using walk forward testing. I do however use walk forward tests extensively on development of my core strategies to establish a good set of optimized variables to start off with. However that said walk forward tests will never guarantee future performance, although a tight range of variables will show that you are on the right track. There is no such thing as a magic set of variables. It is necessary to regularly optimize variables to ensure your strategy is suited to current market conditions.

Thanks for your comments, juanj, probably explains why I tend to optimize a strategy and then find I lose money when I trade it. The trouble is one can optimise today and market conditions change tomorrow I get the point about a tight range of variables though

Thanks again

Dymjohn

Hi Juanj, thanks for sharing this, are you using the same sp500-optimizer-5min-strategy.itf for the German 30?

Cheers

Hi @Benjamin, unfortunately as I have mentioned before I cannot say that I use this strategy. It was purely conceptual in design. I did post a version of the above adapted for the DAX. See earlier comments. However I cannot advise using this strategy without at least running it live for a month or so. Even then re-optimization would be necessary to ensure performance related to then ‘current’ market conditions.

Hi I created an optimized version that differentiate between long and short and that allows the first trade to be short

Cool can you post it somewhere? Maybe create a topic on the forum?

I tried to post it here but something doesnt seem to work..

///Spread set to 0.9 points for SP500///Spread set to 3 points for DAX//DEFPARAM flatafter = 230000//defparam flatbefore= 080000possize = 1pointspl = 110//20 for SP500 //points where profit is to be locked inpointsbl = 85//36 for SP500 //points where stop is to be taken

pointsps = 90 //20 for SP500 //points where profit is to be locked inpointsbs = 105 //36a = 2.1b=2pf = 100periodfast = 3periodmedium = 15fast = average[periodfast,4](close) //11,4 for SP500medium = average[periodmedium,4](close) //13,4 for SP500

If countofposition = 0 thenIf fast > medium thenBUY possize CONTRACT AT open + averagetruerange[3](close)*a stopEndIfEndIf

If countofposition = 0 thenIf fast < medium thensellshort possize CONTRACT AT open – averagetruerange[3](close)*b stopEndIfEndIf

If longonmarket and close >= positionprice + pointspl thenIf close < close[1] thenSELL AT MARKETEndIfElsIf longonmarket and close <= positionprice – pointsbl thenSELLSHORT possize*2 CONTRACT AT MARKETEndIf

If shortonmarket and close <= positionprice – pointsps thenIf close > close[1] thenEXITSHORT AT MARKETEndIfElsIf shortonmarket and close >= positionprice + pointsbs thenBUY possize*2 CONTRACT AT MARKETEndIf

SET TARGET pPROFIT pf //50 for SP500

I like your modification. Have yo tried it on some of the other indexes or currencies?

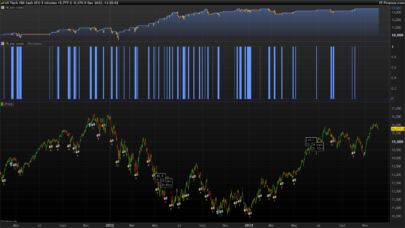

However looking at the DAX for YTD there is some concerns:

Top = Original CodeMiddle = Buy and HoldBottom = Your Code

thats weird, I get a completely different result..

I cant attach the picture here, shall we exchange email?

Hi Juan.

Thanks for sharing. I like the concept.

I’m curious to find out what broker you use? IG? if so, you get about 3 months more data than me on the 5min timeframe.

Have you tried this on the SA40?

Hi,

Please forgive my question… I’m an absolute beginner.

I’m trying to trade the US 500 1€ on a 25 contract base. So, changed “1” on line 3 into 25. I presume other numbers must be changed. Would you be good enough telling which ones, please.

Sorry, but my Broker can only accept a buy-order depending on the averagetruerange-limit if there is a minimum distance from actual price level. Therefore the strategy is being hold quickly. No trading possible.

Hi juanj , thanks for posting this. I’m with IG and have been trying to run it on US 500 but orders keep getting rejected. Any idea why that might be?

Hello Juanj, I really like this concept. I especially like the possibility of a reversal when the market is going against you. I have created several versions with different inputs (RSI2, close>close(1) etc.) and with the possibility to go short or long as the first trade if the trend demands it. I also changed the diagnosis of the trend. It performs very well in so many markets. Of course, it’s often on the market for a very long time. Is that a good thing or a bad thing?

Do you use this concept? Do you maybe have a few tips for me?