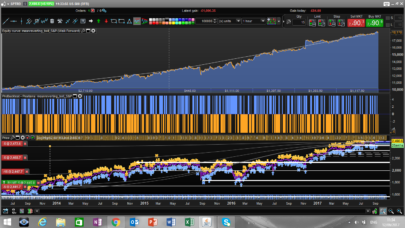

Simple strategy on S&P500 with “controlled” averaging down orders. Strategy has stoploss (100 points by default). Default is 5 contracts per order, but you can modify it in the code if you want (please adapt it to your account size). Could be adapted to other markets for sure.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 |

// TF Giornaliero // JR1976 TRADERS // Molto Buono con Cumulate order LONG // MM125=filtro lungo periodo , MM14 media di corto periodo per le operazioni long , MM4 media di corto periodo per le operazioni short + check RSI 2 // TIme Frame DAYLY // MAX dd ... // Loss ... // JR1976 TRADERS DEFPARAM Cumulateorders = true //defparam flatafter = 220000 //defparam flatbefore = 130000 MM125=average[125](close) MM14=average[14](close) MM4=average[4](close) RSI2 = RSI[2](close) //h1 = high > Bollingerup[20] short = RSI2 > 90 mm200=average[200](close) // Condizioni per entrare su posizioni long IF NOT LongOnMarket and close >MM125 and MM125>MM125[1] and close<MM14 THEN BUY 5 CONTRACTS AT high stop trading = 0 ENDIF //if trading < 7 then if trading < 5 then //IF LongOnMarket and close>mm200 and Close-TRADEPRICE(1)>1 then IF LongOnMarket and close>mm200 and TRADEPRICE(1)- close>1 then BUY 5 CONTRACTS AT market trading = trading +1 ENDIF endif // Condizioni per uscire da posizioni long //If LongOnMarket AND close>mml and close>close[1] THEN If LongOnMarket AND close>MM14 THEN SELL AT market ENDIF // Stop e target: Inserisci qui i tuoi stop di protezione e profit target if not shortonmarket and close<MM125 and MM125<MM125[1] and close>MM4 and short then sellshort 5 contracts at low-3 stop endif if shortonmarket and close<MM4 and close<close[1] and TRADEPRICE(1)- close>1 then exitshort at market endif //if shortonmarket then //exitshort at high+10 stop //endif //set target pprofit 25 set stop ploss 100 |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

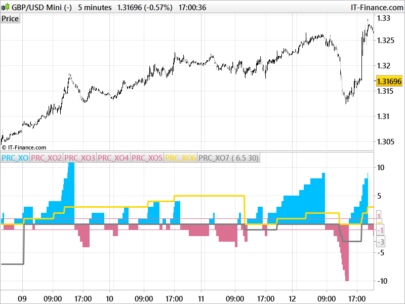

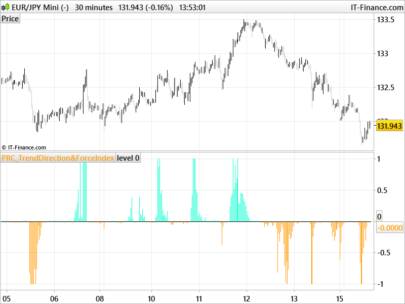

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Troppi pochi trade per uno storico così elevato. La probabilità nella sua accezione frequentista , è attendibile se il campione preso a riferimento sia ampio. Mia personalissima opinione. Buona giornata!

Is there anyway to make this system work for the us market? Thanks!

DO you mean US Market ? Like Nasdaq or Dow ?

Yes! Thanks for your reply. Also, can you give any more details on how this system works? It says it’s automated. Does that mean that it will automatically make daily trades or weekly trades? What type of returns will it generate and does it work with any portfolio size? I know you have to sign-up for Prorealtime monthly in order to use. Thanks in advance!

Hi Thomas,

The system is totally automatic , make daily trade ( daily timeframe ) .

Follow the trend because need to know if the close is above or below the ‘Average 125’ and entry when the market have the weak points , only at the break of previous Daily high or low

About your portfolio size …

Depend of your risk , but I think 3000 €/US is the minimum

Hi! Looks like a good system, I would like to try it out and see if I can make it fit into any of my ideas. However I’m having a hard time understanding the system, can you explain in words when the system is supposed to enter a long position?

I Ricx,

Thanks an advance for your comment

The most important condition to go long are :

SP500 – riding the trend 3

SP500 – riding the trend

Simple strategy on S&P500 with “controlled” averaging down orders. Strategy has stoploss (100 points by default). Default is 5 contracts per order, but you can modify it in the code if you want (please adapt it to your account size). Could be adapted to other markets for sure.

// TF Giornaliero

// JR1976 TRADERS

// Molto Buono con Cumulate order LONG

// MM125=filtro lungo periodo , MM14 media di corto periodo per le operazioni long , MM4 media di corto periodo per le operazioni short + check RSI 2

// TIme Frame DAYLY

// MAX dd …

// Loss …

// JR1976 TRADERS

DEFPARAM Cumulateorders = true

//defparam flatafter = 220000

//defparam flatbefore = 130000

MM125=average[125](close)

MM14=average[14](close)

MM4=average[4](close)

RSI2 = RSI[2](close)

//h1 = high > Bollingerup[20]

short = RSI2 > 90

mm200=average[200](close)

// Condizioni per entrare su posizioni long

IF NOT LongOnMarket and close >MM125 and MM125>MM125[1] and close<MM14 THEN

BUY 5 CONTRACTS AT high stop

trading = 0

ENDIF

//if trading < 7 then

if trading mm200 and Close-TRADEPRICE(1)>1 then

IF LongOnMarket and close>mm200 and TRADEPRICE(1)- close>1 then

BUY 5 CONTRACTS AT market

trading = trading +1

ENDIF

endif

// Condizioni per uscire da posizioni long

//If LongOnMarket AND close>mml and close>close[1] THEN

If LongOnMarket AND close>MM14 THEN

SELL AT market

ENDIF

// Stop e target: Inserisci qui i tuoi stop di protezione e profit target

if not shortonmarket and close<MM125 and MM125MM4 and short then

sellshort 5 contracts at low-3 stop

endif

if shortonmarket and close<MM4 and close1 then

exitshort at market

endif

//if shortonmarket then

//exitshort at high+10 stop

//endif

//set target pprofit 25

set stop ploss 100

// TF Giornaliero

// JR1976 TRADERS

// Molto Buono con Cumulate order LONG

// MM125=filtro lungo periodo , MM14 media di corto periodo per le operazioni long , MM4 media di corto periodo per le operazioni short + check RSI 2

// TIme Frame DAYLY

// MAX dd …

// Loss …

// JR1976 TRADERS

DEFPARAM Cumulateorders = true

//defparam flatafter = 220000

//defparam flatbefore = 130000

MM125=average[125](close)

MM14=average[14](close)

MM4=average[4](close)

RSI2 = RSI[2](close)

//h1 = high > Bollingerup[20]

short = RSI2 > 90

mm200=average[200](close)

// Condizioni per entrare su posizioni long

IF NOT LongOnMarket and close >MM125 and MM125>MM125[1] and close<MM14 THEN

BUY 5 CONTRACTS AT high stop

First of all, simple average 125 , previous close must be above

Then the trend of the average 125 must be in up direction

Previous close are below average 14

And the last condition but important is to break the previous high to entry in the market

To avoid the big drawdown , cumulate order if you are not in profit

The stop loss obviously are most important

Regards

I Ricx

Sorry but there is an error in copy paste of the previous reply.

The follow the simple condition to set up LONG

1 previous close must be above simple moving average 125

2 the trend of the average 125 must be up direcction

3 previous bar close below average 14

4 at the last open a position if the current price break the previous daily high

Cumulate order (limited) if you are not in profit

That’s all

Regarda

Good ideas!

Hi JR1976,

thank you for posting this trading system.

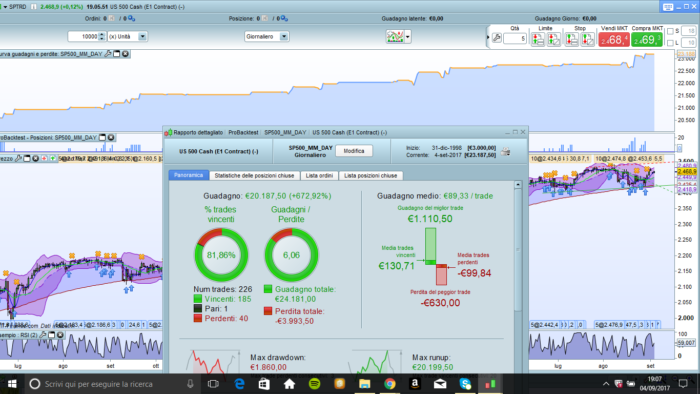

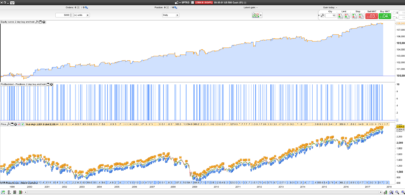

In the screenshot you attached there are some incoherences that make me think you messed up with the screenshot because in the bigger window I see:

the CFD is “US 500 cash”

the timeframe is “Daily” (Giornaliero)

the test period is from somewhere before 1999 and september 2018

while in the “Rapporto dettagliato” window I see:

the CFD is “France 40 cash”

the timeframe is 4 hours

the test period is from 29/04/2013 to 01/09/2017

The system applied to US 500 on a daily frame breaks after a few positions and if applied to the CAC 40 index, it works better but not that much.

Please may you review your whole post?

Thank you

Danibo

Hi Danibo ,

Is an error in the attachment

Not consider screenshot cac40 .

Soon I enclosed the complete figure of the equity Us

obviously you can try to play the strategy on other index like cac ecc

JR1976, thank you for your reply.

Still I can’t make the TS work with the US 550 because it breaks after few trades.

Did you change the code?

NOthing change … tried with CFD US500 cash mini

Hallo

Im Demomodus bei IG habe ich das Problem, dass oft keine Orders ausgeführt werden können, da anscheinend der STOP Kauf zu nahe am gegenwärtigen Martlevel liegt. Änderung von STOP Kauf auf Market funktioniert im Code leider nicht. Was müsste ich da ändern?

Translate:

In demo mode with IG I have the problem that often no orders can be executed, because apparently the STOP purchase is too close to the current market level.

The minimum distance must be 10 points. Change of STOP Buying on Market does not work in the code unfortunately. What should I change there?

EchnatonX, nice late answer of me:

Make the stop loss a percentage of the close, like 100/10000 * close. For currency pairs just use the required pips distance x close, like 100 * close /// for Euro/dollar likewise 100 * 1,09

Hello

I made some optimization to make it better. But there are 5 transacttion which increase drawdown. Can you help to optmize too

Thanks