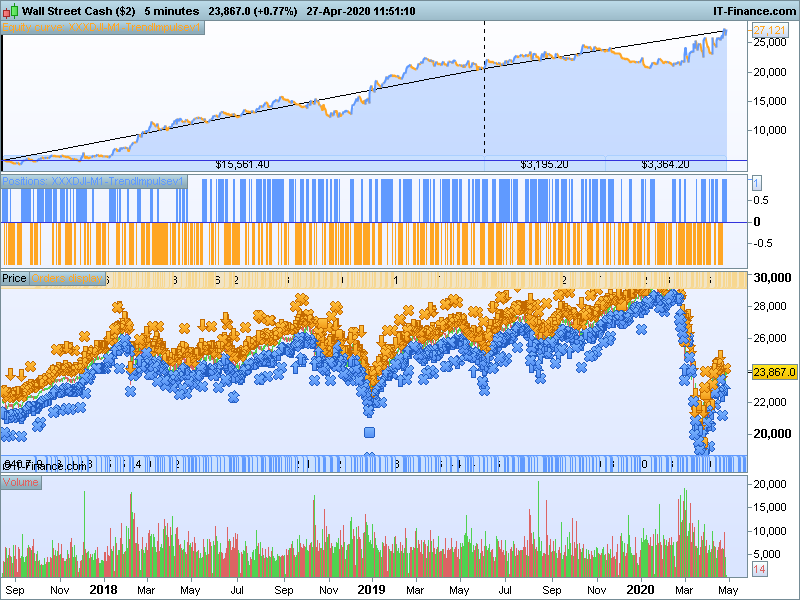

Here is a new strategy on Wall Street/DJI 5 min TF that utilize Perfect Trend Line as entry/exit and Trend Impulse Filter as trend direction. All credits to the original author.

DLS code is added to avoid high spread period. Time Zone used is UTC+08:00.

Forum for discussion https://www.prorealcode.com/topic/strategy-trendimpulse-v1/

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 |

DEFPARAM CumulateOrders = false DEFPARAM PRELOADBARS = 1000 // --------- US DAY LIGHT SAVINGS MONTHS ---------------- // mar = month = 3 // MONTH START nov = month = 11 // MONTH END IF (month > 3 AND month < 11) OR (mar AND day>14) OR (mar AND day-dayofweek>7) OR (nov AND day<=dayofweek AND day<7) THEN USDLS=010000 ELSE USDLS=0 ENDIF timeok = NOT(time >051500- USDLS AND time <053000 - USDLS) AND NOT(time >060000 - USDLS AND time <070000 - USDLS) timeframe(5 minute) thigh1 = Highest[SlowLength](high)+ SlowPipDisplace*pointsize tlow1 = Lowest[SlowLength](low)- SlowPipDisplace*pointsize thigh2 = Highest[FastLength](high)+ FastPipDisplace*pointsize tlow2 = Lowest[FastLength](low)- FastPipDisplace*pointsize if barindex>2 then if Close>line1[1] then line1 = tlow1 else line1 = thigh1 endif if Close>line2[1] then line2 = tlow2 else line2 = thigh2 endif endif if (Close[0]<line1[0] and Close[0]<line2[0]) then trend = 1 endif if (Close[0]>line1[0] and Close[0]>line2[0]) then trend = -1 endif if (line1[0]>line2[0] or trend[0] = 1) then trena = 1 endif if (line1[0]<line2[0] or trend[0] = -1) then trena = -1 endif if trena<>trena[1] then if trena=1 then //bear prefecttrend = 2 else //bull prefecttrend = 1 endif endif timeframe(default) once bb = src if barindex>length then src = (highest[length](high)+lowest[length](low))/2 rising = src-src[length]>0 falling = src-src[length]<0 aa = rising or falling bb = exponentialaverage[centertrend](aa*src+(1-aa)*bb[1]) //—- if bb>bb[1] then //bull trendimpulse = 1 elsif bb<bb[1] then //bear trendimpulse = 2 endif endif //====== Enter market - start ===== // LONG side C1 = trendimpulse = 1 AND prefecttrend[1] = 2 AND prefecttrend = 1 IF timeok AND Not OnMarket AND C1 THEN BUY 1 CONTRACT AT MARKET SET STOP pLOSS SL ENDIF // SHORT side C2 = trendimpulse = 2 AND prefecttrend[1] = 1 AND prefecttrend = 2 IF timeok AND Not OnMarket AND C2 THEN SELLSHORT 1 CONTRACT AT MARKET SET STOP pLOSS SL ENDIF //====== Enter market - end ===== //====== Exit market - start ===== X1 = prefecttrend[1] = 1 AND prefecttrend = 2 IF LONGONMARKET AND X1 THEN SELL AT MARKET ENDIF X2 = prefecttrend[1] = 2 AND prefecttrend = 1 IF SHORTONMARKET AND X2 THEN EXITSHORT AT MARKET ENDIF //====== Exit market - end ===== |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Excellent en 1mn…;-)

Hi! Many thanks! Can you please indicate us some value of the variables?

Hi, only 3 variables to optimize: SlowLength, FastLength and length. Other variables are actually fixed. You can see the range by importing the .itf,

MERCI yahootew3000, SUPPER la programmation! belle perf avec ProBacktest. Je rencontre un petit problème avec ProOrder Auto Trading (Remplacez les variables par des valeurs fixe… )

@Pascal, Oui effectivement, une fois le Backtest terminé, il te propose des valeurs pour le résultat obtenus pour les variables. Avant de lancer en ProOrder, il suffis soit de déclarer les variables sur le code et de mettres les valeurs du backtest avant de lancer au auto. exemple de déclaration :

once SL=300

once SlowLength = 50

once FastLength = 35

once SlowPipDisplace = 0

once FastPipDisplace = 0

once length = 2

once centertrend = 1

Bonjour Souhait Sam,

Après de nombreux essais pour le mettre en format afin d’utiliser ce code sur ProOrder je me retrouve bloqué avec des variables toujours non-définies. Voici le code en question.

Je les aies tour à tour déclarée dans un ensemble de définition de variables et ensuite modifiés directement dans le code mais je reste bloqué dans l’exécution qui me dit que les variables ne sont pas modifiées …

Il faut supprimer celles qui existent dans la fenêtre d’optimisation et les créer en dur dans le code, au début c’est l’idéal, après les defparam.

Merci Souhail Sam pour ta réponse rapide et précise. 😉 Je suis novice.

Hi, I have a question regarding the frequency of the points and the backtest time window. Looking at your screenshot it seems that you have 1 point every 5 minutes and a backtest of a duation of 2 years and a half. When I try to do a backtest with a data point every 5 minutes, the maximum backtest I can achieve is 11 days. Is there a trick to allow longer analysis?

Cheers

Hi, you need to adjust the unit to higher number, for normal account, it is 100k units (the option is on the left of the time frame option, default maybe is 10k). You will need a premium PRT for longer test period (200k unit). I build strategy on 100k then ask my friend to test on 200k.

Thank you Souhail Sam for the help. Btw, I have improved the strategy, you can get the latest from here, https://www.prorealcode.com/topic/strategy-trendimpulse-v1/page/2/#post-129779

It is me that i must thank you for your work.

I have worked a lot on this version, I will finish some ameliorations before sharing it here.

The strategie is running live in demo and it has given me good results.

Just one problem is one day, 6 positions oppened in the same time and lost -164e six times. The problem is i have fixed 1 position a time in proOrder and cumulateorder is on false on the code, maybe it’s a bug, hope that it will not do it on live trades in Real account.

Thank you again for your work. I will take a look on the new version.

bonjour il m’est impossible de me servir de vos stratégie il y a message d’erreur .avez vous réussi de votre coté ?

merci pour votre travail

Bonjour, télécharge le fichier itf et importe le directement sur la plateforme, évite le copier coller. Bon courage

Hi all, thanks for the code. I would like to test and have loaded into the backtest but its asking me to add variables even though I see them loaded at the top of the backtest window. do I need to add them variables to the code itself? sorry, fairly new to this.

Thanks

Darren

btw i added the below but still asks me to ‘replace variables with specific values’

once SL=300

once SlowLength = 50

once FastLength = 35

once SlowPipDisplace = 0

once FastPipDisplace = 0

once length = 2

once centertrend = 1

Thanks

Darren

Hello,

Do you use the itf to import it in the platform ? if yes, i can’t see why it keeps asking you to replace variables … :/

Thanks Souhail, in the end i just copy/paste the logic with variables and it works.

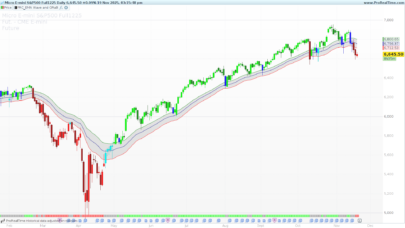

I removed the time function and use on Australia 200 (ASX) and have had good results. Currently testing with 1min and 5min

One thing to note also for DOW trading if using IG, change the buy/sell qty from 1 to 2

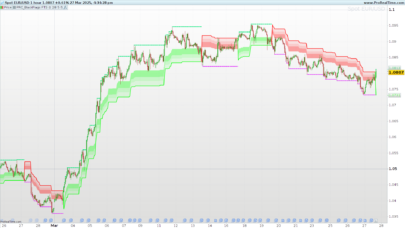

How can I optimize it for DAX 30? Thanks!

hi there, anyone can help making this strategy work, i have a message saying replace variable, what I’m suppose to do?

thanks