Hello everyone,

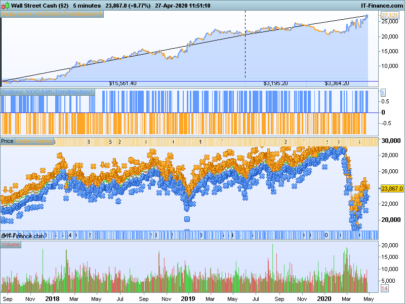

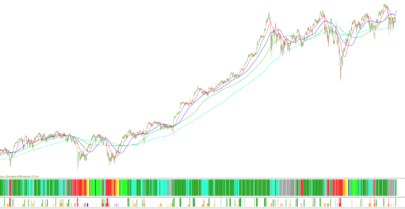

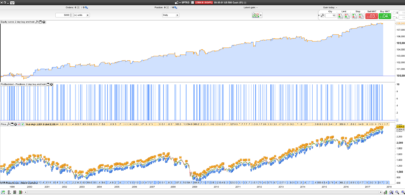

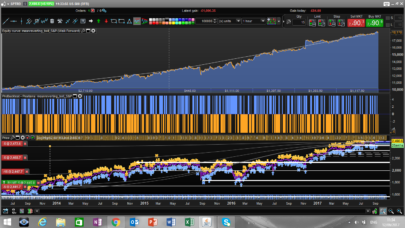

Here is a well-known strategy, and very effective.

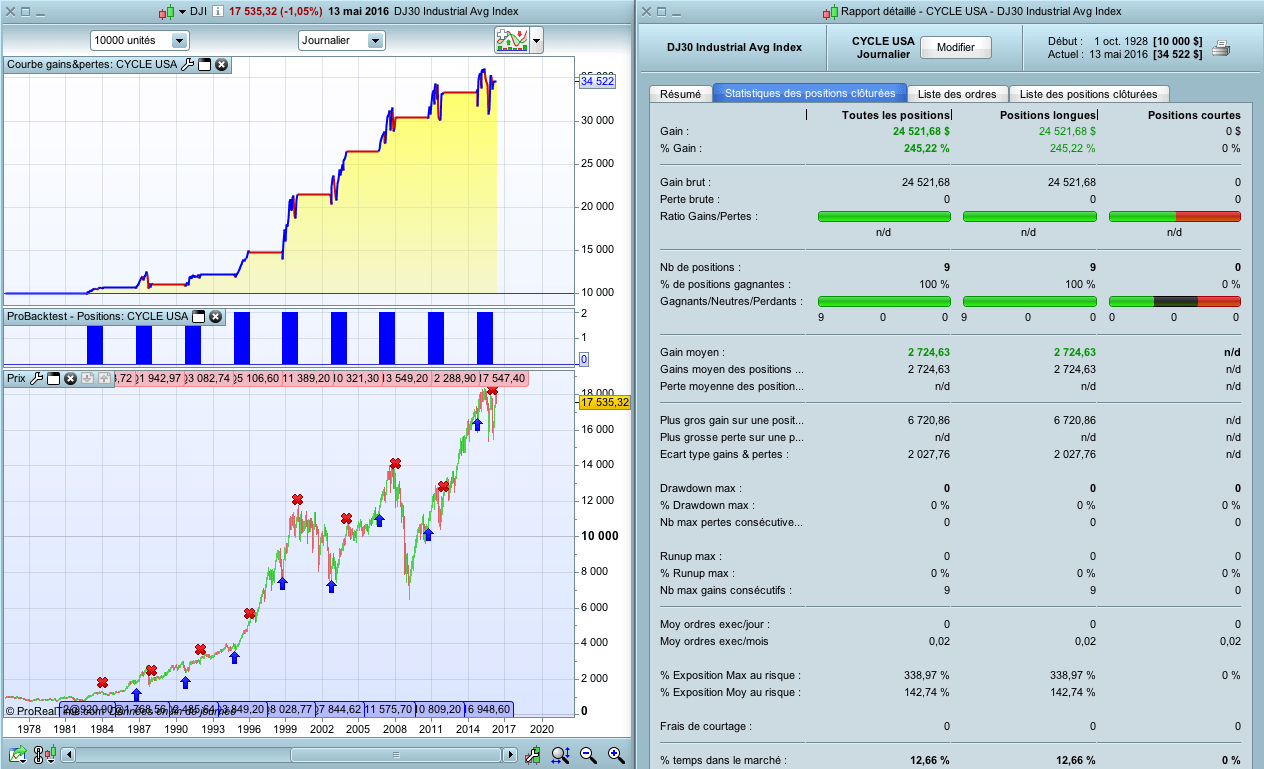

We buy a US index in the 3rd year of the presidential cycle, and sell the following year.

Actually, indices (such as Dow Jones, S&P500) raise because periods of presidential campaigns, whose promises make indices to grow.

I had to adapt some dates with the symbols ” >= ” , because there are days when September 30 for example is not a business day.

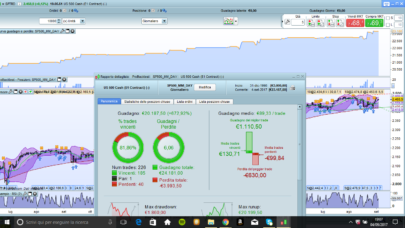

The strategy is profitable nearly each time.

The test was launched since 1982, but actually by launching the strategy in 1932, it is almost always positive (just 2 short years with low losses ).

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 |

// CYCLE PRESIDENTIEL USA Defparam cumulateorders = false //TAILLE DES POSITIONS N = 2 // à adapter selon DJ, S&P500, etc. // CYCLE PRESIDENTIEL DE 4 ANS ANNEEDEBUT = 1982 IF year >= (ANNEEDEBUT + CYCL) and month >= 09 and day >= 25 THEN buy n shares at market ENDIF IF year >= (ANNEEDEBUT + CYCL + 1) and month >= 12 and day >= 25 THEN sell at market CYCL = CYCL + 4 ENDIF |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

This did not expect .. 🙂

Thanks Doctrading for sharing

Is this Daily Time frame?

Hello,

Yes, it is daily timeframe.

Good job.