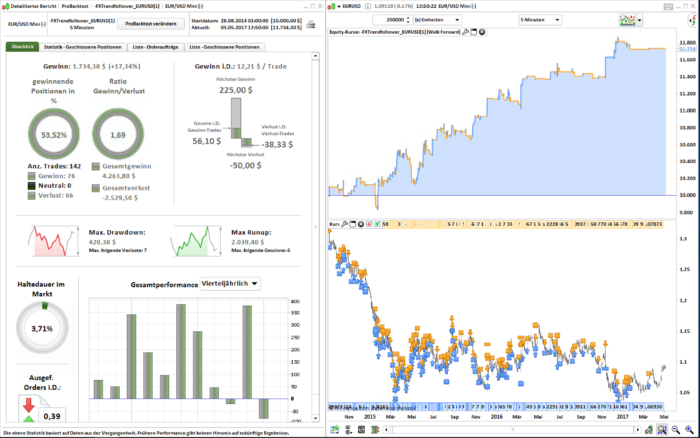

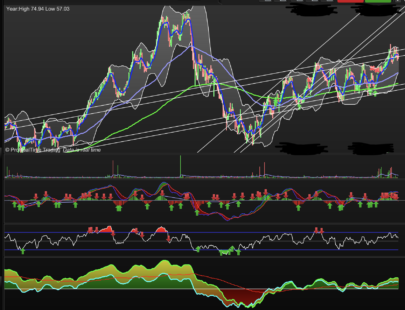

The algorithm is searching for situations, where the range of the last 8 bars is wider than 60 pips. Opens a long position if the close is above and a short positions if the close is below the range.

Unfortunately I only have backtest data since 11/2015 for the 5 minute chart. Maybe somebody can backtest with more data? Thanks!

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 |

// Timeframe M5 // EURUSD (IG - Markets) // Spread 2 pips DEFPARAM CumulateOrders = False DEFPARAM FLATBEFORE = 080000 DEFPARAM FLATAFTER = 210000 IF (abs(close-open[8]) > 0.006) THEN IF (close > open[8]) THEN BUY 1 CONTRACTS AT MARKET SET STOP pLOSS 50 SET TARGET pPROFIT 225 ENDIF IF (close < open[8]) THEN SELLSHORT 1 CONTRACTS AT MARKET SET STOP pLOSS 50 SET TARGET pPROFIT 225 ENDIF ENDIF |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thumbs up for considering your stop loss and take profit that generates RR more that 1

Cheers Kasper

Here is another spin on your code that aslo works nicely;

// Timeframe M5

// EURUSD (IG - Markets)

// Spread 2 pips

DEFPARAM CumulateOrders = False

DEFPARAM FLATBEFORE = 080000

DEFPARAM FLATAFTER = 220000

possize = 1

rng = 0

HighestClose = close[8]

LowestClose = close[8]

pips = 0.0019

For i = 1 to 8 Do

IF (abs(close-open[i]) > pips) THEN

rng = rng + 1

EndIf

If close[i] > HighestClose then

HighestClose = high[i]

ElsIf close[i] < LowestClose then

LowestClose = close[i]

EndIf

Next

If rng >= 4 and (abs(close-open) > pips) then

IF close > HighestClose THEN

BUY possize CONTRACTS AT MARKET

ElsIF close < LowestClose THEN

SELLSHORT possize CONTRACTS AT MARKET

ENDIF

EndIf

SET STOP pLOSS 50

SET TARGET pPROFIT 225

Thanks!!!

Here are another small tweak (just check Flatafter time as I am in a different timezone);

// Timeframe M5

// EURUSD (IG - Markets)

// Spread 2 pips

DEFPARAM CumulateOrders = False

DEFPARAM FLATBEFORE = 080000

DEFPARAM FLATAFTER = 220000

possize = 5

f = 12

pips = 0.0019

rng = 0

HighestClose = close[f]

LowestClose = close[f]

For i = 1 to f Do

IF (abs(close-open[i]) > pips) THEN

rng = rng + 1

EndIf

If close[i] > HighestClose then

HighestClose = high[i]

ElsIf close[i] < LowestClose then

LowestClose = close[i]

EndIf

Next

If rng >= 4 and (abs(close-open) > pips) then

IF close > HighestClose THEN

BUY possize CONTRACTS AT OPEN + averagetruerange[f](close) stop

SELLSHORT possize CONTRACTS AT OPEN - averagetruerange[f](close)*3 stop

ElsIF close < LowestClose THEN

SELLSHORT possize CONTRACTS AT OPEN - averagetruerange[f](close) stop

BUY possize CONTRACTS AT OPEN + averagetruerange[f](close)*3 stop

ENDIF

EndIf

SET STOP pLOSS 50

SET TARGET pPROFIT 320

Also change the ATR multiplier to 2 instead of 3. Slightly better drawdown.

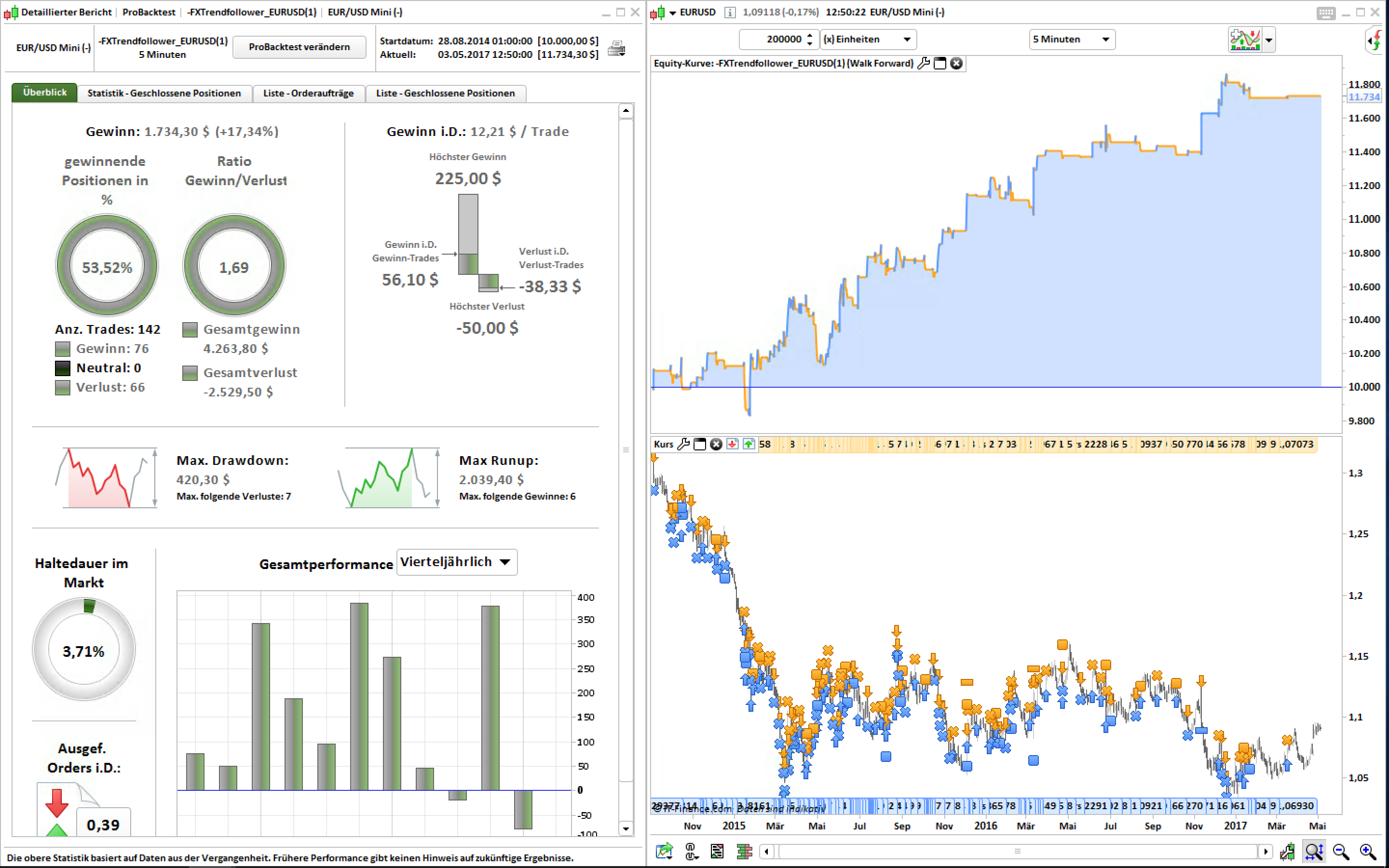

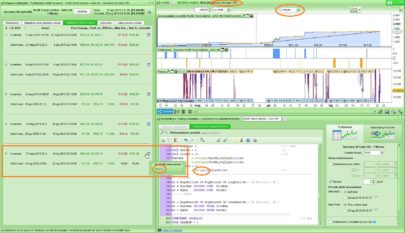

I started he thread below as I get the results shown on image below. Please help on the Forum thread.

https://www.prorealcode.com/topic/trendfollower-eurusd-5m/

Hi Everybody,

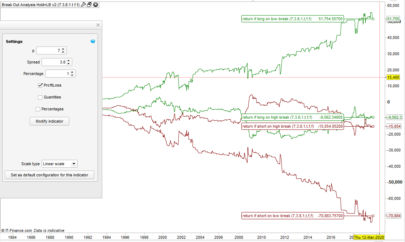

when I look at the strategy I felt the need to implement a Moneymanagement-System. Because I cant Prog this by myself, I took Kasper’s reinvestment version Code from “ALE’s Fractals breakout intraday Strategy EUR/USD 1H” and ty to implement it. Mayby it looks a little bit rudimentary, but it seems to be working! I couldn’t believe my eyes! I also take some different Numbers. Does someone get similar results (Spread: 1,5 Pips)?

Here is the code:

// Timeframe M5// Timeframe M5

// EURUSD (IG - Markets)

// Spread 2 pips

DEFPARAM CumulateOrders = False

DEFPARAM FLATBEFORE = 080000

DEFPARAM FLATAFTER = 210000

Reinvest=1

if reinvest then

Capital = 10000

Risk = 1//0.1//in % pr position

StopLoss = 26

REM Calculate contracts

equity = Capital + StrategyProfit

maxrisk = round(equity*(Risk/100))

MAXpositionsize=5000

MINpositionsize=1

Positionsize= MAX(MINpositionsize,MIN(MAXpositionsize,abs(round((maxrisk/StopLoss)))))//*Pointsize))))

else

Positionsize=1

StopLoss = 26

Endif

IF (abs(close-open[2]) > 0.006) THEN

IF (close > open[2]) THEN

BUY positionsize CONTRACT AT MARKET

set stop loss stoploss*pointsize

SET TARGET pPROFIT 191

ENDIF

IF (close < open[2]) THEN

SELLSHORT positionsize CONTRACT AT MARKET

set stop loss stoploss*pointsize

SET TARGET pPROFIT 191

ENDIF

ENDIF

I would like to upload a picture but for some reason it did not work.

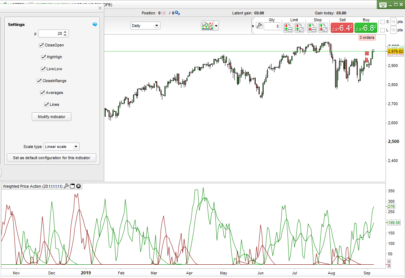

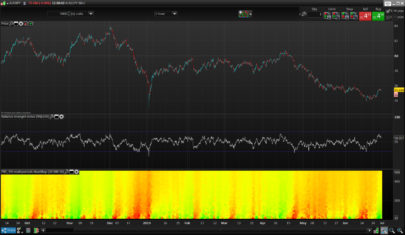

Results in 3 Jears on 15min Timeframe (EUR/USD) from Juli 2015 till now: From 10.000 to 22.344 $ (without MM)From 10.000 to 236.428 $ (with MM)

<// Timeframe M15

// EURUSD (IG - Markets)

// Spread 2 pips

DEFPARAM CumulateOrders = False

DEFPARAM FLATBEFORE = 080000

DEFPARAM FLATAFTER = 210000

TS = 25 // 35 default

SL = 50

PT = 80

m = 8 // 8 default

once startpositionsize=1

once positionsize=startpositionsize

once flatoverweekends=1

once startequity=0

once Reinvest=1

if reinvest then

//------------ Fixed fraction money management ----------

once multiplier=1

once delta=100 // newlevel then

multiplier=multiplier+1

oldlevel=newlevel

newlevel=strategyprofit+startequity+multiplier*fraction

positionsize=multiplier*startpositionsize

elsif strategyprofit+startequity=2 then

newlevel=strategyprofit+startequity

oldlevel=strategyprofit+startequity-multiplier*fraction

multiplier=multiplier-1

positionsize=multiplier*startpositionsize

endif

Endif

if flatoverweekends then

//————— daylight-saving corrections ——————

if currentmonth=3 and day>=15 then

dlc=10000

elsif currentmonth=11 and day=(223000-dlc))

else

fridaynight=0

endif

if fridaynight then

if longonmarket then

sell at market

elsif shortonmarket then

exitshort at market

endif

endif

REM Conditions to enter long hereafter

IF (abs(close-open[m]) > 0.006) THEN

IF (close > open[m]) THEN

BUY positionsize CONTRACTS AT MARKET

SET STOP pLOSS SL

SET TARGET pPROFIT PT

ENDIF

ENDIF

//trailing stop

trailingstop = TS

if not onmarket then

MAXPRICE = 0

priceexit = 0

endif

//LONG order

if longonmarket then

MAXPRICE = MAX(MAXPRICE,close) //saving the MFE of the current trade

if MAXPRICE-tradeprice(1)>=trailingstop*pointsize then //if the MFE is higher than the trailingstop then

priceexit = MAXPRICE-trailingstop*pointsize //set the exit price at the MFE – trailing stop price level

endif

endif

//exit on trailing stop price levels

if onmarket and priceexit>0 then

EXITSHORT AT priceexit STOP

SELL AT priceexit STOP

endif

SET STOP ploss SL//

>

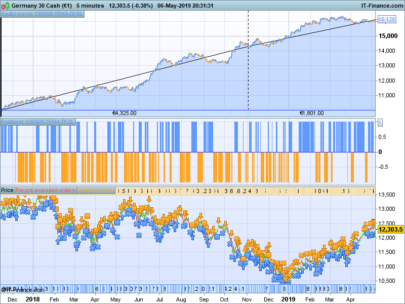

Hi Bjoern, I was playing around with your code this morning (EUR/USD 5′).

Thank you to the community for the piece of code (Despair for the MM module…).