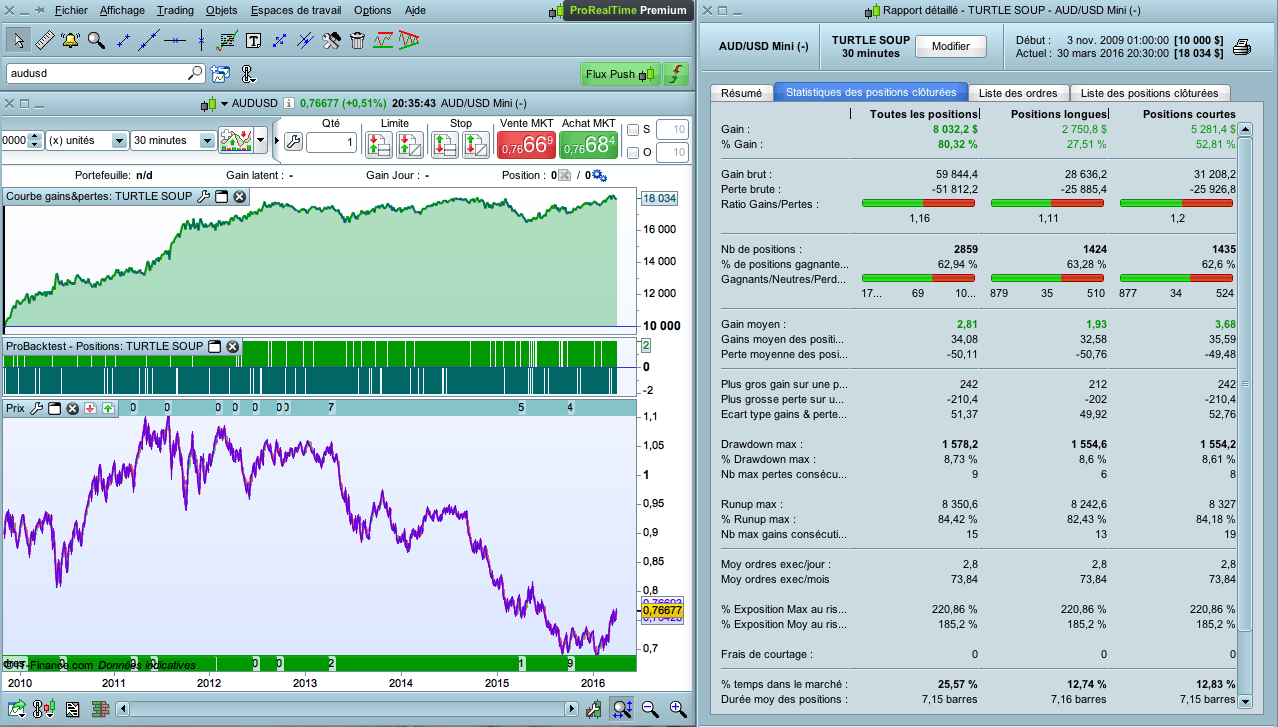

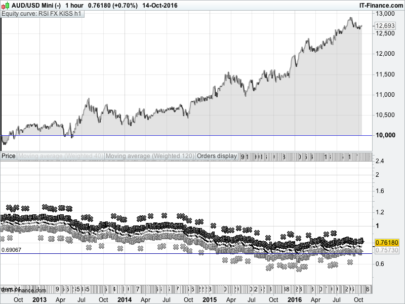

I recently discovered this strategy Linda Bradford Raschke.

Everyone knows the mythical “Turtle strategy”. The problem is that it is not performing with forex.

This new strategy applies in forex, with modified parameters, which are a bit like the strategy of turtles.

It applies in M30 timeframe.

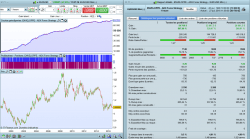

I’m a little disappointed with the results overall (bad profit factor), even is the strategy is profitable on the long term, with most forex pairs. I have checked my code, there is no error.

Too bad we can not go before the backtest 2010 with PRT (the website where I saw the backtest showed tests since 2006, with good growth in capital curves).

In any case it remains promising, there are probably ways to improve the code.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 |

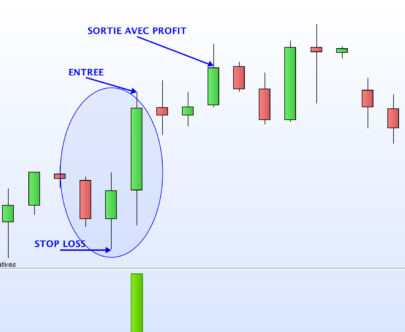

DEFPARAM CumulateOrders = False n = 2 // Conditions pour ouvrir une position acheteuse c1 = close < lowest[5](low)[1] c2 = ExponentialAverage[21](close) > ExponentialAverage[30](close) ctime = time > 060000 and time < 220000 IF c1 AND c2 and ctime THEN BUY n CONTRACT AT MARKET nextbaropen ENDIF // Conditions pour fermer une position acheteuse c3 = high > highest[5](high)[1] IF c3 THEN SELL AT MARKET ENDIF // Conditions pour ouvrir une position vendeuse c1 = close > highest[5](high)[1] c2 = ExponentialAverage[21](close) < ExponentialAverage[30](close) ctime = time > 060000 and time < 220000 IF c1 AND c2 and ctime THEN SELLSHORT n CONTRACT AT MARKET nextbaropen ENDIF // Conditions pour fermer une position vendeuse c3 = low < lowest[5](low)[1] IF c3 THEN EXITSHORT AT MARKET ENDIF // Stops et objectifs SET STOP LOSS 3*AverageTrueRange[20](close) |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

If im running this system on the Nikkei from Germany. The difference in time from Germany to Japan are 7 hours.

So if i want the system to start at 6 o clock in Japan do i have to put in

ctime = time > 230000 and time < 150000

or does PRT automatically change the Time Zones?

i am running this on the cac 5m time frame but the results are very different from the backtest?

Hello,

The trading hours depend of your broker.

So you must change the Ctime.

But before running it, make some verifications.

Best regards,

I´m using IG markets

When i change ctime there are 0 results

ctime = time > 230000 and time < 150000

This should be the Times which equal 6 o clock in the morning and 22 o clock in Japan or not?

Btw the Backtest is very positive on the Nikkei

Nice Job 🙂

That a realy great strategy !!!

It’s realy profitable in daily trade.

I’m gonna put some filter on it and I’ll post it in the comment. 😉

Thanks

hello timeframe on what works best and how couples ??grazie