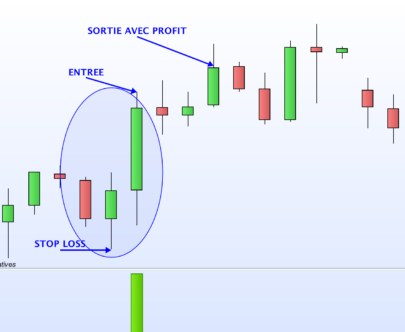

here is the same strategy (other one can be found here) with the parameters adapted to follow the movements of the shares of the famous JP Morgan Chase bank.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 |

//------------------------------------------------------------------------- // Codice principale : Universal XBody Strategy //------------------------------------------------------------------------- //Universal XBody STrategy // instrument: Jp Morgan Chase // timeframe : Daily // Spread: 0.3 // created and coded by davidelaferla //————————————————————————- //------------------------------------------------------------------------- defparam cumulateorders=false //*********************************************************************************************************** //------------------ SYSTEM VARIABLES--------------------------------------- //CAC40 Values: -------------------------------------------- Ottimization info period=578// Optimize best value for each Symbol, range=1-1000, with step=1 mode=2// Optimize the best trading mode , range=1-4, with step=1 invertsignal=1// 1=positive signal, -1=negative signal, range=-1-1, with step=2 //*********************************************************************************************** //------------------ SYSTEM FILTER--------------------------------------- filter1=46// to set after the variable optimization, range=1-100, with step=1 filter2=1// to set after the variable optimization, range=1-100, with step=1 //------------------ INDICATOR --------------------------------------- n=5 giorno=opendayofweek body=close-open var=(body-body[1]) sumvar=summation[period](var) if sumvar>filter1*pipsize then green=(sumvar) endif if sumvar<-filter2*pipsize then red=(sumvar) endif if mode=1 then c1=red<red[1] c2=green>green[1] endif if mode=2 then c1=red>red[1] c2=green<green[1] endif if mode=3 then c1=red<red[1] c2=green<green[1] endif if mode=4 then c1=red>red[1] c2=green>green[1] endif if c1 then signal=1*invertsignal elsif c2 then signal=-1*invertsignal endif // Conditions for entering long positions and exit short positions IF signal>0 and opendayofweek<5 then BUY n contract AT market ENDIF // Conditions for entering short positions and exit long positions IF signal<0 and opendayofweek<5 THEN SELLSHORT n CONTRACTs AT market ENDIF |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

you cant really use 0.3 spread since u got like 5 or 15 dollars cost when you open and close a postion on action . So your backtest isnt actually good .

Hello, how is it possible to optimized the 3 parameters (period, filter1 and filter2) at the same time because combinations number is over than 10000 ? Thank you.

Follow these instructions: first optimize the period and the mode (leaving invertsignal=1 ) , and then optimize filters 1 and 2

Hello daviddelaferla. Ok, but to optimize period and mode, filter1 and filter2 must be 0 or 1, or… ? Thank you

Hello YvesRobert! To optimize period and mode, filter1 and filter2 must be 0

hello, thx for sharing,

but wich broker do you use?

At IG I got the notification “automatic trading not allowed for this instrument”

thanks

Hi Davide,

You have done a great job: I modified a bit your strategy for Nasdaq, and now I am in automatic trading with it.

Musiar können sie den code des automatischen systems teilen.