Forums › ProRealTime English forum › ProOrder support › Pathfinder Trading System › Reply To: Pathfinder Trading System

Don’t worry, in the next version, the bad days will be optimized away…

I have to admit I had to smile about that comment even so my profits seem to melt away with Pathfinder recently. But I still want to highlight that the year 2017 ,when we started (Reiner started

), was very successful. Pathfinder (Backtest) was very profitable because it starts from 2010 and from then onward is was more or less a constant way up. We have unfortunately no comparison to significant corrections like it happened at the beginning of the year and still ongoing. We have to keep in mind Pathfinder is specially profitable in trending bull markets. (Same applies for the Swing System) Personally, I reduced all my positions for now and wait until we enter another bull trend. I still believe in the system but we have to evaluate what it can and what it can’t. Kind regards

You need to remember that we already had a big correction in 2015, bigger than the current one (30% down from the top in DAX), and the pathfinder backtest performed well (i.e., was well optimized) for this period.

In total, when we leave all position sizing away, I count at least 9 adaptable parameters (all stop loss and take profit parameters not considered).

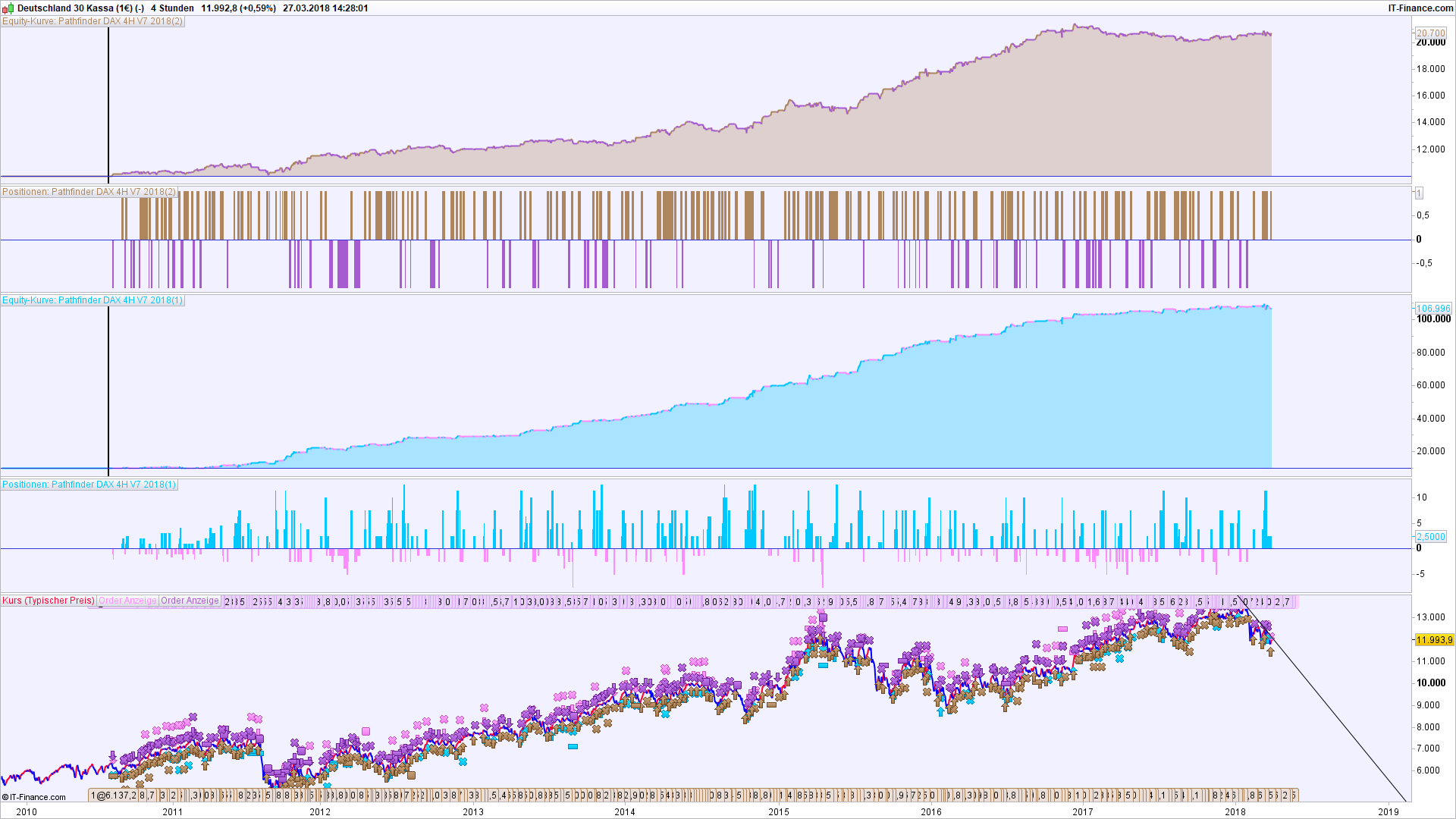

Now look at the result when you take all position sizing and all the seasonal stuff out, which add a lot more of additional adaptable and optimizable parameters.

Position size in the upper equity curve is always 1 for pathfinder DAX 4H V7 2018. The lower curve is the original system with all adaptable and optimized parameters :

), was very successful. Pathfinder (Backtest) was very profitable because it starts from 2010 and from then onward is was more or less a constant way up. We have unfortunately no comparison to significant corrections like it happened at the beginning of the year and still ongoing. We have to keep in mind Pathfinder is specially profitable in trending bull markets. (Same applies for the Swing System) Personally, I reduced all my positions for now and wait until we enter another bull trend. I still believe in the system but we have to evaluate what it can and what it can’t. Kind regards

), was very successful. Pathfinder (Backtest) was very profitable because it starts from 2010 and from then onward is was more or less a constant way up. We have unfortunately no comparison to significant corrections like it happened at the beginning of the year and still ongoing. We have to keep in mind Pathfinder is specially profitable in trending bull markets. (Same applies for the Swing System) Personally, I reduced all my positions for now and wait until we enter another bull trend. I still believe in the system but we have to evaluate what it can and what it can’t. Kind regards