[beta-testing] multi timeframe support for automatic trading, ideas are welcome!

Forums › ProRealTime English forum › ProOrder support › [beta-testing] multi timeframe support for automatic trading, ideas are welcome!

- This topic has 287 replies, 47 voices, and was last updated 5 years ago by

Brianoshea.

Brianoshea.

Tagged: mtf, multitimeframe

-

-

11/03/2018 at 6:06 PM #84097

You must have misspelled something, I think, because having a 4-hour default TF makes it impossible to use lower TF’s within any strategy!

11/03/2018 at 10:30 PM #84103TF makes it impossible to use lower TF’s within any strategy

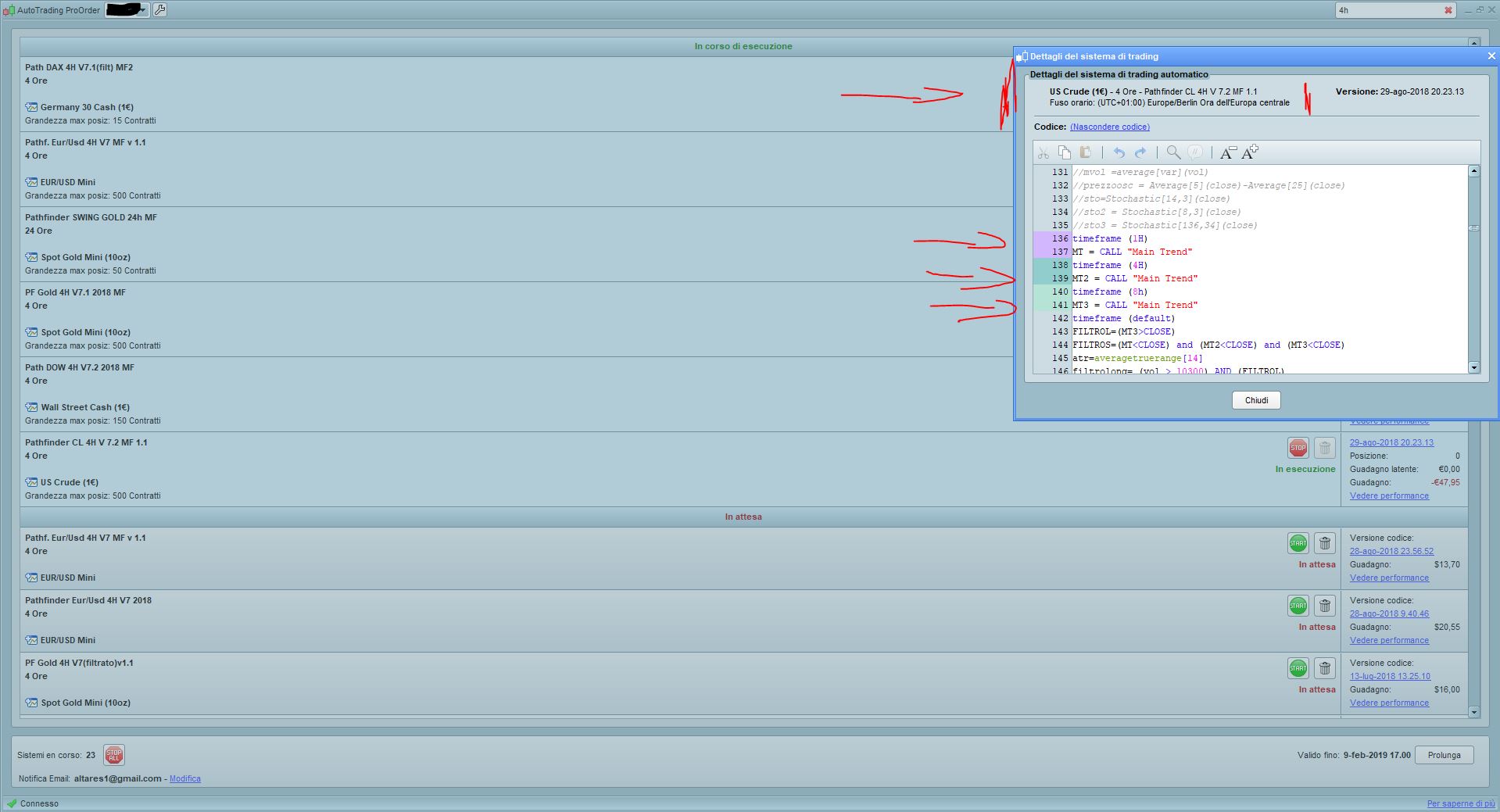

I have it on real. i posted the screenshot.

11/03/2018 at 10:54 PM #84105So if you back test those same strategies do you get the error message telling you to test it on the default/fastest time frame? My guess is that when back tested the platform would give you an error but when put live it does not. You think it is running on a four hour time frame when it is in reality running on the default faster time frame.

Possibly a bug that PRT need to check out.

11/03/2018 at 11:49 PM #84106When I have tried to launch strategies from wrong TF’s I’ve always been given an error message, I can’t figure out why this behavior, provided they really have lower TF’s inside.

It makes no sense, since when launched from a 4-hour TF it would be executed every four hours and the 1-hour piece of code would only be executed once in four hours! That’s why it is not allowed.

11/12/2018 at 7:40 PM #84704Hi,

my idea for multitimeframe coding , would be the following:Timeframe daily:

When, for example, an indicator (generic issue) crosses over other element (e.g mm50 and mm20, etc..), the system should save the higher (MAX) value of the day.. that’s would be simple..Next days (with timeframe 5 minutes) – but only for 2 or maximum 3 days (better if programmable):

after first hour of market (e.g. 10.00am of each day after the previous one), the system should save the maximum and the minimum price of this period (first hour),

then, if the price crosses over the max price (MAX) of the previous day (as I wrote before) AND the maximum price of the first hour, the system

should buy at the market – with (e.g.) 5 pips of threshold-.In order to stop the position, the system should sell ALL at the market if the price crosses under the lower price of the first hour

( of the day where the position is entered.)

Other stop strategy could be valuated in addition..I tried to code that but something seems wrong..

thanks a lot,

leo

11/12/2018 at 7:50 PM #84705can’t figure out why this behavior, provided they really have lower TF’s inside.

It makes no sense, since when launched from a 4-hour TF it would be executed every four hours and the 1-hour piece of code would only be executed once in four hours! That’s why i

There was a week or two when that message of error disappeared, in that days i make that code and luanched others codes. Now that message is back but i have still running those code and they are making trades, some winning some loose.

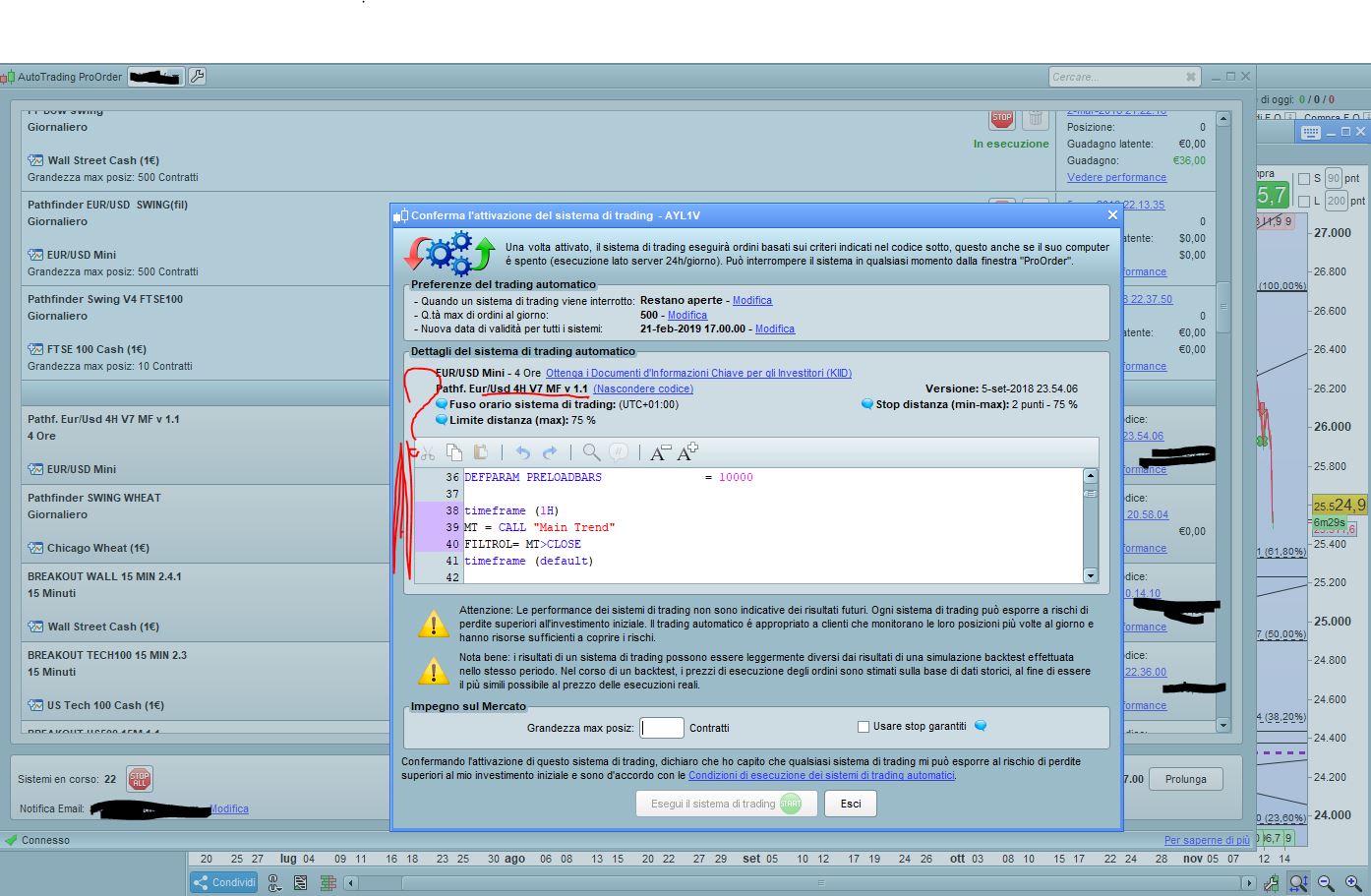

IS INSANE how there is no official support, i wroted an email 3 weeks ago about a couple of bug and i didn’t received any response from it. On friday i had a reply from my request about this post, and the reply was: “Dear Sir xxxx,The technicians have analyzed his Pathf code. Eur / Usd 4H V7 MF v 1.1. The UT of the selected graph must be the smallest of those entered in its code.

If the code uses time frames in 1h, 2h and 4h, you need to select the 1h chart.

With regard,

*****” yes strange, look this picture, i can still launch the code with lower timeframe.Why the support didn’t say that for a couple of week this option was enabled and now no? why nobody say if is reasonable to stop those code or not?

11/13/2018 at 4:36 PM #84765Keep in mind that MTF is still beta and not officially released. You have it activated and that’s really cool for you 😉

About the H timeframe issue, it should now be fixed for ProRealTime trading accounts, there was indeed a problem when the timeframe was declared with H or Hour.

1 user thanked author for this post.

11/13/2018 at 9:22 PM #84791Keep in mind that MTF is still beta and not officially released. You have it activated and that’s really cool for you

About the H timeframe issue, it should now be fixed for ProRealTime trading accounts, there was indeed a problem when the timeframe was declared with H or Hour.

Yes, but the complain wasn’t about the bug, but was about the total leak of information from PRT assistance.

11/29/2018 at 6:41 PM #86030Hello, I use PRT via IG, and MTF doesn’t work in live nor demo. When I ask for the activation, I got the answer that there has been a lot of bugs reported and the project is currently suspended. Did you hear that too? Any further info?

12/02/2018 at 11:04 PM #86215Hi, last week I tested the MTF code found here (and other basic algorithms…) and they work very well on the PRT demo station. According to PRT support, there is no problem, it works the same way with a real account. However, I have some doubts when I see the “lack of exchanges” about MTF automated strategies, whether on this site or on other forums. There are some very interesting strategies into the library which are based on a single TF, but it seems to me that I haven’t seen any MTF strategies yet into the PRC library. Please, would anyone have an explanation about the “small amount” of exchanges about MTF? With the possibility to program MTF automated strategies, this forum would “collapse” under comments. Would not be?

12/03/2018 at 9:18 AM #86223Thank you for this very interesting question. I will try to answer as much as possible. But first, I think you have a very cheerful idea of this new feature.

Indeed, the MTF support is revolutionary for ProOrder, but it adds a new layer of complexity in search of the right strategy, that’s all. The MTF is not the miracle ingredient to find even more better strategies than before its release 🙂I think there are several factors that make it no more topics about this on the forums and in the library:

1. the MTF is still not “live” and most customers do not use a demo account, so they ignore the possibility of the MTF.

2. I know a lot of people who do not talk about it, who is doing very well in trading, and who does not care about the MTF.

3. the fraction of people who use it and understand it do not ask questions.

4. there is less and less strategy posted in the library, because I think we managed to educate the coders on the dangers of curve fitting and especially thanks to the WFA. They are therefore more cautious and post less:

_ people discover that their OOS optimization results are bad.

_ people do OOS tests live and it takes time.

People have less need of other people to reassure themselves about their strategies since the arrival of the WFA, it is an observation.5. The MTF adds a layer of complexity that few people want to tackle

6. Unless I am mistaken, the MTF is not referenced in the ProOrder documentationIn short, and certainly other reasons ..

12/03/2018 at 5:27 PM #8625712/03/2018 at 5:53 PM #8625812/03/2018 at 6:51 PM #86263but any color as to when PRT hopes to finish the debug phase and go live (again)?

With any major platform change I guess we have to consider that there is more than one party involved. There is us the traders, PRT the platform creators and then the broker (IG) that the platform connects to and trades through. All three parties need to be fully satisfied that it does what it says on the tin before putting any major update live otherwise it will be a terrible mess of traders blaming PRT and asking IG for money back and IG blaming PRT to try to avoid paying and then PRT blaming IG because it was a bug their end.

It is probably best just to sit on our hands and wait until everyone is fully satisfied that it works as losing money is easy enough – getting it back after we’ve lost it is the hard bit!

1 user thanked author for this post.

12/04/2018 at 8:53 AM #86283Thank you very much for these detailed answers. This confirms the interrogations I had about MTF in live trading, but this also brings other questions.I have no doubt that many traders are successful with strategies based on a single TF, but I also know that trend following strategies are an interesting way to get a “safer methodology” or to “maximize” our chances to get profitable strategies in the long term. And one of the best ways to follow the trend is to get a MTF convergence. Isn’t it? There may be a lot of traders who, as you say Nicolas, don’t want to annoy themselves with this layer of additional complexity (or also ignore it) and prefer to program strategies by using “rules of three” to define hypothetical periods even if this give them approximate data as you said here. And they may don’t have the need and the time to speak about these strategies and prefer to exchange about strategies under development…

My questions are:

1. If somebody doesn’t have any profitable strategies in its strategies portfolio, would it not be wise to prospect for a trend following strategy based on MTF (whether with this future feature or through “rules of three”) rather than looking at single TF strategies?

2. This may seems like a very basic question, but why in automated trading it seems there aren’t strategies that are know to all? In manual trading, it is obvious that various traders psychologies cannot make this or that strategy emerge above all others. But in automated trading (and with the absence of psychological factor) only few strategies must be used by many traders. Isn’t it?

3. You said you “managed to educate the coders on the dangers of curve fitting and especially thanks to the WFA” and “people discover that their OOS optimization results are bad”. I am sorry but I don’t understand what “curve fiitting”, “WFA” and “OSS” are meaning. Could you please explain what these terms mean? Or please give me a link where find some explanations?Of course no need to be impatient to use this new feature if this one is not operational for now. As Vonasi said wait until all parts are fully satisfied.

I am sincerely sorry for all these questions and if I get a little bit out of the subject…

-

AuthorPosts

Find exclusive trading pro-tools on