Done !

It confirms what I said previsously

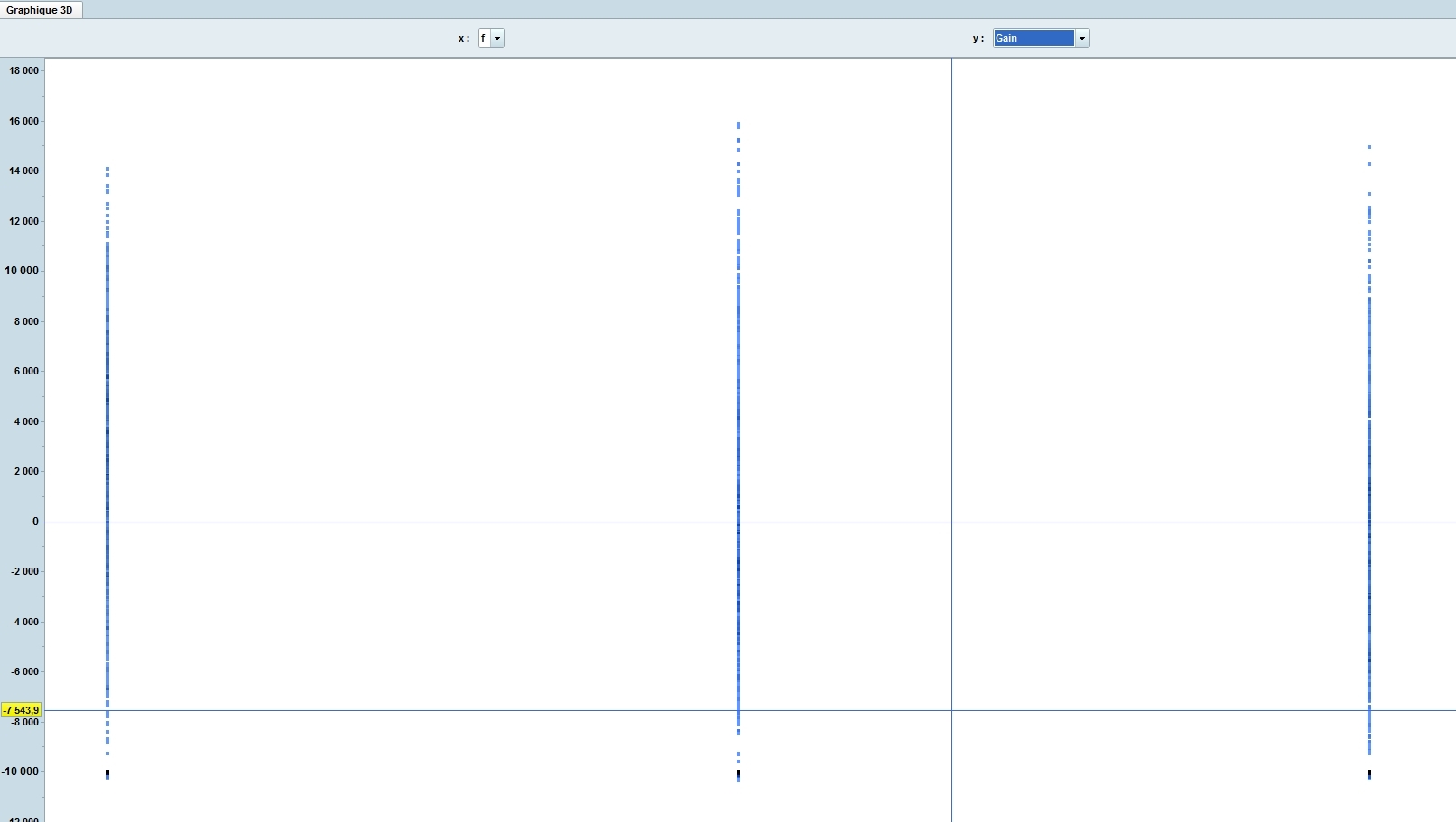

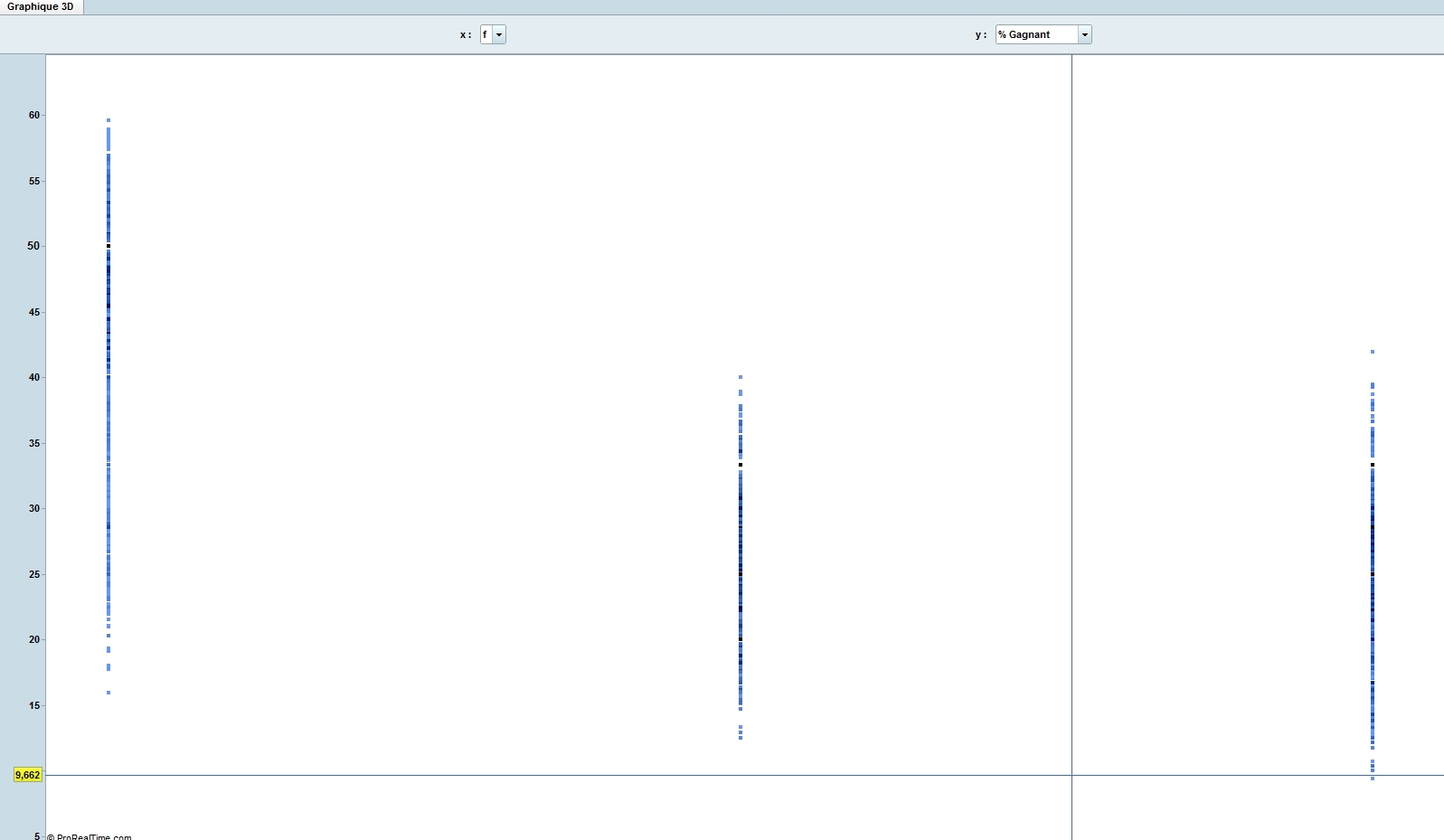

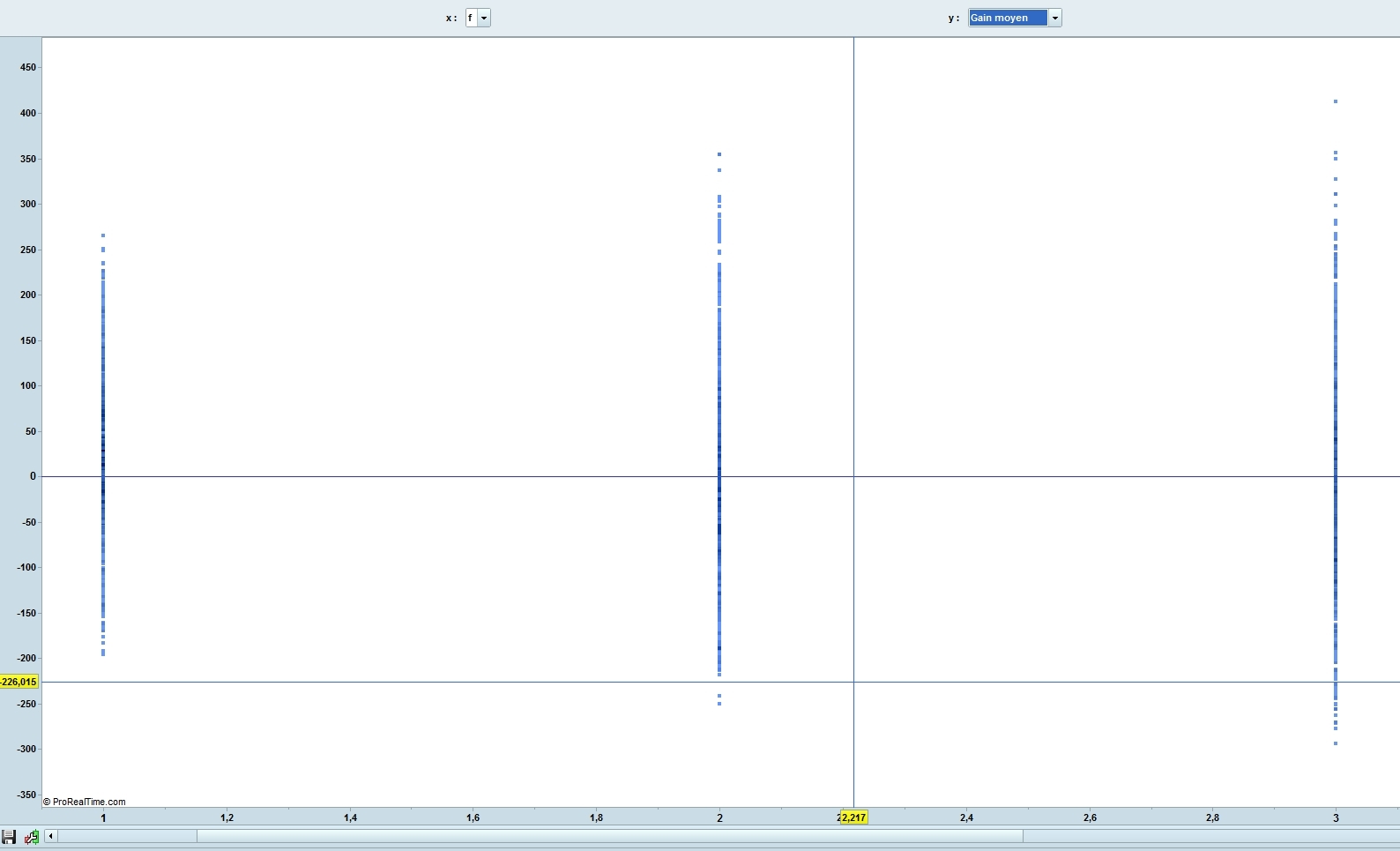

See the pictures

As you see : The total gain is quite the same between f=1=No BE or f>1 with Trailing stop and BE

When f=1 the % of winning trade is higher compare when f>1

But when f=1 the average gain is less important = you win more / trade when f>1 (but remember we have less winning trades)

In conclusion, as I said before and to reduce my stress notably…I use generally f=1 with No Trailing Stop and No Breakeven who seems to be unuseful

This is MY experience and MY tests, may be you can do yours to compare

Have a nice day

Zilliq