@Kenneth: Intresting strategy, thanks for sharing. What do you mean by “make it take position after 30~40pips after every signal”. Do you mean the position size shall increase every 30 pips?

And for your averaging down, once the position is 50-70 pips in drawdown you double the position size?

What I mean is that when the taken position is in lets say minus 30-60 pips or whatever we take and buy one more contract and set the stop and target and trailfunction exacly the same as the firt position taken. I belive its called avrage down .

https://www.prorealcode.com/blog/trading/averaging-techniques-automated-trading/

OK, I will try to incorporate that.

But you also propose adding to a winning position?

I made a new version of your system. I made the following changes:

- all positions are closed friday night (I don’t like holding a volatile asset like crude over the weekend)

- I added a dynamic take profit

- I changed the trailing stop to an atr-dependand stop

- I added the averaging down function you described

I also tried making the initial stop loss atr-based but the results did not improve so I went with the original fix stop loss.

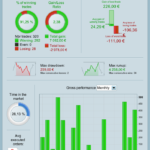

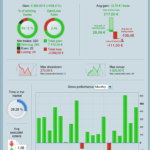

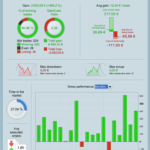

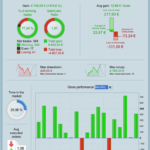

I attached the results I achieved. First your original version, then my version (2.1 WE) with dynamic take profit and different trailing (i ran all systems with only one contract) which shows only a little improvement to your version. Then my version but exiting all open positions friday night (2.1 NOWE; little worse result but less risk). Finally my version with averaging down (2.1 NOWEAD) after 30 pips DD (you can change after how many pips drawdown the system averages down with the parameter adthreshold).

As you see my version without averaging down gives a slightly better average gain of winning trades and but also little higher max DD. Closing all trades friday night (2nd from the right) reduces the result some but the gain of average winning trade is little higher and the losers are little smaller than with the original version. Anyway I prefer this version inspite of the lower profit because I really do not want to hold positions over the weekend.

The version to the right with activated averaging down (you can turn it on/off with the parameter averagedown=0/1) produces most profit of all versions but also increases DD significantly.

Judge yourself…

And here is the code of my version (I could obviously only attach 4 files to the message before)…

I added some MM. Now the equity curve starts to look appealing. 😛

Great work Despair. I will have a look at this when I have time.

Dont know what MM you have made but I did a martin gale on it and also got sick gains;)

I added fixed fraction MM that I use in almost all my live strategies. It is just increasing the position size when there is profit (and reducing it again after losses). It is not as risky as martingale.

I find your strategy really interesting. It also seems to be adaptable to other assets. If you trade this live, what is your experience how often the parameters should be re optimized and which parameters do you re optimize? I assume the periods of the moving averages. Do you also re optimize the SMI?

I havent run this strategy to long live. I have primarly done tests, changed parameters and made sure how it has responded comapre to backtest ect.

Thsi strategy seems to always do the same as backtest, and all the backtests that I have done it seems to me that moving average +/- 10-30 dosent change much.

Same with smiparameters that are set now I dont change.

What really makes diffrens is trailingstop and set stop and target. Does 3 parameters is the one that can and will change the profit/losses the most.

To have set stop lower than 70 seems to be little gain loss ratio. I like to have gain/loss ratio close to 2 and over.

Evan if you optimise and Gain loss ratio are under 2 it can give same or close to same gain over time as ratio over 2, but I preffere to have months or evan weeks in gain vs loss.

I see, anyway i think one should re optimize the MA periods frequently. In my WFA the parameters seems to be rather stable for about 8 months. So I think I will try re optimizing every month with a lookback of about 8-9 months.

Hello Despair,

Can you give me the exact code to increase the size of the position when there is profit (and reduce it again after the losses).

Can it be adapted to a daily strategy?

Thank you<

Hello Despair,

Can you give me the exact code to increase the size of the position when there is profit (and reduce it again after the losses).

Can it be adapted to a daily strategy?

Thank you

Hi Bertholomeo,

Both of us have the same question but please, do not get me wrong, try to read the code by yourself and understand it before doing a simple “copy paste”. You may soon or later apply this bit of code on live to one of your strategy so work on it to understand its action…I am currently doing it to see how it works…And to potentially understand the losses if losses happen, how and when…Again, I am just trying to be preventive…Apologies…