Breakout Strategy for the Dax and Dow Open – Trader Tom

Forums › ProRealTime English forum › ProOrder support › Breakout Strategy for the Dax and Dow Open – Trader Tom

- This topic has 53 replies, 12 voices, and was last updated 3 years ago by

GraHal.

-

-

11/09/2021 at 6:51 AM #181276

https://tradertom.com/breakout-strategy-for-the-dax-and-dow-open/

The world’s simplest strategy but which is proven to make money in the long run.

Breakout of the DAX index

- Observe DAX pre-market from 7am until 07.59am.

- Mark the high and the low of those 59 minutes of trading.

- Place a BUY order at the high of the 59 minutes observation period.

- Place a SELL SHORT order at the low of the 59 minutes observation period.

- This obviously needs to be done in the minute before the market opens.You need to be quick.

- You risk 9 points.

- Your target is to make 6 points.If one order is filled, I cancel the other. Some do not. I do.

Breakout of Dow Open

- Observe Dow pre-market from 13:30 until 14:29.

- Mark the high and the low of those 59 minutes of trading.

- Place a BUY order at the high of the 59 minutes observation period.

- Place a SELL SHORT order at the low of the 59 minutes observation period.

- This obviously needs to be done in the minute before the market opens. You need to be quick.

- You risk 9 points.

- Your target is to make 6 points, but I always go for more.

Would this be possible to code?

11/09/2021 at 10:31 AM #18129211/09/2021 at 12:12 PM #181297Murre,

This is a good system with the same idea, you can change the parameters as you please… for instance you can set the range from 7 to 7.59, the target profit and so on…

Good Luck

11/09/2021 at 1:00 PM #181305Try this:

1234567891011121314151617181920212223DEFPARAM cumulateOrders = false//-----------------------------------------timeframe (1 minute)OTD = Barindex - TradeIndex(1) > IntradayBarIndex //one trade X daystartHour = 080000cTime = time >= startHour//------------------------------------------------------if openTime = 070000 thenmyHighest = highmyLowest = lowendifif openTime >= 070000 and openTime <=075900 thenmyHighest = max (myHighest,high)myLowest = min (myLowest,low)endif//--------------------------------------------------------------if not onMarket and cTime and OTD thenbuy 1 contract at myHighest + (1*pointSize) stopsellShort 1 contract at myLowest - (1*pointSize) stopendif//-----------------------------------------------------------------set stop pLoss 9set target pProfit 61 user thanked author for this post.

11/09/2021 at 1:53 PM #18130711/09/2021 at 2:30 PM #181310<span class=”bbp-author-name”>@murre87</span>

Hi, I tested the strategy as written on the DAX and it does not seem to work! I moved the hour to the open and it wins 100% of the time with a tweak using a 5 mon bar for direction backtested 100,000 units. See attached.

I will try a premarket tweak and see what tI can do!

11/09/2021 at 3:00 PM #18131311/09/2021 at 6:45 PM #18132711/09/2021 at 7:25 PM #181331Thanks SMP.

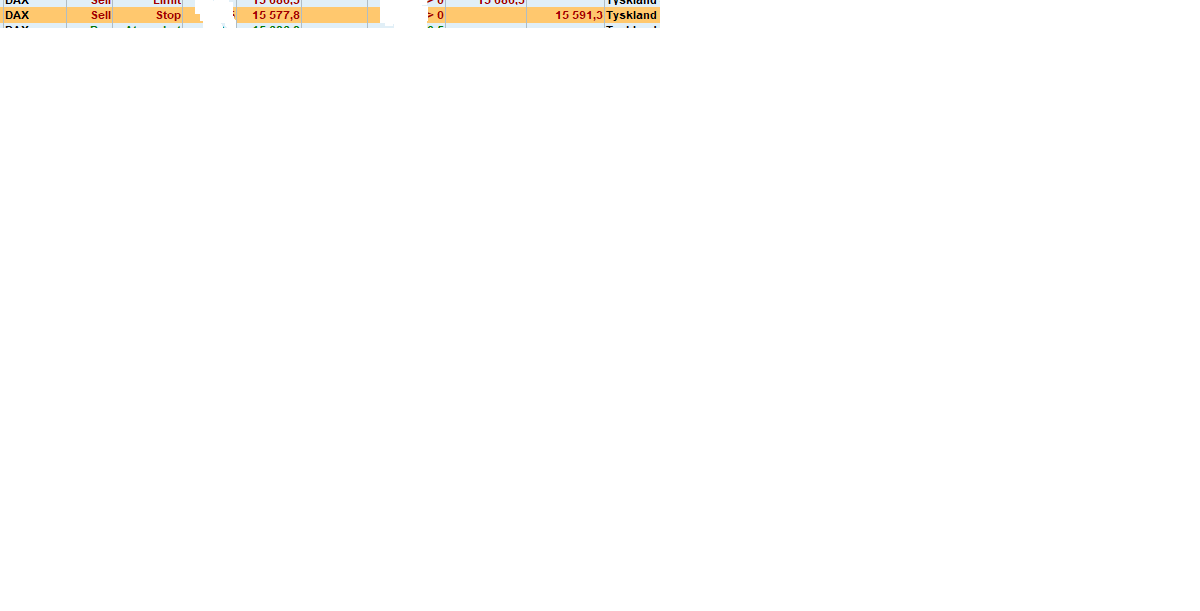

Ur code in text. Im not getting same result as u. See last week..

Early Bird DAX V1.012345678910111213141516171819202122232425262728293031323334353637383940414243444546474849505152535455565758596061626364656667686970717273747576//Early Bird Breakout Stratgy v1.0//November 9th 2021//www.harkoltd.com//==========================================================// Definition of code parameters//UTC+1DEFPARAM CumulateOrders = False // Cumulating positions deactivated// Cancel all pending orders and close all positions at the "FLATAFTER" timeDEFPARAM FLATAFTER = 130000// Prevents the system from placing new orders to enter the market or increase position size after the specified timenoEntryAfterTime = 110000timeEnterAfter = time < noEntryAfterTime//==========================================================// Prevents the system from placing new orders on specified days of the weekdaysForbiddenEntry = OpenDayOfWeek = 6 OR OpenDayOfWeek = 0//==========================================================//Stake limited to 1.5% aiming at 2.6% return, stop and profitStake=11.5Spread=1maxstop=13//9Takeprofit=23//6//==========================================================//Limit to one tradeTrade = Barindex - TradeIndex(1) > IntradayBarIndex//==========================================================//Trading spread, entry of half spreadIf Spread = 1 THENSpreadEntry = 0.5ELSESpreadEntry = SpreadENDIF//==========================================================//Leading breakout directionTimeframe (5 MINUTE)EMA1 = ExponentialAverage[10](close)EMA2 = ExponentialAverage[12](close)IF EMA1 > EMA2 AND EMA1 > EMA1[1] AND EMA2 > EMA2[1] THENLongNotShort = 1ENDIFIF EMA1 < EMA2 AND EMA1 < EMA1[1] AND EMA2 < EMA2[1] THENLongNotShort = 0ENDIFIF abs(EMA1 - EMA2) < 1 THENLongNotShort = 0.5ENDIF//==========================================================//Entry timeframeTimeframe (1 minute)Opening = 090000Start = time >=Openingif openTime = 080000 thenmyHighest = highmyLowest = lowendifif openTime >= 080000 and openTime <=085900 thenmyHighest = max (myHighest,high)myLowest = min (myLowest,low)endif//==========================================================If Start and Trade and timeEnterAfter and not daysForbiddenEntry then// Conditions to enter long positions (0.5pt break)IF LongNotShort = 1 THENBuyPrice = myHighest + SpreadEntry + 0.5BUY stake PERPOINT AT BuyPrice stopENDIF// Conditions to enter short positionsIF LongNotShort = 0 THENSellPrice = myLowest - SpreadEntry - 0.5SELLSHORT stake PERPOINT AT SellPrice stopENDIFSET STOP LOSS MaxstopSET TARGET pPROFIT TakeProfitendif11/09/2021 at 9:27 PM #18133711/09/2021 at 11:32 PM #18134511/10/2021 at 6:41 AM #18135011/10/2021 at 8:54 AM #18135211/10/2021 at 9:09 AM #181355The 3 lines are allowed, but the first one is immediately overridden by the second line, as only one STOP can be used and it’s always the last one executed.

Lines are read and executed sequentially.

11/10/2021 at 9:15 AM #181356 -

AuthorPosts