Feel like giving up?

Forums › ProRealTime English forum › General trading discussions › Feel like giving up?

- This topic has 29 replies, 7 voices, and was last updated 6 years ago by

Leo.

-

-

10/08/2018 at 1:51 PM #82280

Dont.

I was listening to the “better system trader” podcast and there was a guest talking about “inner motivation” and how many people sort of fall into trading, not because they have always wanted to trade. But rather because they felt like life was missing something, that their lives are not what they dreamed about when they where kids…. and here comes this life changing thing called “Trading”.

Trade your way to riches is the first thought that 9/10 people think when they first realized that you can make money by trading the markets. But if that’s your only motivation, then every trade you do is going to feel like life or death.. Screwing up trades are gonna hurt x10 more than they should. Further more, screwing up a trade means that the money you invested in your own idea, and the time youve spent developing this idea, is wrong. Something like “Youre wrong and you shouldnt even try” is a thought E.V.E.R.Y trader gets sometime in his or hers career. Maybe they just thought it once, when they screwed up their first trade. Some might think it every time they loose a trade. Or maybe just once a year when the mood is low and bad.. However many times you might have felt like this, or thought something similar, just know that this is the breaking point of people. This is when “people” give up and start doing other stuff than trading. If you’re serious about trading, this is the hard part that you have to get thru. This is the “grit” part of it, this is the “work” that you gotta put in. Anyone can scroll thru a forum, anyone can make an algorithm (profitable or not). But if you’re serious about making money in the market, you gotta just keep on pushing like there’s no tomorrow.

Don’t get me wrong, its OK to take breaks. Its OK not to dedicate every minute of your life to this. But if you wanna make serious profits, if you wanna make great systems, then be prepared for the grit. Prepare yourself mentally for the hard time that are 100% sure to come, again and again. Even great pro traders have moments of doubts and fear. Its the determination and grit that separates real traders from wannabes who’s out the game next month when the market hits their account hard!

Keep on grinding guys, don’t give up because things look dark just then and there.

10/12/2018 at 5:03 PM #8266210/12/2018 at 5:41 PM #82673With the recent big falls in the major indices I feel we may be at one of those times when a lot of people throw up their hands in desperation and give up trading saying ‘I didn’t see that coming’ whereas those who have been putting in the time and effort will be looking at the charts and saying ‘That’s interesting, this is probably a good buying opportunity’.

1 user thanked author for this post.

10/17/2018 at 8:27 AM #82937This is what we live for booooys! (and maybe girl?) hehe

Yesterday was INSANE for my part at least, most big indicies up 2-3% means big bucks and winning back the losses from the “crash” the other day.

If you know you got good strategies, just hold on! Dont panic. Let the systems work!

10/17/2018 at 10:26 AM #82957With the recent big falls in the major indices I feel we may be at one of those times when a lot of people throw up their hands in desperation and give up trading saying ‘I didn’t see that coming’ whereas those who have been putting in the time and effort will be looking at the charts and saying ‘That’s interesting, this is probably a good buying opportunity’.

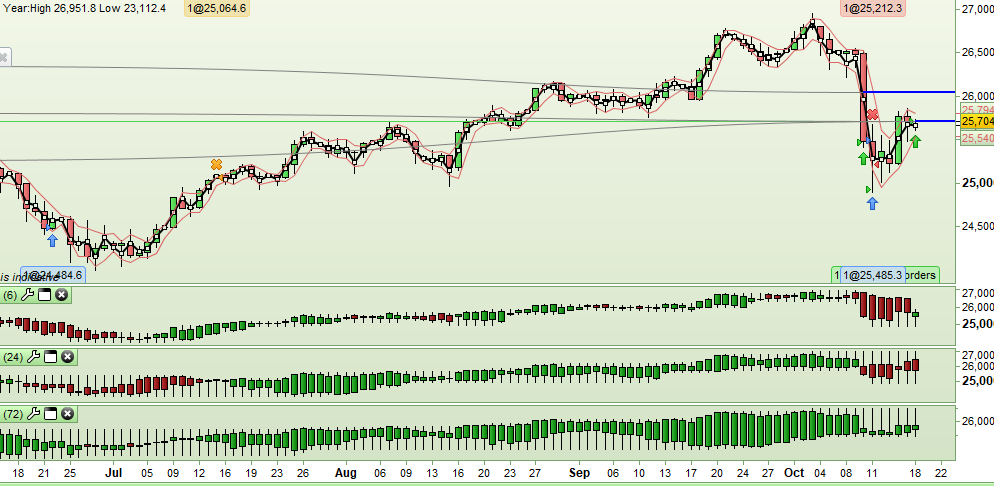

No doubt a tough time for those not prepared BUT there are ways to be aware a downturn is coming although predicting the depth of downturn not so easy . Patterns exist in market conditions that give a headsup that a downturn probability is increasing , you just have to look real hard. NQ as example here , big prize for those who can reverse engineer this … the lows are indicated here but the highs are just inverted signal

The point is dont give up easily , once you know the problem solutions become easier , what is a commonality in market swing highs ? how can we define it mathematically? what is the efficacy of the setup and is it exploitable . System development is all about answering the questions , work out the question that need to be asked goes a long way to that end

10/17/2018 at 2:40 PM #82978big prize for those who can reverse engineer this …

Long term average over standard deviation around a short term mean?

10/18/2018 at 1:31 AM #83027big prize for those who can reverse engineer this …

Long term average over standard deviation around a short term mean?

You are sort of warm , lets say cool side of warm . The point im trying to make is what questions do you ask of indice ( what i trade mostly so is my focus) during 2018 that will give insite into whats about to occur next with a degree of probability . I understand this website is about learning to code and it does that job fantastically and Nicholas and the crew are to be commended for doing a great job in that regard . BUT i see little focus on What to code , what is a leading indicator , what is meaningful ? I personally pursue metrics that i use in price action type styles of trading , now what are these metrics is the questions im not seeing asked enough . What parts of price action are important in giving a probability of what happens next , what question can we ask of this data to define this probability . There is only 3 inputs of data we can manipulate . So what are the important aspects of price action , As a discretionary trader what questions do we ask of PA . If we gather a list of these questions we can then methodically design filters that ask these questions in a defined mathematical sense that can be collated to produce an empirical set of rules . Its the horse and cart thing here guys . Plenty here are great coders and present impressive reams of code but is it LOGICAL , i think many get lost in the code and a form of curve fitting when as what i refer to as technical scientists we should be pursuing controlled experiments . The tools developed here are extremely powerful but much of the coding ability here is wasted . Hope some of this helps and i hope this conversation is explored . cheers

Sidenote i am far from the best coder here but have become reasonably competent with the help of this forum so i am eternally grateful for that . My forte before starting this journey was as a accomplished discretionary trader . I know what to measure and that is a distinct advantage in this game , All im trying to do is elicit some thoughts in that direction

10/18/2018 at 6:51 AM #83034I guess the reason that you don’t see much discussion regarding this is because once most traders work it out and go through their own personal Eureka! moment then they do not feel like giving away for free what they feel they have worked hard to achieve just so that a newbie trader can take a short cut. Ironically most newbie traders would probably find the theories boring compared to an exciting new indicator or over complicated new strategy idea and probably not be very interested anyway.

10/18/2018 at 8:12 AM #83049Maybe this discussion will gain traction , maybe it will die on the vine . It’s no real loss to me either way but i got something to say if interest is shown . I will start here , when you are building an algo what are some of the primary objectives outside the obvious one , making money . What are some of the variables worth measuring/filtering

“A highly successful trader does nothing but follow patterns that exhibit an inefficiency in the market that presents an exploitable edge and rinses and repeats ad nauseum ”

An algo is nothing but a means to mathematize these patterns . How would we go about that ? What are the variables we can measure for starters ? once again outside the obvious x and y axis

Lets see where this leads

1 user thanked author for this post.

10/18/2018 at 9:30 AM #83052once most traders work it

Thing is most dont . I would suggest 5% is incredibly generous , hell 2% is likely pushing it

10/18/2018 at 9:36 AM #83054On the subject of patterns – every candle is a pattern but most people limit themselves to just looking at one candle – a daily one or an hourly one etc. A good way to train your brain that a candle is just a snapshot of a moment in time is to create a set of candles for a different period. In this image there is the standard daily candle and then underneath candles that represent the last 6 days (a week), 24 days (a month approx) and 72 days (3 months approx). It is like having a weekly and monthly and three monthly candle that is updated daily or even on the fly for the latest candle.

A standard weekly candle would close at the end of the week and just give us a snapshot of how the market was at that moment in time whereas this type of candle gives a true feeling for market sentiment at a glance.

10/18/2018 at 9:47 AM #8305910/18/2018 at 11:44 AM #83076I give up searching for those patters you guys are talking about… I do not believe that if you find one pattern then you trade ad nauseum (I create an code for trade double bottoms or double tops, one of the most reliable Patterns and they are not!)

Then I realize that this is what exactly artificial intelligence is about: look in data, search for a pattern, and learn constantly

As you can imagine, prorealtime is not the proper language to build an AI. Then I have two paths:

- Either I learn another programing language, open an account in a broker and learn to use the Interface with the new lenguage, feel confident with the adgorithmic trading with this new methodology and finally learn to write my own code of artificial intelligence with all the libraries that are available for it.

- Or continue with Prorealcode, and write line by line my own IA and being consequent with all the drawbacks we know.

I choose to write my AI code in PRT… and I post it here every time I have a Progress, hoping that some of you can help me with this huge task.

10/18/2018 at 12:17 PM #83079I’m with you on the pattern thing Leo. Trading is not about patterns – it is about value and probability. Buy at a cheap price and when probability is in your favour and you can’t go far wrong. Whether or not the candles or the indicators are making pretty little patterns is completely irrelevant. IMHO.

10/18/2018 at 12:28 PM #83082I get what you are saying , the patterns i look for are in the maths , they arent necessarily visible though often they are visual as well . As a price action trader i wasnt interested in DTs , Db’s and support/resistance in the traditional sense . I was more interested in defining trend and dynamic supp/resist , identifying how and where major reversals are likely , ascertaining best places to enter trends , where momentum explosions take place , how long they last and so on and so on , all about taking the highest probability trades . I know the answer doesnt lie in generic methods , i am all about innovating for imitating is mostly perpetuating shit . I could show you patterns that repeat ad nauseum that have success rates north of 75% but these are my edges and i am not willing to dilute them

I measure things , i dont just make squilly lines of overbought and oversold . I understand exactly what the maths i write is representing . Its not easy and thats what makes this pursuit so rewarding . Its all about taking a structured approach with preset guidelines and benchmarks . I know the ideal expectancy metrics before i start . i break it down bit by bit . I worked on my filters for years before i seriously started bolting them together . I worked on trend regime recognition , i worked on mean reversion measures , i worked on volatility filters , i worked on 2-3 bar reversals , and more .. i did all these as standalone individual items before i seriously started complete algos . Its quantitative and i think thats the huge part thats overlooked , statistical analysis . People are not putting enough focus on the maths with everything on the code . OK todays rant over

Ok clearly my time appears to be wasted here , i am not going to argue . There are no patterns and if this is the case writing code is futile for its all random … massive eye roll …

I was going to show some patterns but im not going to fight against negativity for no reward

-

AuthorPosts

Find exclusive trading pro-tools on