Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

Jeffrey Kennedy Trend Analyzer

-

AuthorPosts

-

Help needed to translate to PRT

In brief it is built using Williams%R, 5 period or 10 period or 15 period, calculated on (ExponentialMovingAverage[5]-ExponentialMovingAverage[20])

I cannot do it…. it gives me error or, anyway, not what is shown below

from: http://indexswingtrader.blogspot.it/2012/05/so-you-think-you-can-count-but-can-you.html

Followers of R.N. Elliott do count waves. This week Pretzel Logic’s Market Charts and Analysis (see blogroll) published a two part Introduction on understanding Elliott Wave Theory. After reading that 101 on counting waves, a handy tool for counting waves and thus analyzing the wave structure would come in handy, right?

It happens some years ago Elliott Wave International’s chief commodity analyst and “Futures Junctures Service” editor Jeffrey Kennedy” presented his Trend Analyzing Tool in a webinar. On Tuesday, 22 December 2009, EWI disclosed the formula to the public on their website.

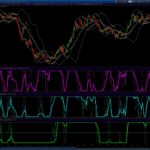

JK Fast Line measures the most immediate, near-term progression of a market’s trend and smallest degree of the Elliott wave structure.

JK Base Line measures the intermediate progression of a market’s trend.

JK Slow Line (not show on screen shot) measures the long-term progression of a market’s trend.In the original JK_TA each panel of the indicator consists of three lines: a 5-period %R, a 10-period %R and a 15-period %R of the line concerned.

A reading of 100 indicates an uptrend. A reading of 0 indicates a downtrend.The JK TA as such is as a proxy for clarifying the underlying Elliott wave structure:

When all three lines in any version are flatlining (blended into one), it signals an impulsive, or motive, structure. See the blue lines in screen shot.

On the other hand, anytime you see the three lines separate, it’s a strong signal that the market is yielding a countertrend, or corrective pattern.The JK_TA can be used on any instrument and on any time frame:

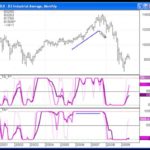

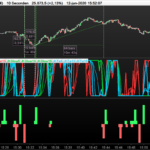

The first, second and third chart depict the basic indicator for different time frames. The fourth chart shows a custom variant of JK_TA: the Fast, Base and Slow lines packed together in one panel, selectable by the 5%R, 10%R or 15%R version of the three indicators.Anyone needing help in counting waves can download the thinkscript studies from the comment section. While the default settings are 5 and 20, these may be adjusted to ones preferences.

Ready? Start counting!

The indicator is based on Williams%R, which is provided in the TOS studies set.The default settings are three different Williams%R lines, each calculated for a

Fast: (20-period exponential moving average) substracted from (5-period exponential moving average)

Base: (5-period exponential moving average)

Slow: (20-period exponential moving average)# Jeffrey Kennedy's Trend Analyzer Tool - JK_TA # Original by Jeffrey Kennedy/Elliott Wave Internatial Inc. # as presented on Tue, 22 December 2009 on www.elliottwave.com # # thinkscript by TrendXplorer # website: www.trendxplorer.info # e-mail: trendxplorer@gmail.com # Revised: May 29, 2012 #hint:Jeffrey Kennedy's Trend Analyzer ToolnWhen all three lines in any version are flatlining as one, it signals an impulsive, or motive, structure.nAnytime the three lines separate, it's a strong signal that the market is yielding a countertrend, or corrective, pattern. #hint setting: select Fast, Base or Slow version of the 5-period %R, 10-period %R and 15-period %R settings for the JFTA_5, JFTA_10 and JFTA_15 lines. # # --- script begin ---- # declare lower; input setting = {FAST, default BASE, SLOW}; input price = close; input fastLength = 5; input slowLength = 20; def value; def color; switch (setting) { case FAST: value = ExpAverage(close, fastLength) - ExpAverage(close, slowLength); color = 1; case BASE: value = ExpAverage(close, fastLength); color = 2; case SLOW: value = ExpAverage(close, slowLength); color = 3; } # Original Williams%R calculation by TD Ameritrade IP Company, Inc. (c) 2007-2012 def hv5 = Highest(value, 5); def lv5 = Lowest(value, 5); plot JKTA_5 = if hv5 == lv5 then 0 else ((hv5 - value) / (hv5 - lv5) * (-100) + 100); def hv10 = Highest(value, 10); def lv10 = Lowest(value, 10); plot JKTA_10 = if hv10 == lv10 then 0 else ((hv10 - value) / (hv10 - lv10) * (-100) + 100); def hv15 = Highest(value, 15); def lv15 = Lowest(value, 15); plot JKTA_15 = if hv15 == lv15 then 0 else ((hv15 - value) / (hv15 - lv15) * (-100) + 100); JKTA_15.SetDefaultColor(GetColor(9)); JKTA_15.SetLineWeight(3); JKTA_15.SetStyle(curve.firm); JKTA_15.AssignValueColor(if color==1 then color.magenta else if color==2 then color.cyan else color.green); JKTA_10.SetDefaultColor(GetColor(9)); JKTA_10.SetLineWeight(1); JKTA_10.SetStyle(curve.firm); JKTA_10.AssignValueColor(if color==1 then color.magenta else if color==2 then color.cyan else color.green); JKTA_5.SetDefaultColor(GetColor(9)); JKTA_5.SetLineWeight(1); JKTA_5.SetStyle(curve.short_dash); JKTA_5.AssignValueColor(if color==1 then color.magenta else if color==2 then color.cyan else color.green); plot line50 = 50; plot line0 = 0; plot line100 = 100; line50.SetDefaultColor(GetColor(7)); line50.SetLineWeight(1); line50.SetStyle(curve.firm); line0.SetDefaultColor(GetColor(7)); line0.SetLineWeight(1); line0.SetStyle(curve.short_dash); line100.SetDefaultColor(GetColor(7)); line100.SetLineWeight(1); line100.SetStyle(curve.short_dash); # # --- script end ---- # ********************************************************** # Jeffrey Kennedy's Trend Analyzer Tool - JK_TA_Combo # Original by Jeffrey Kennedy/Elliott Wave Internatial Inc. # as presented on Tue, 22 December 2009 on www.elliottwave.com # # thinkscript by TrendXplorer # website: www.trendxplorer.info # e-mail: trendxplorer@gmail.com # Revised: May 29, 2012 #hint:Jeffrey Kennedy's Trend Analyzer Tool Combined versionnWhen all three lines in any version are flatlining as one, it signals an impulsive, or motive, structure.nAnytime the three lines separate, it's a strong signal that the market is yielding a countertrend, or corrective, pattern. #hint setting %R: select 5-period %R, 10-period %R or 15-period %R as settings for the JFTA_Slow, JFTA_Base and JFTA_Base lines. # # --- script begin ---- # declare lower; input price = close; input setting_R = {"5", "10", default "15"}; input fastLength = 5; input slowLength = 20; def period; switch (setting_R) { case "5": period = 5; case "10": period = 10; case "15": period = 15; } def fast = ExpAverage(close, fastLength) - ExpAverage(close, slowLength); def base = ExpAverage(close, fastLength); def slow = ExpAverage(close, slowLength); # Original Williams%R calculation by TD Ameritrade IP Company, Inc. (c) 2007-2012 def hs = Highest(slow, period); def ls = Lowest(slow, period); plot JKTA_Slow = if hs == ls then 0 else ((hs - slow) / (hs - ls) * (-100) + 100); JKTA_Slow.SetDefaultColor(GetColor(6)); JKTA_Slow.SetLineWeight(2); JKTA_Slow.SetStyle(curve.firm); def hb = Highest(base, period); def lb = Lowest(base, period); plot JKTA_Base = if hb == lb then 0 else ((hb - base) / (hb - lb) * (-100) + 100); JKTA_Base.SetDefaultColor(GetColor(1)); JKTA_Base.SetLineWeight(2); JKTA_Base.SetStyle(curve.firm); def hf = Highest(fast, period); def lf = Lowest(fast, period); plot JKTA_Fast = if hf == lf then 0 else ((hf - fast) / (hf - lf) * (-100) + 100); JKTA_Fast.SetDefaultColor(GetColor(0)); JKTA_Fast.SetLineWeight(2); JKTA_Fast.SetStyle(curve.firm); plot line50 = 50; plot line0 = 0; plot line100 = 100; line50.SetDefaultColor(GetColor(7)); line50.SetLineWeight(1); line50.SetStyle(curve.firm); line0.SetDefaultColor(GetColor(5)); line0.SetLineWeight(1); line0.SetStyle(curve.short_dash); line100.SetDefaultColor(GetColor(6)); line100.SetLineWeight(1); line100.SetStyle(curve.short_dash); # # --- script end ---- #GraHal thanked this postDone 🙂

//JKFast fastLength=5 slowLength=20 valuefast=ExponentialAverage[fastlength](close)-ExponentialAverage[slowlength](close) hv5 = Highest[5](valuefast) lv5 = Lowest[5](valuefast) if hv5 = lv5 then JKFast5=0 else JKFast5=((hv5 - valuefast) / (hv5 - lv5) * (-100) + 100) endif hv10 = Highest[10](valuefast) lv10 = Lowest[10](valuefast) if hv10 = lv10 then JKFast10=0 else JKFast10=((hv10 - valuefast) / (hv10 - lv10) * (-100) + 100) endif hv15 = Highest[15](valuefast) lv15 = Lowest[15](valuefast) if hv15 = lv15 then JKFast15=0 else JKFast15=((hv15 - valuefast) / (hv15 - lv15) * (-100) + 100) endif Return JKFast5 coloured (255,150,255) as "JKFast5", JKFast10 coloured (255,100,255) as "JKFast10", JKFast15 coloured (255,50,255) as "JKFast15"//JK TA fastLength=5 valuebase=ExponentialAverage[fastlength](close) hv5 = Highest[5](valuebase) lv5 = Lowest[5](valuebase) if hv5 = lv5 then JKTA5=0 else JKTA5=((hv5 - valuebase) / (hv5 - lv5) * (-100) + 100) endif hv10 = Highest[10](valuebase) lv10 = Lowest[10](valuebase) if hv10 = lv10 then JKTA10=0 else JKTA10=((hv10 - valuebase) / (hv10 - lv10) * (-100) + 100) endif hv15 = Highest[15](valuebase) lv15 = Lowest[15](valuebase) if hv15 = lv15 then JKTA15=0 else JKTA15=((hv15 - valuebase) / (hv15 - lv15) * (-100) + 100) endif Return JKTA5 coloured (150,150,255) as "JKTA5", JKTA10 coloured (100,100,255) as "JKTA10", JKTA15 coloured (50,50,255) as "JKTA15"//JK Slow slowLength=20 valuebase=ExponentialAverage[slowLength](close) hv5 = Highest[5](valuebase) lv5 = Lowest[5](valuebase) if hv5 = lv5 then JKSlow5=0 else JKSlow5=((hv5 - valuebase) / (hv5 - lv5) * (-100) + 100) endif hv10 = Highest[10](valuebase) lv10 = Lowest[10](valuebase) if hv10 = lv10 then JKSlow10=0 else JKSlow10=((hv10 - valuebase) / (hv10 - lv10) * (-100) + 100) endif hv15 = Highest[15](valuebase) lv15 = Lowest[15](valuebase) if hv15 = lv15 then JKSlow15=0 else JKSlow15=((hv15 - valuebase) / (hv15 - lv15) * (-100) + 100) endif Return JKSlow5 coloured (150,200,0) as "JKSlow5", JKSlow10 coloured (100,200,0) as "JKSlow10", JKSlow15 coloured (50,200,0) as "JKSlow15"Hey well done Ciccio! Bet you’re well chuffed with yourself?

I’m interested in any ‘tools’ re Elliott Waves … I’ll read the blog you mention in 1st post.

Are you thinking of making an Auto-Trading Strategy with this or are you using for manual trading?

Thank You for Sharing

GraHalLighthouse thanked this postAnd here you are the Combo (in case anyone is interested)

//JKFast fastLength=5 slowLength=20 valuefast=ExponentialAverage[fastlength](close)-ExponentialAverage[slowlength](close) hv5 = Highest[5](valuefast) lv5 = Lowest[5](valuefast) if hv5 = lv5 then JKFast5=0 else JKFast5=((hv5 - valuefast) / (hv5 - lv5) * (-100) + 100) endif hv10 = Highest[10](valuefast) lv10 = Lowest[10](valuefast) if hv10 = lv10 then JKFast10=0 else JKFast10=((hv10 - valuefast) / (hv10 - lv10) * (-100) + 100) endif hv15 = Highest[15](valuefast) lv15 = Lowest[15](valuefast) if hv15 = lv15 then JKFast15=0 else JKFast15=((hv15 - valuefast) / (hv15 - lv15) * (-100) + 100) endif //JK TA valuebase=ExponentialAverage[fastlength](close) hv5 = Highest[5](valuebase) lv5 = Lowest[5](valuebase) if hv5 = lv5 then JKTA5=0 else JKTA5=((hv5 - valuebase) / (hv5 - lv5) * (-100) + 100) endif hv10 = Highest[10](valuebase) lv10 = Lowest[10](valuebase) if hv10 = lv10 then JKTA10=0 else JKTA10=((hv10 - valuebase) / (hv10 - lv10) * (-100) + 100) endif hv15 = Highest[15](valuebase) lv15 = Lowest[15](valuebase) if hv15 = lv15 then JKTA15=0 else JKTA15=((hv15 - valuebase) / (hv15 - lv15) * (-100) + 100) endif //JK Slow valueslow=ExponentialAverage[slowLength](close) hv5 = Highest[5](valueslow) lv5 = Lowest[5](valueslow) if hv5 = lv5 then JKSlow5=0 else JKSlow5=((hv5 - valueslow) / (hv5 - lv5) * (-100) + 100) endif hv10 = Highest[10](valueslow) lv10 = Lowest[10](valueslow) if hv10 = lv10 then JKSlow10=0 else JKSlow10=((hv10 - valueslow) / (hv10 - lv10) * (-100) + 100) endif hv15 = Highest[15](valueslow) lv15 = Lowest[15](valueslow) if hv15 = lv15 then JKSlow15=0 else JKSlow15=((hv15 - valueslow) / (hv15 - lv15) * (-100) + 100) endif Return JKFast5 coloured (255,150,255) as "JKFast5", JKFast10 coloured (255,100,255) as "JKFast10", JKFast15 coloured (255,50,255) as "JKFast15", JKSlow5 coloured (150,200,0) as "JKSlow5", JKSlow10 coloured (100,200,0) as "JKSlow10", JKSlow15 coloured (50,200,0) as "JKSlow15", JKTA5 coloured (150,150,255) as "JKTA5", JKTA10 coloured (100,100,255) as "JKTA10", JKTA15 coloured (50,50,255) as "JKTA15"PS

I also corrected some syntax of the JK Slow indicator posted before

Razz thanked this postThanks a lot Ciccio! You are saving me 🙂 These ones could be posted into the library! Do you want me to push them there?

Lighthouse thanked this postOK 😉

If you think they are useful do as you wish.

Hello guys,

I would like to have this indicator on Tradingview. Can anyone help me please?

Thanks

vangarde – read the forum rules before posting again. Only use the language of the forum that you are posting in. This is an English language forum. Also do not double post. I have deleted your double post in French in this English language topic.

These forums are dedicated to ProRealCode. If you want a translation to another language then try a forum dedicated to that language. Alternatively click on help and use the paid for programming service that Nicolas offers.

vangarde thanked this postExellent stuff. Thanks!

I studied the indicator and have some good news, even at very short term graphs.

In the middle the indicator as jou published and direkly and other vision.

Thanks, but could you explain how we should interpret this new version? Sorry but that’s not very clear to me at first glance 😆

It must be “and at the bottom of the graph ” an other vision.

I added the sin(atan) version.

Not change the indicator , but added the following:

// from line 99 till end 118. I added my famous sin(atan) principle // Zigo's vieuw: if (JKFast5 +jkslow5 +JKTa5) >20 then JK1 = 1 else JK1=-1 endif if (JKFast10 +jkslow10 +JKTa10) >20 then JK2=1 else JK2=-1 endif if (JKFast15 +jkslow15 +JKTa15) >20 then JK3=1 else JK3=-1 endif JK = sin(atan(JK1 +JK2 +JK3)) JKTotal= JK-JK[1] Return jkTotalThe indicator works on every instrument and on every timeframe.

-

AuthorPosts

- You must be logged in to reply to this topic.

Jeffrey Kennedy Trend Analyzer

ProBuilder: Indicators & Custom Tools

Author

Summary

This topic contains 32 replies,

has 9 voices, and was last updated by ![]() Meta Signals Pro

Meta Signals Pro

5 years, 6 months ago.

Topic Details

| Forum: | ProBuilder: Indicators & Custom Tools |

| Language: | English |

| Started: | 04/30/2017 |

| Status: | Active |

| Attachments: | 19 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.