Lift up and down

Forums › ProRealTime English forum › General trading discussions › Lift up and down

- This topic has 13 replies, 5 voices, and was last updated 8 years ago by

Nicolas.

Nicolas.

-

-

06/01/2016 at 4:44 PM #8599

hi all, let’s discuss about the TS proposed by Reiner here:

http://www.prorealcode.com/prorealtime-trading-strategies/lift-up-down-trading-strategy-dax-5m/

There is one thing that I do not like at all. this TS is curve fitted on DAX 5 minute time frame. I would never put one euro on this TS on the dax… We all know why. BUT….

The TS is working on other indexes also! this mean that it is robust. It is the first TS that I find in this forum that works on more than 1 Index!

Good Job Reiner!

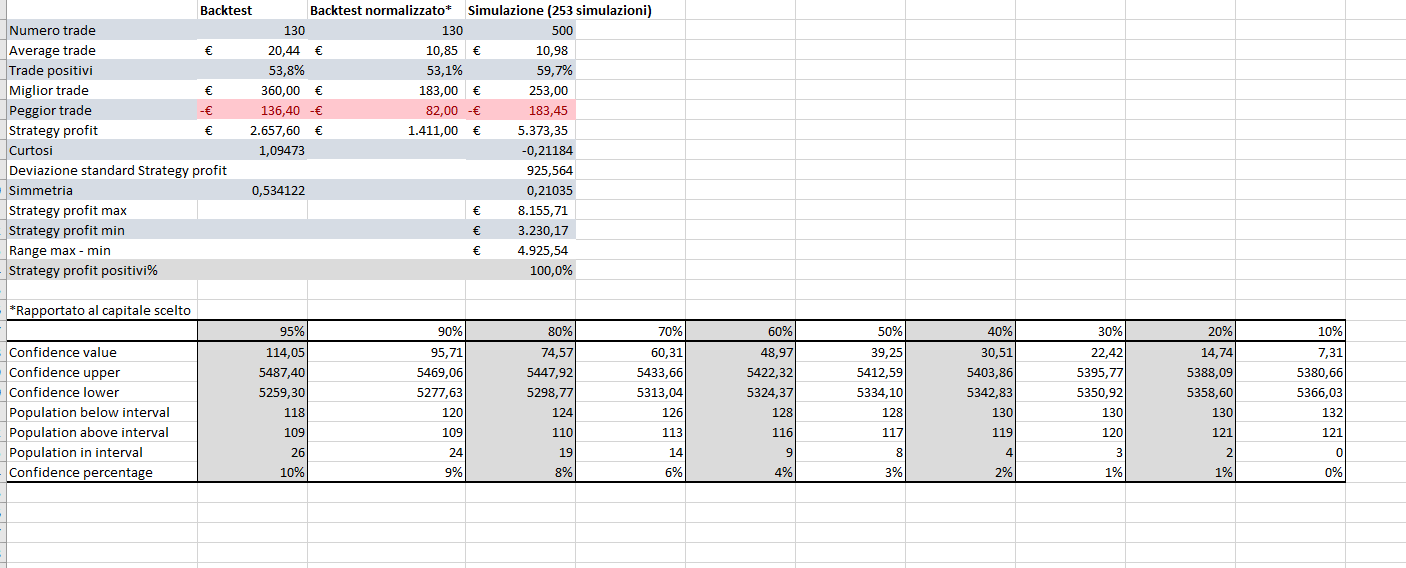

In the excel image you can find how well perform the TS with original settings on all European indexes. IG Market spreads are included (Spain and Italy do not perform too well due to the big spread that they have). also same capital is invested to compare the different indexes (around 19000 euro per index).

In yellow you may find a similar TS that do not works with fixed SL and TP but it uses ATR.

The ATR values has been chosen using a backtest on the only dax index.

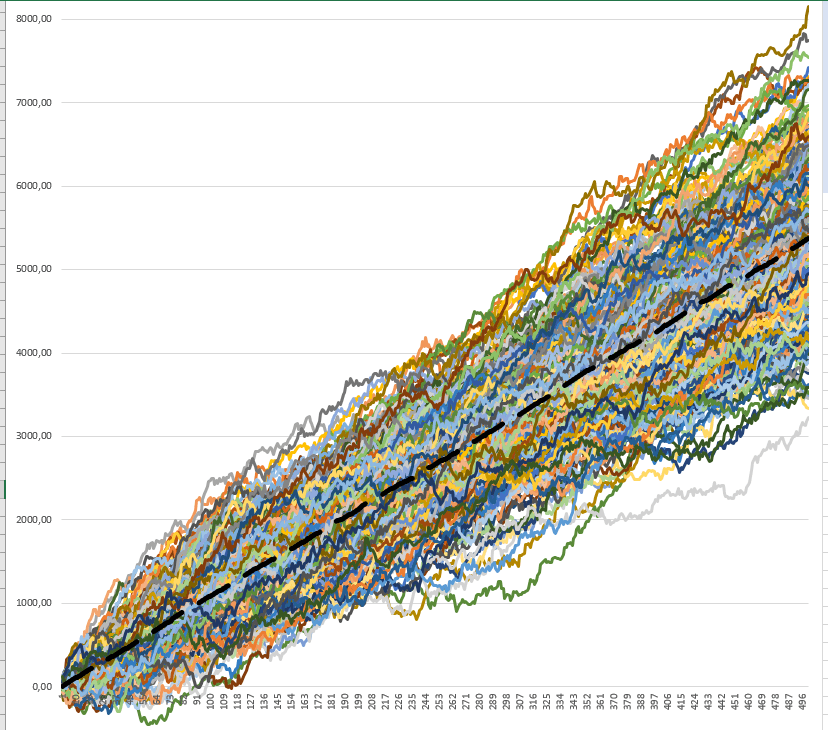

In the other images you may find the montecarlo test for the CAC (I choose the CAC and not the DAX because the CAC should not be curve fitted). comment on this are appreciate.

This is for my TS with ATR:

06/01/2016 at 4:47 PM #8604Here the Montecarlo for the standard paramenters (Reiner TS):

Reiner have you tested in real market if the trade are equal to the backtest?

any comments? Idea how to improve? What should we test before going live?

Here the code:

123456789101112131415161718192021222324252627282930313233343536373839404142434445464748495051525354// Lift up and down// Code-ParameterDEFPARAM FlatAfter = 113000// trading windowONCE BuyTime = 84500ONCE SellTime = 113000x= 14 //y =9 //ottimizzato 13// money management// variable position size - thanks Adolfo :-)//ONCE Capital = 1000//ONCE Risk = 0.01//ONCE StopLoss = 10//ONCE equity = Capital + StrategyProfit//ONCE maxrisk = round(equity*Risk)//ONCE PositionSize = abs(round((maxrisk/StopLoss)/PointValue)*pipsize)// fixed position sizeONCE PositionSize = 2// manage number of tradesIF Time = BuyTime THENLongTradeCounter = 0ShortTradeCounter = 0ENDIF// long on Monday until Thursday with filter close is above MA(14) and max 2 trades per dayIF Not LongOnMarket AND Time >= BuyTime AND close CROSSES OVER DHigh(1) AND close > Average[x](close) AND LongTradeCounter < 2 AND CurrentDayOfWeek <> 5 THENBUY PositionSize CONTRACT AT MARKETLongTradeCounter = LongTradeCounter + 1sl = AverageTrueRange[14](close)*2tp = AverageTrueRange[14](close)*6ENDIF// short on Monday and Tuesday with filter close is under MA(9) and max 2 trades per dayIF Not ShortOnMarket AND Time >= BuyTime AND close CROSSES UNDER DLow(1) AND close < Average[y](close) AND ShortTradeCounter < 2 AND CurrentDayOfWeek < 3 THENSELLSHORT PositionSize CONTRACT AT MARKETShortTradeCounter = ShortTradeCounter + 1sl = AverageTrueRange[14](close)*2.5tp = AverageTrueRange[14](close)*4ENDIF// exitIF LongOnMarket AND Time = SellTime THENSELL AT MARKETENDIFIF ShortOnMarket AND Time = SellTime THENEXITSHORT AT MARKETENDIF// stop and targetSET STOP pLOSS slSET TARGET pPROFIT tp06/01/2016 at 7:01 PM #8611Would you mind post here the Excel backtest result to do my own test. Thanks.

Please also consider that european indices are correlated, this could explain a bit why it would perform so well (and in the same way) on all of them.

Trades symetry are not the same at all in your random strategies than the backtest one, please have a look at this. Did you change the percentage of positive trades in your matrix?

06/01/2016 at 9:55 PM #862006/02/2016 at 5:35 PM #8661even if the european indices move in a similar way the grafh at the end is very different between them. This is a good thing because a TS should work always even if there is a small change. This avoid the curve fitting in my opinion. If the european indices are all similar why does 99% of the TS that we find works only on one? do you agrree?

In a TS like this the most important thing to check in my opinion it is how the TS works on other similar index. Am I wrong?

I don’t have time, I update tomorrow what you have asked.

06/03/2016 at 3:18 PM #8754Hi Nicolas, here there are the 2 excel files. One for the standard TS and one for the modified TS with ATR instead of fixed TP and SL.

In my opinion the standard one is for sure curve fitted. the one with ATR? I dont’ know… I hope not… I am curios on your analisys.

12/27/2016 at 10:30 AM #19151Hi all,

I modified “Lift Up” & “Lift Down” into 2 different strategies as the tweaks for both are different & easier for me to monitor the live results.

(I will share also Lift down once i have free time)Below is my code modification based on Reiner Lift up. Is anyone could help to verify what’s result before Aug 2015? (as i have access to only 100,000 candles)

In your opinion, is this considered as curve lifted? -> This is one of my live strategyTime Zone CET, No Custom Trading Hours, 2 spread + initial capital 6000

br, CKW

12/27/2016 at 10:35 AM #1915412/27/2016 at 6:43 PM #1918412/28/2016 at 7:44 AM #1920512/28/2016 at 11:46 AM #19228Hi Guys,

This is BLEntryDAX(Long)_5M. (Derrived from Reiner Lift Down but more conservative version)

Is anyone could help to verify what’s result before Aug 2015? (as i have access to only 100,000 candles)

In your opinion, is this considered as curve lifted? Result may looks not real BUT I optimized it based on with market sense & avoid noise window period entry that not suitable for 5M strategy.I am happy to share, your comment are welcome 🙂

SL: 50

TP: VariableTime Zone CET, No Custom Trading Hours, 2 spread + initial capital 6000

br, ckw

12/28/2016 at 3:53 PM #1925312/28/2016 at 4:22 PM #1925612/28/2016 at 4:45 PM #19261This should be known as “Equity Curving”.

Indeed, this is a perfect example. Quite a difficult job to build robust trading strategies 🙂

-

AuthorPosts

Find exclusive trading pro-tools on