Money management & control risk

Forums › ProRealTime English forum › ProOrder support › Money management & control risk

- This topic has 23 replies, 4 voices, and was last updated 5 years ago by

Vonasi.

Vonasi.

Tagged: Kelly’s optimal F, money management

-

-

08/15/2019 at 9:19 PM #104829

Anyone know how to code Kelly’s F Optima for PRT ???

Thanks, is very important for a good medium por long strategie.08/16/2019 at 12:25 PM #104857Some links may help:

https://en.wikipedia.org/wiki/Kelly_criterion (english)

https://www.brainyforex.com/position-sizing-methods.html (english)

http://quantfiction.com/2018/05/06/position-sizing-for-practitioners-part-1-beyond-kelly/ (english)

https://www.ishowtrading.com/money-management/trading-la-formula-di-kelly/ (italian)

08/16/2019 at 1:58 PM #104864Ok.

But, the traducción yo PRT???

Sorry, im not programmer!!!

08/16/2019 at 2:38 PM #104867Someone may help when they have time (provided they have the knowledge to do it).

08/16/2019 at 5:49 PM #104882O wait.

Thanks boys!!

The vector dax code is very good as a base. but I have modified it widely. The results are very good, but you have to pyramid. operates much less than the original vector. mine level is between 90-95% of success. That’s why I need Kelly’s F Optima, to be able to pyramid without too much risk.

08/16/2019 at 6:09 PM #104885Here is Kelly’ Criterion Formula as an indicator.

Just input the decimal odds and the probability of success and it returns the percentage of capital that you should stake.

123456789B = 2.0 //decimal oddsP = 52 //probability of successB = B-1P = P/100Q = 1-p //probability of failureKCF = ((B*P-Q)/B)*100return KCF1 user thanked author for this post.

08/17/2019 at 10:18 AM #104912I’m afraid Vonasi is no use to me… thank you for your work, though.

Kelly’s F Optima takes into account capital, % hit, stop, and average profit and loss.

Besides, I’d like to automate it for Proorder.

Serious type:

REM Money Management

Capital 1000

Risk – 0.0005

PStopLoss ? 1.2 // Could be our variable XREM Calculate contracts

equity – Capital + StrategyProfit

maxrisk ? round(equity*Risk)

PositionSize ? abs(round(maxrisk/PStopLoss)/PointValue)*pipsize)but becareful, applying Kelly’s F Optima.

08/17/2019 at 10:28 AM #104914-

These are my results after substantially modifying Balmora’s Vector Dax.

The backtest is 100000k.

There are two robots… one for bullish trades and one for bearish trades.

http://prntscr.com/ottyet

http://prntscr.com/ottykw

http://prntscr.com/ottypwTo do this, among other modifications to its code, I have applied a common money management.

But I think with Kelly’s F Optima, the economic results would be even better.Keep trying, please… and much thanks!!!

08/17/2019 at 10:29 AM #104915sorry, the result links don’t work, I think

The hit rate is in both robots between 90-95%.

And they earn about 5000 euros each robot in 100000k trading in addition with a very small account and with little money per operation.

08/17/2019 at 10:35 AM #104916@sdesergio

Please do not post links to pictures, rather attach them as either JPG or PNG files.

Should you need to attach documents, please use either PDF or TXT file.

Thank you.

08/17/2019 at 10:59 AM #104920And other problem…

In the normal Code if money management, i cant management Risk under 0.0005 (5% of capital).

I say, for example, i cant management Risk to 0.0002 or 0.0003 (2 or 3% of capital).

Thanks too!!!

08/17/2019 at 12:53 PM #104924sdesergio – please try to be tidier when posting. Several of your posts have had to be deleted as they were either repeat posts or meaningless. 🙂

There is an old discussion about Optimal F here:

https://www.prorealcode.com/topic/ralph-vinces-optimal-f-positioning-sizing/

08/17/2019 at 1:16 PM #104925Thanks Vonasi!

And sorry, but im from Spain, and my english language is basic.

I traduct with Google traductor… Is bad.

Ok, thanks for the links.

I think what the F Optimal, or F Secure, can programmer automatically for Proorder.

But i need help.

08/19/2019 at 10:18 AM #10505808/19/2019 at 3:34 PM #105077sdesergio – please do not bump posts by simply posting ‘Hi!’. It does not make anything happen any faster. If no one has answered then it is because they do not have the answer and wasting their time by getting them to read ‘Hi!’ will not make them suddenly have the answer.

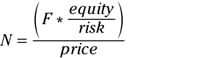

It seems that the F in Optimal F is a factor based on historical data but what that is exactly I have no idea from what I have read so far, and the risk is the biggest percentage loss that you experienced in the past. To automate this you need to have a trade history of what your worst loss can be so as to calculate it. This would involve having a simulated version of your strategy to keep a record of the value of F. As no one knows what your strategy is then they cannot code it and it may be a very difficult thing to code.

The calculation itself is not complicated but knowing what F is and automating it is.

-

-

AuthorPosts

Find exclusive trading pro-tools on