Hi,

I’m quite new here, but I have the following questions. I’m creating a code, but I can not figure out how to create the following piece of code:

- Every trading day I would like to know what the highest market price is between the previous day 21.00 and the current day 04.00 hours. And I would like to know what the lowest market price is between the previous day 21.00 and the current day 04.00 hours.

- Trading hours are from 06.30 hours until 21.00 hours

- I only want to trade when the 1-hour candle closes above the highest market price mentioned before or when the 1-hour candle closes under the lowest market price mentioned before.

- When the 1-hour candle closes above the highest market price, we take a long trade with a stop loss of 230 pips and a profit stop of 800 pips

- When the 1-hour candle closes below the lowest market price, we take a short trade with a stop loss of 230 pips and a profit stop of 800 pips

- We will only trade once a day. So after the first trade, the system should stop.

Thanks guys!!!

Wing

WingParticipant

Veteran

First question:

Once myhigh=0

Once mylow=0

Once tradedtoday=0

If time=040000 then

tradedtoday=0

MyHigh=Highest[7](high)

MyLow=Lowest[7](low)

Endif

Second question: Use “defparam flatafter/flatbefore”. Eg. “Defparam flatafter 210000”. Must be the first lines in your code.

Third question:

If close>myhigh and tradedtoday=0 then

Buy 1 lot at market

tradedtoday=1

Endif

Then set your SL/TP. Does that help you on the way?

Thanks a lot, Wing. I created the following code, but it is not working. Would you be able to look into it, maybe you have a solution for me? Thanks in advance…

// Definition of code parameters

DEFPARAM CumulateOrders = False // Cumulating positions deactivated

// The system will cancel all pending orders and close all positions at 0:00. No new ones will be allowed until after the "FLATBEFORE" time.

DEFPARAM FLATBEFORE = 063000

// Cancel all pending orders and close all positions at the "FLATAFTER" time

DEFPARAM FLATAFTER = 210100

// Prevents the system from placing new orders on specified days of the week

daysForbiddenEntry = OpenDayOfWeek = 1 OR OpenDayOfWeek = 6 OR OpenDayOfWeek = 0

// check on highest and lowest price

Once myhigh=0

Once mylow=0

Once tradedtoday=0

If time=040000 then

tradedtoday=0

MyHigh=Highest[7](high)

MyLow=Lowest[7](low)

Endif

// buy when above highest high

If close>myhigh and tradedtoday=0 AND not daysForbiddenEntry THEN

Buy 1 lot at market

tradedtoday=1

Endif

// sell when below lowest low

If close>mylow and tradedtoday=0 AND not daysForbiddenEntry THEN

Buy 1 lot at market

tradedtoday=1

Endif

// Stops and targets

SET STOP pLOSS 230

SET TARGET pPROFIT 800

Hi PJ, Wing is offline, so thought I’d jump in (to keep you going 🙂 ) … is this maybe the problem?

// sell when below lowest low

If close>mylow and tradedtoday=0 AND not daysForbiddenEntry THEN

Buy 1 lot at market

tradedtoday=1

Endif

From your ‘non-code strategy’ below, it looks like it should be …

- When the 1-hour candle closes below the lowest market price, we take a short trade with a stop loss of 230 pips and a profit stop of 800 pips

// sellshort when below lowest low

If close<mylow and tradedtoday=0 AND not daysForbiddenEntry THEN

SellShort 1 lot at market

tradedtoday=1

Endif

Maybe “Sellshort” instead of buy in line 30?

Edit: You were faster Grahal 🙂

Thank you guys. Changed it, but still no results 🙁

Close cannot be superior to myHigh or inferior to myLow, you must referred to their values one bar ago, otherwise Close is myHigh or myLow and testing a value superior or inferior to itself has no sense.

// sell when below lowest low

If close>mylow[1] and tradedtoday=0 AND not daysForbiddenEntry THEN

Buy 1 lot at market

tradedtoday=1

Endif

// sellshort when below lowest low

If close<mylow[1] and tradedtoday=0 AND not daysForbiddenEntry THEN

SellShort 1 lot at market

tradedtoday=1

Endif

Andyswede we were both correct, but not quite correct enough! 🙂

Hi guys,

Thanks again, but I still dont have any results. Something is wrong. I did some manual backtesting and there should be 17 trades in june 2017. You have any clues left? Thanks again for helping me out, I really appreciate it.

Hi PJ

Please add your code at latest up to date version on here then I will run it on my platform,

GraHal

Thanks GraHal,

This is the code I use right now.

// Definition of code parameters

DEFPARAM CumulateOrders = False // Cumulating positions deactivated

// The system will cancel all pending orders and close all positions at 0:00. No new ones will be allowed until after the "FLATBEFORE" time.

DEFPARAM FLATBEFORE = 063000

// Cancel all pending orders and close all positions at the "FLATAFTER" time

DEFPARAM FLATAFTER = 210000

// Prevents the system from placing new orders on specified days of the week

daysForbiddenEntry = OpenDayOfWeek = 1 OR OpenDayOfWeek = 6 OR OpenDayOfWeek = 0

// check on highest and lowest price

Once myhigh=0

Once mylow=0

Once tradedtoday=0

If time=040000 then

tradedtoday=0

MyHigh=Highest[7](high)

MyLow=Lowest[7](low)

Endif

// buy when above highest high

If close>myhigh[1] and tradedtoday=0 AND not daysForbiddenEntry THEN

Buy 1 lot at market

tradedtoday=1

Endif

// sellshort when below lowest low

If close<mylow[1] and tradedtoday=0 AND not daysForbiddenEntry THEN

sellshort 1 lot at market

tradedtoday=1

Endif

// Stops and targets

SET STOP pLOSS 230

SET TARGET pPROFIT 800

You say … . I did some manual backtesting and there should be 17 trades in june 2017 …. what does manual backtest mean, how did you do it??

Aren’t you restricting potential with time= 040000 ??

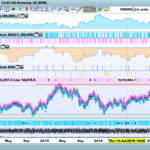

Results attached since 1 Apr 13 (100,000 bars?) on DAX at 1 hour TF with time = 040000 lower curve. With time = 090000 upper curve … rest of the code same as yours above.

I did the backtesting myself using graphs and no software.

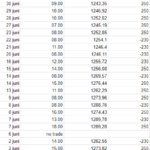

Attached you will find the results with a 250 pips profit stop and a 230 pips stoploss

Your code above shows 800 profit stop, but your manual results above are based on 250 profit stop?

So is there still a problem or are you good to continue now?

If there is still a problem, is it that you want PRT backtest results to match your manual backtest results? Have you got same parameters in each scenario, including spread etc?