Pathfinder Trading System

Forums › ProRealTime English forum › ProOrder support › Pathfinder Trading System

- This topic has 1,834 replies, 139 voices, and was last updated 1 year ago by

CFD AutoTrading.

CFD AutoTrading.

Tagged: Pathfinder

-

-

03/27/2018 at 7:29 AM #6649703/27/2018 at 8:52 AM #66509

the bad days are not a problem so long the wins are bigger

…..and so long as you have a big enough bank balance and a mind that can cope with a whole load of bad days in a row! Otherwise known as being able put up with a huge drawdown. 🙂

03/27/2018 at 9:11 AM #6651103/27/2018 at 9:30 AM #66514Big overall drawdowns make me feel so shite

It is an ironic fact of life that if you start with a lot of money then making a lot of money is easier. Anyone could have made a lot of money over the years if they can cope with massive draw downs. Just keep holding and buying more as the market collapses and ignore the number of negative zeros on your account balance and wait for things to start going up again.

However for those with a smaller bank balance finding a strategy that fits their needs is far harder . Lots of big profits with hardly any draw down is what they need and that is a very challenging strategy to come up with.

Bit off topic so I will drop this subject now! 🙂

03/27/2018 at 10:23 AM #66524Big overall drawdowns make me feel so shite

It is an ironic fact of life that if you start with a lot of money then making a lot of money is easier. Anyone could have made a lot of money over the years if they can cope with massive draw downs. Just keep holding and buying more as the market collapses and ignore the number of negative zeros on your account balance and wait for things to start going up again. However for those with a smaller bank balance finding a strategy that fits their needs is far harder . Lots of big profits with hardly any draw down is what they need and that is a very challenging strategy to come up with. Bit off topic so I will drop this subject now!

story of my trading life :-\

03/27/2018 at 12:42 PM #66534Don’t worry, in the next version, the bad days will be optimized away…

I have to admit I had to smile about that comment even so my profits seem to melt away with Pathfinder recently.

But I still want to highlight that the year 2017 ,when we started (Reiner started 🙂 ), was very successful. Pathfinder (Backtest) was very profitable because it starts from 2010 and from then onward is was more or less a constant way up. We have unfortunately no comparison to significant corrections like it happened at the beginning of the year and still ongoing.

We have to keep in mind Pathfinder is specially profitable in trending bull markets. (Same applies for the Swing System)

Personally, I reduced all my positions for now and wait until we enter another bull trend.I still believe in the system but we have to evaluate what it can and what it can’t.

Kind regards

1 user thanked author for this post.

03/27/2018 at 1:04 PM #66538We have to keep in mind Pathfinder is specially profitable in trending bull markets.

Everyone is a hero super trader in trending bull markets but when the tide goes out we get to see who still has their underpants on!

Recognising early enough that a bull market has started and recognising early enough that it has ended is the fine art – and history can be very little help in determining this. Sometimes you have to be out of the market for a while just to work out whether you should have been in it or not. People sometimes forget that it is not possible to lose money if you are sitting on the sidelines – and not losing money is half the battle won. Patience will reward us even if not trading is not very exciting.

GraHal has started a discussion on handling draw down on the General Trading Discussion forum here:

https://www.prorealcode.com/topic/drawdowns-have-you-got-the-stomach/

03/27/2018 at 1:40 PM #66541Don’t worry, in the next version, the bad days will be optimized away…

I have to admit I had to smile about that comment even so my profits seem to melt away with Pathfinder recently. But I still want to highlight that the year 2017 ,when we started (Reiner started

), was very successful. Pathfinder (Backtest) was very profitable because it starts from 2010 and from then onward is was more or less a constant way up. We have unfortunately no comparison to significant corrections like it happened at the beginning of the year and still ongoing. We have to keep in mind Pathfinder is specially profitable in trending bull markets. (Same applies for the Swing System) Personally, I reduced all my positions for now and wait until we enter another bull trend. I still believe in the system but we have to evaluate what it can and what it can’t. Kind regards

You need to remember that we already had a big correction in 2015, bigger than the current one (30% down from the top in DAX), and the pathfinder backtest performed well (i.e., was well optimized) for this period.

In total, when we leave all position sizing away, I count at least 9 adaptable parameters (all stop loss and take profit parameters not considered).

Now look at the result when you take all position sizing and all the seasonal stuff out, which add a lot more of additional adaptable and optimizable parameters.

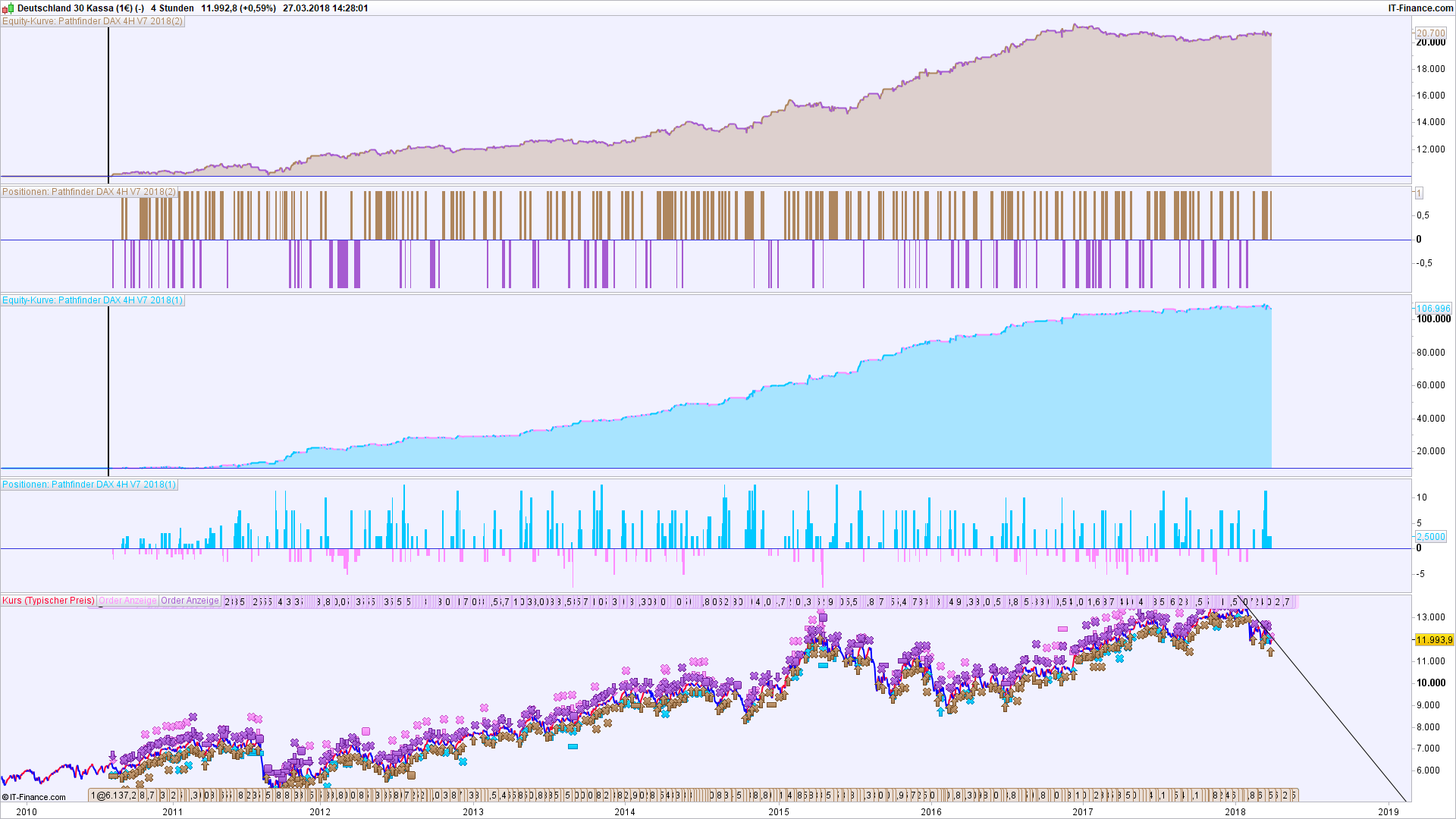

Position size in the upper equity curve is always 1 for pathfinder DAX 4H V7 2018. The lower curve is the original system with all adaptable and optimized parameters :

03/27/2018 at 2:53 PM #66557Sorry, the upper equity curve in the post above is wrong. I made a mistake in position sizing.

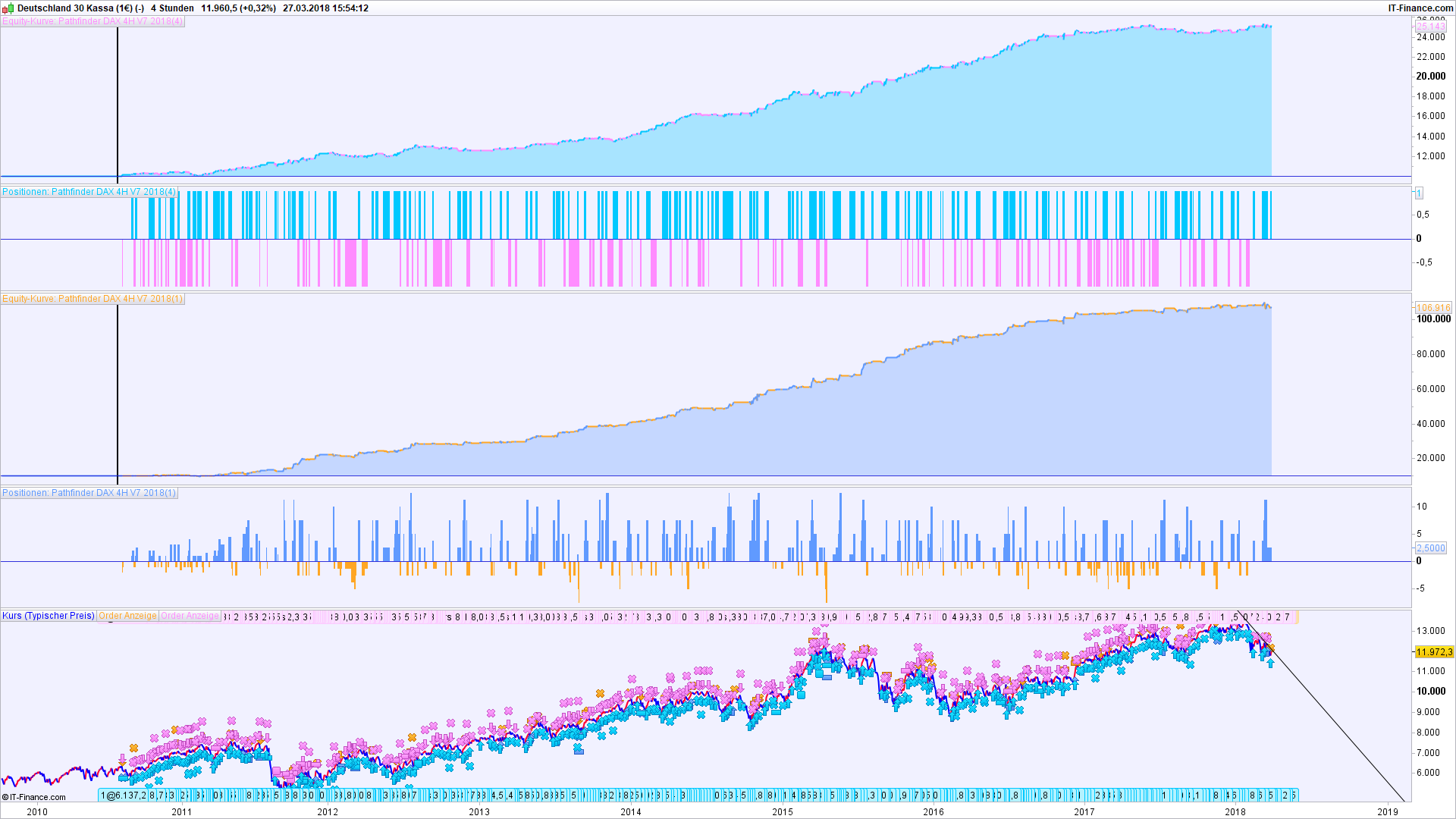

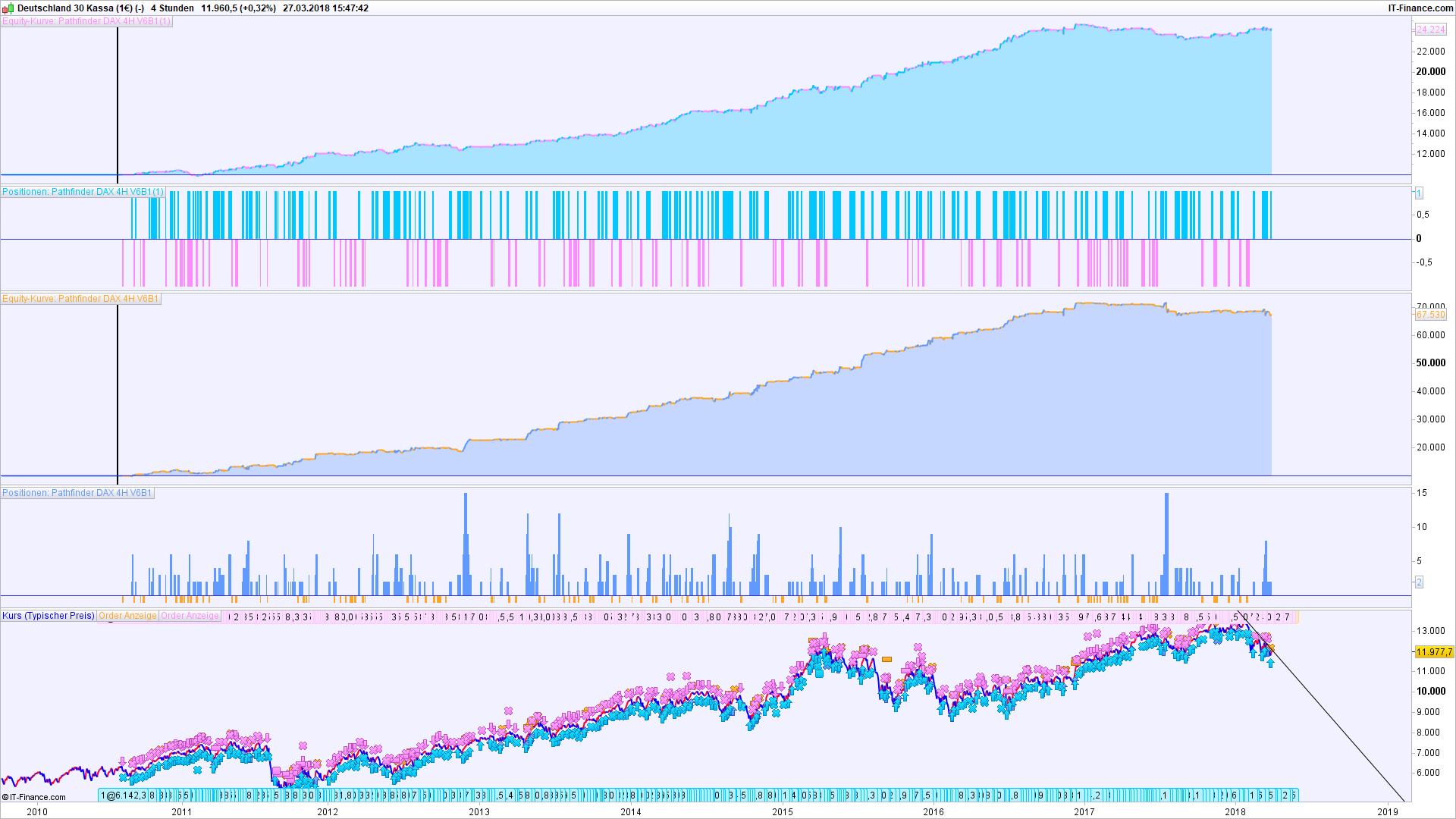

So here is once again a comparison between variable position sizes and position size = 1 for the older V6B1 version and the latest 2018 version. Upper curves are with position size = 1, lower curves are with original variable position sizes (seasonal adjustment, etc.).

2018 version :

V6B1 :

For both versions, results with position size =1 are almost identical. The 2018 version has re-optimized position sizing and therefore yields are higher.

Once again, we can see what a difference lots of adaptable parameters can make in hindsight.

What I learned again : it’s difficult to code or to post with two children running around and asking : Paapaaa, when will you ?….

03/27/2018 at 5:00 PM #66573I notice that your above post has been reported Verdi55. I cannot understand what anyone would have to report as all I read is a very useful analysis of the continued development of the Pathfinder strategies and in so doing highlighted the dangers of over and continued optimization as well as the dangers of too many variables.

03/27/2018 at 6:18 PM #6657603/27/2018 at 6:47 PM #66579I have reported it myself, because I made a mistake. But Nicolas deleted another following post, so I worked the missing info into the second post. No problem at all.

Reporting yourself – now that is a new one on me!

03/27/2018 at 6:50 PM #66580I have reported it myself, because I made a mistake. But Nicolas deleted another following post, so I worked the missing info into the second post. No problem at all.

Reporting yourself – now that is a new one on me!

Well – @nicolas – and as you already suggested, Vonasi, how about the possibility to delete posts or at least to be able to modify them for a longer period than just 5 minutes ?

03/27/2018 at 7:09 PM #66581You need to remember that we already had a big correction in 2015, bigger than the current one (30% down from the top in DAX), and the pathfinder backtest performed well (i.e., was well optimized) for this period.

Isn’t above the point though? If we optimise over a big correction period then the System looks great as the optimiser works out variable values that give us a good profit over that big correction period (I haven’t seen the equity curve).

Moving forward with that System through another similar non-optimised correction period (similar but not the same!) then trades may not perform anywhere near as good and so losses mount??

03/27/2018 at 7:34 PM #66584 -

AuthorPosts

Find exclusive trading pro-tools on