Reverse thinking on position sizing

Forums › ProRealTime English forum › General trading discussions › Reverse thinking on position sizing

- This topic has 15 replies, 3 voices, and was last updated 7 years ago by

Vonasi.

Vonasi.

-

-

08/03/2018 at 6:49 PM #77501

Say for example you have written a strategy and it is a winning machine but you know it is a high risk strategy because at any moment the market could go into free fall and you know your strategy could just empty your account very rapidly….. but the chance of the market going into one of these sort of free falls is a once in a twenty year chance. Surely if you have money that you are willing to lose then it would make sense to start with a big stake and as the wins and profits accumulate reduce your stake so that as more time passes and the once in a twenty year account killing event has not happened when it finally does you will have lots of profits and a small stake. You might even survive the event thanks to your large capital and small stake size. Then you can start again with a bigger stake once the market has reverted to normal (I am thinking major indices here). Obviously the account killing event could happen tomorrow but then it is called ‘Spread BETTING’ for a reason.

Just a bit of reverse thinking for discussion…..

08/03/2018 at 7:13 PM #77503I must assume this winning strategy shows massive drawdowns else why not run it with disaster stop loss?

it would make sense to start with a big stake

A lot of eggs in your basket? How do you know the disaster will not strike tomorow/ next week … tonight even while you are sleeping?? 🙂

If disaster does strike at the worst time … will you live to fight another day??

08/03/2018 at 7:33 PM #77504You do not know if it will strike tomorrow but you do know that it is a rare event. Think of it like going ‘all in’ on the first hand of a poker match. You stand a very good chance of everyone else folding because the risk to reward is too high for them but just once in a while one of them will be dealt a royal flush in the first hand of a game and you’ll go bust.

I have several strategies that don’t show massive draw downs in back testing but you never know what the future will be so just because a filter has kept you out of the market in the whole of the historical past it does not mean that it will stop you buying at the top just before a disaster event in the future. Nothing is certain in this game.

My thoughts are that the longer you are in a game the more chance that you will be in it when a disaster event occurs so try to make money fast and reduce your risk as time goes by.

As for a disaster stop loss – why use one if you have a large capital and a small stake? With a large stake you can ride out a big drawdown – you just have to be mentally able to start with a small capital and a large stake and be willing to lose the small capital if an event happens too soon.

From all my back-testing I have seen quite often that when you switch reinvestment on you start with a lot of winning trades with small stakes and then just as you have a reasonable amount of capital and a larger stake an event happens and you wipe out a lot of your large capital. So why not do it the other way round – start small – bet big and reduce stakes as capital goes up?

08/03/2018 at 7:40 PM #7750508/03/2018 at 8:07 PM #77509start small – bet big

Not quite sure what you mean? Small capital? so the bet / lot size is a big % of Capital??

08/03/2018 at 8:17 PM #77510Not quite sure what you mean? Small capital? so the bet / lot size is a big % of Capital??

Correct. The reverse of everything we think is correct. Remember though that this is money we are willing to lose if need be.

I guess it is reverse pyramid position sizing.

1 user thanked author for this post.

08/03/2018 at 8:49 PM #77511money we are willing to lose

Sounds okay if we can continue our life just the same even after losing (if disaster should strike) but why not spread the same amount of capital across several winning machines??

Unless – bearing in mind the new rules re margin etc – we are talking a very small lot size anyway so we can’t spread across several markets / Systems?

08/03/2018 at 9:21 PM #77512Spreading our capital across different indices does not really help in this situation because if there is a crash then all indices crash and all we have done is reduced our starting take size and in each market for no extra gain. We might as well go ‘all in’ on one market if they are all going to crash at the same time. See once again we have to do reverse thinking – diversification does not help us.

08/03/2018 at 10:22 PM #77514diversification does not help us.

I was not thinking more indexes, but markets that go up when index go down, e.g. a fall in DAX can often be seen when EUR/USD is rising.

Maybe if we have a preponderence of Long only Strategies then diversification as above would help us in times of disaster?

08/04/2018 at 8:21 AM #77522e.g. a fall in DAX can often be seen when EUR/USD is rising.

I’m not sure that I see what you are seeing in the relationship between these two instruments! Plus there is the fact that I find the DAX to be one of the toughest indices to write a successful strategy on and I avoid all forex!

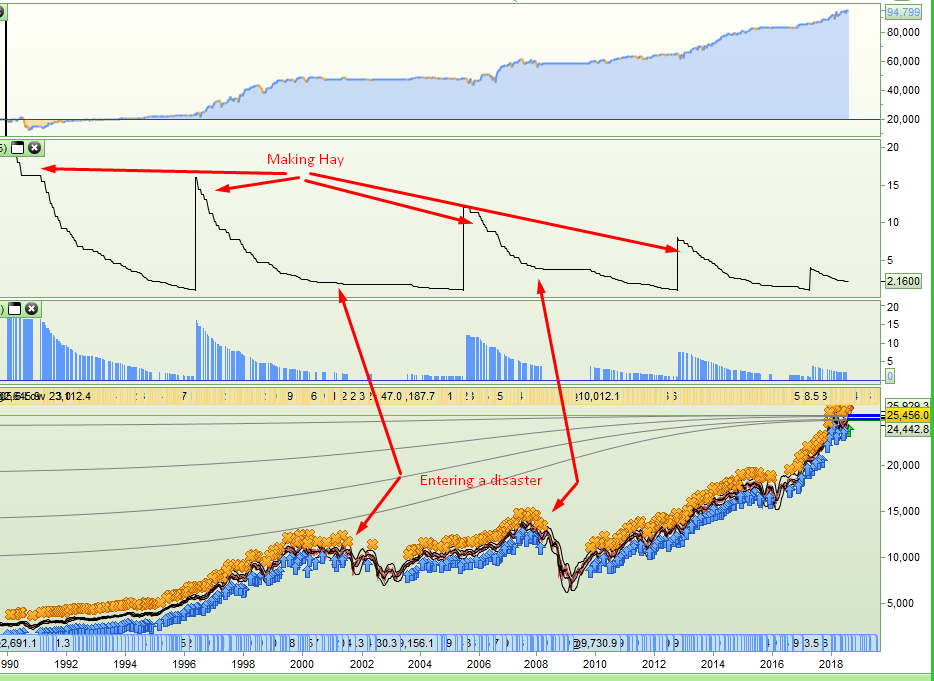

Bottom chart is DAX and top EUR/USD. Weekly charts.

08/04/2018 at 11:24 AM #77534I agree re DAX being difficult and I came to similar conclusion just about the time you first said it on here! I’ve realised that I’ve been obsessed with the DAX over the last 2 years! 🙂

Re correlation … it is generally accepted, but I agree your weekly TF Chart does not support this … maybe it can be seen better on lower TF’s?

It has been found that generally, the DAX Index has over 90% correlation with the leading US stock indices, and a 70% inverse correlation to the euro. This indicates that when the EUR/USD pair moves up or the value of the euro rises, the DAX Index tends to be weaker; and when the euro falls against the USD, the DAX is stronger. Such correlation data can be used by traders to decide their trading strategy for DAX futures.

08/04/2018 at 11:41 AM #77537Yes – I spent ages obsessed with the FTSE100 and then I spent ages obsessed with the DAX and that was worse for me than the FTSE100. I have found the best indices to be the major US indices and why not – the biggest most powerful economy in the world should have the most predictable indices in my mind.

Diversification has a lot to be said for it but I am also beginning to feel that being an expert on one market also has a lot of benefits. By diversifying our portfolio we also diversify our attention and skills across different markets. Maybe being very good at one market is better than being average on many markets for us small fry traders? The new ESMA rules may force people into this anyway.

As for your quote from Blackwell Global – I usually read these things and then only believe them when I have looked for it myself to prove it is true – and for me I just don’t see what they are saying on daily or weekly or monthly charts so I can’t ever use that idea.

08/04/2018 at 2:06 PM #7754408/04/2018 at 2:27 PM #77545What you need to trade are Option. They are perfect for speculate in disasters

It is not really about speculating in disasters you are hoping that one doesn’t come along soon and so making hay while the sun is shining – and as you gather more hay you sew less seeds for the next crop. That way if (or should that be when) a storm comes along you have a lot of hay stored away and not too many new seeds in the ground to be lost to the weather.

Obviously at some point the amount of seeds you are sewing will become so small that you may decide to increase the quantity again but as you already have a lot of hay in storage you do not need to start sewing as many as you started with last time so although your risk is increased it is still lower than when you first started in the hay business.

Hopefully that analogy makes sense!

08/04/2018 at 3:39 PM #77548I tried to code something that sort of does what I am trying to describe:

123456789101112131415161718192021222324defparam cumulateorders = falseStartMultiple = 20PositionSize = 1Once Multiple = StartMultipleif strategyprofit > strategyprofit[1] thenMultiple = Multiple * 0.95endifPositionSize = PositionSize * Multipleif multiple <= 1 thencount = count + 20if count = 100 thencount = 20endifMultiple = Startmultiple * ((100 - count)/100)endifPositionSize = Round(PositionSize*100)PositionSize = PositionSize/100I added it to a simple strategy that does not buy if the close is less than the close 52 weeks ago. As can be seen the money

management slowly reduces exposure and then when a very small stake size is reached it increases it again but to a lower starting stake than before. The starting stake is 20! -

AuthorPosts

Find exclusive trading pro-tools on