Two FTSE100 (JUN -18) instruments

Forums › ProRealTime English forum › ProRealTime platform support › Two FTSE100 (JUN -18) instruments

- This topic has 6 replies, 2 voices, and was last updated 6 years ago by

Despair.

-

-

06/16/2018 at 10:34 AM #7341906/17/2018 at 1:16 PM #73483

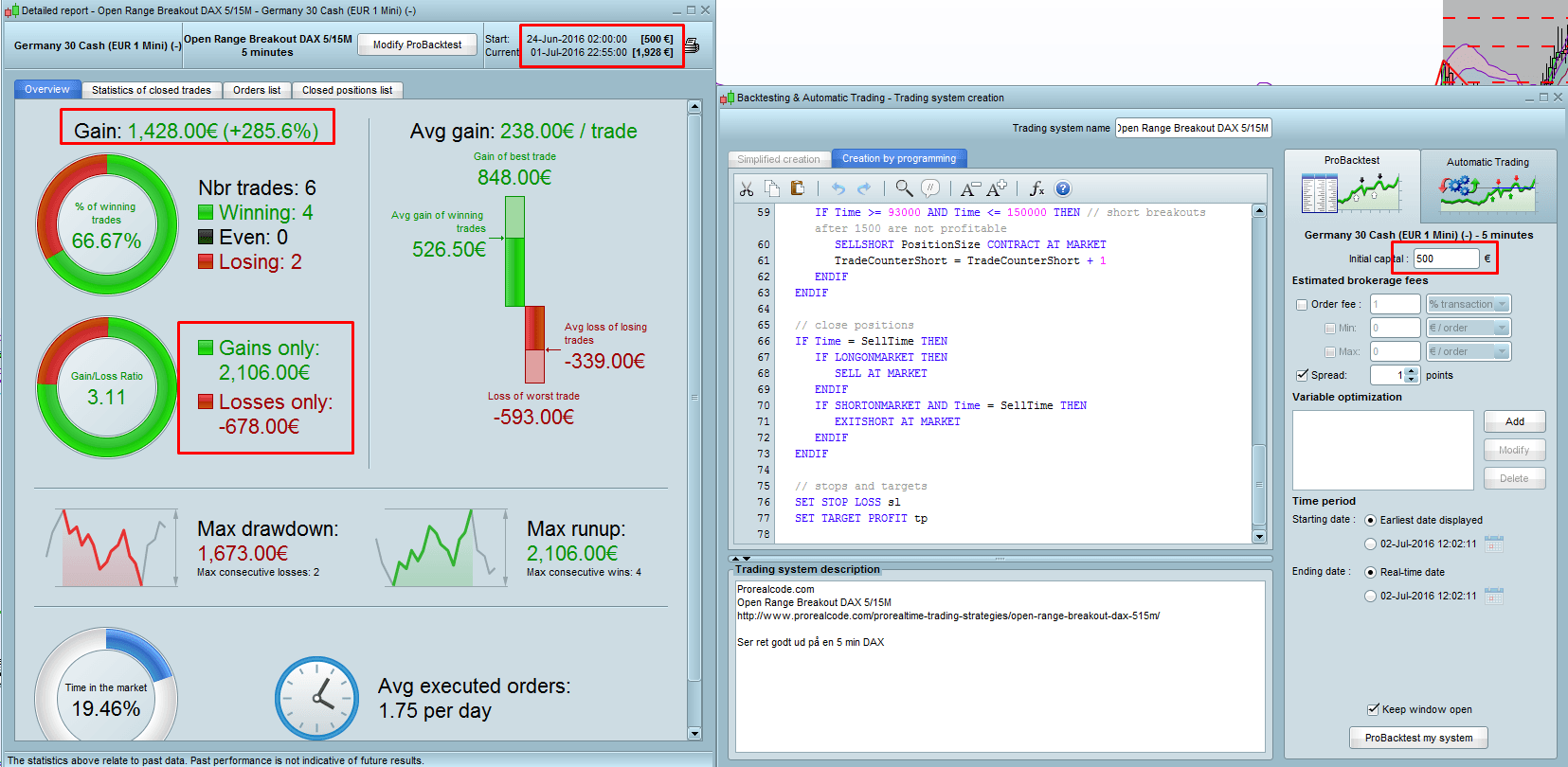

I use(d) futures for most of my daily strategies because they could hold a position for weeks to save the overnight fees that CFDs would cause and there are often problems when a contract is coming closer to expiry. Often the new contract is not updated until the old contract is virtually expired making rolling over more or less impossible.

Also when a new contract starts trading it is often missing the last weeks of data so you can’t run any strategies on the new contract because all indicators are miscalculating because of that. I reported this issue many times and at one point PRT answered that they fixed it and that it should not happen again. Sadly this was not true and it continued happening. I reported it again and PRT then even stated that they thought the problem was fixed. Maybe it is by now, I don’t know.

Then this issue was always fixed by PRT unusually fast after I send a report.

I think the missing data problem is somehow caused by the way PRT handling the rollovers. PRT is somehow splicing together the data from all the front months to create in this way continuous data that can be used for backtesting. This is something IG does not do. Then it is probably up to IG to decide when they start updating a new contract. They seem to do so annoyingly late. I also would like the new contract start trading maybe a week before the old contract expires but my prayers haven’t been heard yet. 😉

If you trade on a real exchange you have the contracts of different maturities being all present all the time and not just the front month and maybe one more. When asking IG why they don’t show all the other contracts they replied this would take too much resources.

06/18/2018 at 9:17 AM #73555I just received a reply from IG regarding this. It is not a very satisfactory situation and it really means that using futures on PRT ProOrder is not a realistic possibility in my mind if PRT cannot handle the rollovers correctly and pass your trade on to the new chart. It appears that you cannot even be certain whether the position will be closed or left open. Not sure how a position could be left open on a chart that no longer exists for trading though?

Here is the reply:

Unfortunately your position will not roll over due to the way our systems are integrated with ProReal Time. Basically ProOrder is designed to run on an instrument with a specific epic/chart code and when an instrument rolls over the epic code changes. ProOrder was not designed to handle this properly so your system will stop running and it should close the associated position as well. Please do monitor this position when it does expire though to ensure it does indeed close because if it doesn’t you may have to monitor it manually.

06/18/2018 at 3:59 PM #73592I replied to IG pointing out that not being able to roll over futures in ProOrder made it useless for trading and I have received this reply:

Thanks for your email and sorry for the inconveniences regarding ProOrder

I will pass your recommendation through as feedback for consideration although this might take time to be looked at especially in Demo

Sometimes the info we (IG) send to PRT for the platform may get duplicated but only one of those instruments will work and note that this doesn’t happen on the Live since most of our resources are allocated there

Not a lot of help there then. Guess it is short term trading on DFB’s or nothing then if you want to auto trade with ProOrder.

What with the new ESMA rules coming in and now things like this I might just have to give up on buying indices via spread betting and start investing directly in ETF’s on dips via my broker.

06/18/2018 at 4:50 PM #73596As I stated above I ran most of my strategies on futures and I experienced different things at rollover. It happened several times that I forgot to close a position because I wasn’t aware that the contract was expiring.

It happened to me both two situations without that I changed any settings in PRT:

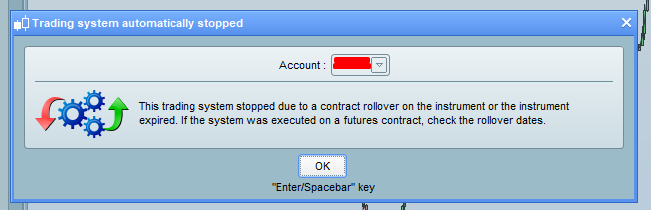

1.) On the day of expiry strategy was stopped and the open position closed. (this is what I’d expect to happen)

2.) My strategy was stopped the morning of the expiry while the contract was still trading but left my position open in the market without SL or anything else. I then had to close the position manually when I noticed.

Ah yes and there is a 3rd version. If you enable auto-rollover in your IG platform, IG will close the position on the day of expiry and open a new one of same size in the new front month but when this happens PRT stops your strategy because of external interference and the position in the new contract will not have SL or be in control of a strategy. You will have to manage the trade manually.

06/18/2018 at 6:20 PM #73602I have traded futures manually with rollover enabled on the IG platform with no issues so I just assumed that PRT and IG would be well enough connected to do the same thing if a futures position is opened on the PRT platform. I guess that I had just not had a demo strategy hit a rollover date until the three strategies that were on demo test stopped a few days ago. In some ways it is good that I found out on demo as it would have been very frustrating had my backtest never hit a rollover and then when I went live a trade was closed because it then did.

I may have to re-think things now and maybe switch some of my longer time frame strategies to manual trading if I feel I need a futures market. I hate manual trading as it requires being in front of a computer at specific times and then having the will power to push the BUY button.

06/18/2018 at 7:58 PM #73605 -

AuthorPosts

Find exclusive trading pro-tools on