Hi all !

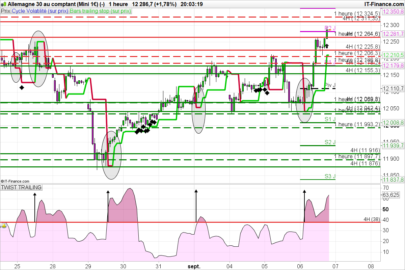

At the request of one of my readers of my website, I created this code : the ATR Trailing Stop.

I have not found any ProRealTime code of this indicator over the internet, so I created myself this code today.

I apologize if you already have a same code.

The ATR trailing stop is an indicator which, as its name suggests, uses the Average True Range as a trailing stop.

In this code, I did choose a period p = 14, but feel free to change it.

How to calculate the ATR trailing stop (ATRts) ?

The ATRx is defined by the closing price which is subtracted (uptrend) or added (in downtrend) 3.5 x ATR.

In uptrend (close > ATRts), if ATRx of the day is greater than the ATRx of the day before, the ATRts takes the value of the ATRx.

But if this ATRx day is lower than the day before, the ATRts is unchanged.

Therefore: the ATRts can only increase or stay the same in uptrend.

Of course, the rules are the opposites for a downtrend.

A simple indicator, and effective for trading!

Notice that it reminds closely the « SuperTrend » of Olivier Seban…

Here is the code (please insert it on the main graph) :

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 |

// Période p = 14 // Average True Range X ATRx = AverageTrueRange[p](close) * 3.5 // ATRts = ATR Trailing Stop // Inversion de tendance IF close crosses over ATRts THEN ATRts = close - ATRx ELSIF close crosses under ATRts THEN ATRts = close + ATRx ENDIF // Cacul de l'ATRts lors de la même tendance IF close > ATRts THEN ATRnew = close - ATRx IF ATRnew > ATRts THEN ATRts = ATRnew ENDIF ELSIF close < ATRts THEN ATRnew = close + ATRx IF ATRnew < ATRts THEN ATRts = ATRnew ENDIF ENDIF return ATRts as "ATR Trailing Stop" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi,

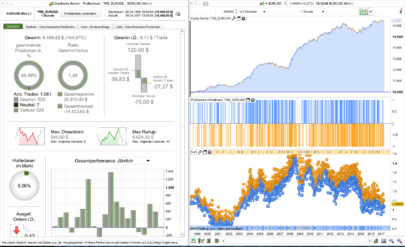

Could you help me add this to my swing trading code?

Mark

defparam cumulateorders = false

REM Money Management

Capital = 2500 // initial capital at launch of the strategy

Risk = 2.5 // risk in percent

REM Calculate contracts

equity = Capital + StrategyProfit

maxrisk = round(equity*(Risk/100))

REM defining moving averages

EMA5 = exponentialaverage[20]

EMA100 = exponentialaverage[150]

EMA200 = exponentialaverage[200]

hh = highest[20](high)

ll = lowest[20](low)

// -- case BUY

if EMA5 crosses over EMA200 then

stoploss = (close-ll)/pointsize

stoplevel = (close-ll)

PositionSize = abs(round((maxrisk/StopLoss)/PointValue)*pipsize)

BUY PositionSize SHARES AT MARKET

endif

// -- case SELL

if EMA5 crosses under EMA200 then

stoploss = (hh-close)/pointsize

stoplevel = (hh-close)

PositionSize = abs(round((maxrisk/StopLoss)/PointValue)*pipsize)

SELLSHORT PositionSize SHARES AT MARKET

endif

// -- trades exit

if EMA5 crosses under EMA100 then

SELL AT MARKET

endif

if EMA5 crosses over EMA100 then

EXITSHORT AT MARKET

endif

SET STOP LOSS stoplevel

SET TARGET PROFIT 100

Bonjour,

J’aimerais utiliser cet indicateur dans un autre indicateur mais quand j’utilise la commande CALL ” ATR TRAILING STOP”, ça ne marche pas. Je ne comprends pas pourquoi ça ne marche pas. Une idée ?

Ajoute ceci à la strategie pour gerer les sorties dans le proorder:

//ATR TRAILING STOP

// Période

p = 14

// Average True Range X

ATRx = AverageTrueRange[p](close) * 3.5

// Inversion de tendance

IF close crosses over ATRts THEN

ATRts = close – ATRx

ELSIF close crosses under ATRts THEN

ATRts = close + ATRx

ENDIF

// Cacul de l’ATRts lors de la même tendance

IF close > ATRts THEN

ATRnew = close – ATRx

IF ATRnew > ATRts THEN

ATRts = ATRnew

ENDIF

ELSIF close < ATRts THEN

ATRnew = close + ATRx

IF ATRnew ATRts THEN

SELL AT MARKET

ENDIF

IF SHORTONMARKET and close < ATRts THEN

BUY AT MARKET

ENDIF

pardon…

IF LONGONMARKET and close < ATRts THEN

SELL AT MARKET

ENDIF

IF SHORTONMARKET and close > ATRts THEN

BUY AT MARKET

ENDIF

Bonjour à tous,

Pour une raison que j’ignore, le code ne fonctionne plus tel quel.

Il fonctionne de nouveau avec ceci :

Je n’ai pas d’explication.

Cordialement,

// Inversion de tendance

IF close[1] ATRts and close < ATRts THEN

ATRts = close + ATRx

ENDIF

Hi Guys Quick question regarding the above indicator. First of all is the below code correct for trailing STOP using the above indicator

I have uploaded the indicator and named it ATRSTOP and used this code. When order is entered before the market turns bearish, and indicator just start to form the upper resistance, the price moves down and then it gets whipsawed at the prior bull support line. If i am understanding this correctly I believe this is what is happening. Any help would be great, thanks,

This is the code, could not insert in with ADD PRT

//ATR STOP TRAIL FOR STU

ATRts = CALL “ATRSTOP”

//IF LONGONMARKET and close ATRts THEN

BUY AT MARKET

ENDIF

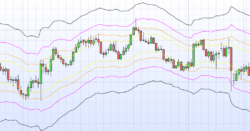

Hi Doctrading,

How do I make the indicator overlay on the price series like on your screenshot?

Thanks

Dave

Hi ! I am asking once again for your help : would it be possible to use the ATR as a “take profit” ? In an uptrend for example it would create a line above the price… Thanks a lot !!

Many thanks for the indicator, however if the price is below the indicator, then the indicator’s line must also be colored red as a stop loss signal for the short. Unfortunately he doesn’t yet. Can this be changed in a new itf?

Merci pour ton travail ! J’ai de bons résultats en utilisant cet indicateur