Pathfinder Trading System

Forums › ProRealTime English forum › ProOrder support › Pathfinder Trading System

- This topic has 1,834 replies, 139 voices, and was last updated 2 years ago by

CFD AutoTrading.

CFD AutoTrading.

Tagged: Pathfinder

-

-

01/09/2018 at 2:08 PM #58608

Hi guys,

V8 engine works as designed :-). The reason for the different behaviour is the trend multiplier mechanism. The trend multiplier only becomes active when the strategy profit from last week is positive. Depending on when the algo was started, the current position size is 1 (started on last weekend or this week) or 2 (started last week).

Pathfinder V8 is currently in the very bullish l5 scenario (signalline > monthlyHigh and dailyHigh > weeklyHigh). As long as the signalline is currently above 13552 (monthly and weekly high), the V8 engine accumulates one position every hour (during trading window 8 – 22:00) up to the maximum position size. Depending on the trend multiplier, 5×2 or 10×1 positions are accumulated up to the maximum position size of 10.

The exit criteria this morning was the time exit when the position is in profit (16+1 = hours) calculated from the last buy. That was 9:00 (trend multiplier 2) or 11:00 (trend multiplier 1).

V8 is currently trading very aggressively to seize the chance of a breakout towards new highs.

01/09/2018 at 2:13 PM #58611a discrepancy caused by the trendmultiplier from my point of view.

I’m no expert on Reiners code but after a quick glance at this TrendMultiplier thing I can’t see how it is the issue. It is simply a bit of code that checks on a Monday to see if have more or less money than we did last week and increases the position size or decreases the position size accordingly. But with TrendMultiplier variable set at two then the maximum position size will only ever be two.

This can have no say in how many bets we open unless there is something else in the code somewhere. As I say I’ve only had a quick glance at it.123456789ONCE profitLastWeek = 0IF DayOfWeek <> DayOfWeek[1] AND DayOfWeek = 1 THENIF StrategyProfit > profitLastWeek + 1 THENpositionSize = MIN(trendMultiplier, positionSize + 1) // increase riskELSEpositionSize = MAX(1, positionSize - 1) // decrease riskENDIFprofitLastWeek = strategyProfitENDIF2 users thanked author for this post.

01/09/2018 at 6:31 PM #5871901/09/2018 at 11:13 PM #58768@gianluca Albino, Is yours set to 2 and did your V8 bought yesterday 3 times 2 positions and sold them this morning at 09.00 O ‘clock in live trading?

Hi, i am actually running the V7 since the system have still open a trade (from 3 days now) and the demo closed the same trade.

01/10/2018 at 3:26 PM #5886201/10/2018 at 4:08 PM #58870I don’t understand the use of so many statements “if 1=1” in lines 218-222, 226-228 and line 303 ? I’d guess 1=1 is always true… However, “1=0” in line 225 should be always false ?

I’m with you on this one. Not something I’ve seen in anyone else’s code before. I guessed they were just on/off variables.

01/10/2018 at 4:24 PM #58876OK, so this means that short condition s1 is always switched off. Also, “isStrongBearish” in lines 215 and 231 is always false, then.

Under the current conditions in DAX, it appears to me that V8 would switch to short when s4 and f1 are true, that is, when close falls below longMA, which is 13130 at the moment ? Let’s see what happens…

01/10/2018 at 4:49 PM #58881OK, so this means that short condition s1 is always switched off. Also, “isStrongBearish” in lines 215 and 231 is always false, then. Under the current conditions in DAX, it appears to me that V8 would switch to short when s4 and f1 are true, that is, when close falls below longMA, which is 13130 at the moment ? Let’s see what happens…

I’d have to take your word for that as to be honest I find Reiners coding style a little difficult to read for some reason so gave up! Also my Pathfinder demo live is currently running a huge loss and a bigger drawdown than I really like so I kind of lost interest and moved on to something else!

01/11/2018 at 10:50 AM #58970For those interested in seasonality (which I guess is anyone interested in the Pathfinder trading method) an updated version of my Seasonality Analysis Indicator has now been posted to the library at

Much improved I think with in sample and out of sample data analysis and a monthly rating system. Used as a continuously walking forward test each month (or series of tests on different length in sample and out of sample periods) it should help any trader make better seasonality decisions month by month.

Hope you enjoy…..

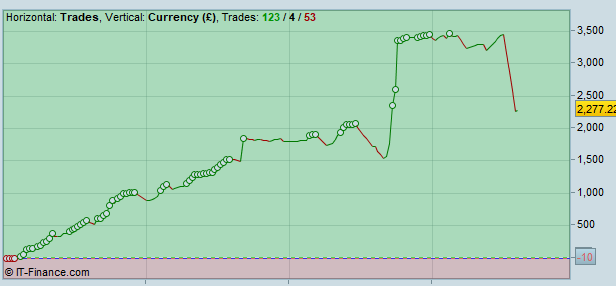

01/12/2018 at 1:05 PM #5917601/12/2018 at 1:08 PM #5917701/12/2018 at 8:24 PM #59281Horrible loss on DAX V8 today on my demo account. Strange as the market was coming back from much lower and then the bets were closed for a massive loss. Hopefully Reiner can explain why – I hope it wasn’t a time based close? Thank goodness it was only virtual beer and pizza that is off my menu today! Made a horrible mess of my demo account graph for January that was doing so well up until then even with four other failed strategies that were also sucking it down pip by 100 pip.

01/12/2018 at 8:56 PM #59293I hope it wasn’t a time based close?

I fear it was. Number of candles of the closed position was 79, which is larger than maxCandlesLongWithoutProfit (= 75).

Is this the fate of an overoptimized system that stops working well right after the optimization period has ended, or just bad luck ? We will see after 6 months, I’d say.

01/14/2018 at 4:44 PM #59448Hi Brage,

I hope you’re all right and that you’ve had a good trading year 2017.

DAX V8 is still in the development and testing phase. It is still too early to be sure if it works in reality. If the tests show that it really works, I would choose the following settings for a small account.

Profit and risk are mainly determined by the size of the position. There are the following 5 parameters to set the chance/risk profile. The least risk exists if all parameters are set to 1. However, this is not recommended as the chances of winning are very limited.

In backtest! the following settings provide a good chance/risk ratio (Profit 444%, 2.100 Euro max. drawdown, highest loss 820 Euro).:

123456// size calculation: size = positionSize * trendMultiplier * saisonalPatternMultiplierONCE positionSize = 1 // default start sizeONCE trendMultiplier = 1 // >1 with dynamic position sizing; 1 withoutONCE maxPositionSizePerTrade = 3 // maximum size per tradeONCE maxPositionSizeLong = 4 // maximum size for a long positionONCE maxPositionSizeShort = 4 // maximum size for a short positionWith the rule of thumb (2 x max drawdown + highest loss + margin max position size) you need a 6 k account size for this setting.

Best regards,

Reiner

1 user thanked author for this post.

01/14/2018 at 5:10 PM #59450last week’s results are different. Unfortunately, the DAX has not completed the hoped-for breakout above 13,400. That’s a pity since V7 and V8 had a bigger long position but unfortunately no one can predict the market.

V7 robots have worked well and earned 1.955 Euro:

- ASX V7: 128 Euro

- FTSE V7: -201 Euro

- DAX V7: 1.271 Euro

- EU-Stoxx: 372 Euro

- SAF V7: 384 Euro

DAX V8 robot has delivered a loss of 1.189 Euros. Losses are unfortunately part of the game and as long as the loss is within the scope of the back-test, there is no reason to change the system. But of course I advise to be careful here and everybody should run V8 in demo first.

-

AuthorPosts

Find exclusive trading pro-tools on